As part of my return to frugality, I am revisiting the core concepts that help me achieve financial independence by age 30. In this post, I am going to show you how to calculate the true cost of anything using a few different calculations.

You can use these methods to evaluate purchasing anything, from a cup of coffee to a home. These calculations have saved me literally tens of thousands of dollars.

I’ll also show you why eating Chipotle for lunch every day could be a wise financial decision and sometimes convenience is worth it.

Random note: I used to work with a guy who literally ate Chipotle every day for lunch and had been doing so for 5 year. Crazy right? Maybe he calculated the true cost and was saving bank?

Example: The True Cost of A Cup of Coffee

How much does a 12 oz $3 cup of coffee (after sales tax) cost you? You would probably answer $3, and you would only be partly right. Yes, $3 is what the cup of coffee is being sold for, but it’s not the true cost of the coffee.

To determine the true cost of the coffee to you, you need to perform a few simple calculations to determine exactly how much it cost you to buy that $3 cup of coffee. Here’s what I try to figure out when evaluating any purchase:

Before Tax Income Price: How much money do you have to make before taxes to buy the $3 cup of coffee?

Life/Time Price: How much of your life will you trade for that $3 cup of coffee?

Price of Convenience: How much would it cost you to make the coffee yourself?

Annual Cost: How much does the coffee cost you if you buy it every day?

The Future Value of Money: How much would the $3 you spent on coffee be worth invested in 5, 10, 20, 30+ years? How much would the money you are spending on coffee every day be worth in the future?

Before Tax Income Price

How much money do you have to make before taxes to buy the $3 cup of coffee? To buy a cup of $3 coffee you really had to earn more than $3, simply because you are paying for it with your after tax dollars.

Depending on the federal tax bracket you are in, as well as how much you pay in social security, and state income tax, you actually had to earn more money than the $3 so your true cost is higher.

I first learned about this idea from one of the best money books for millennials, Andrew Tobias’ The Only Investment Guide You’ll Ever Need. Factor all of these into your calculation and you had to earn likely at least 20-40% more money to buy this $3 cup of coffee.

Next time you want to calculate how much you had to earn to buy anything you can use this formula (using basic numbers like B=25 for tax percentage).

A = advertised price ($3)

B = tax percentage (25% displayed as 0.25)

C = the true cost you are paying

C = A/(1-B)

Back to our example, calculating the true cost of the $3 at a 25% tax rate. C = $3/(1-0.25) = $4

TRUE COST (at 25% tax bracket) = $4

Your Life/Time Price

How much of your time/life energy are you trading for that $3 cup of coffee? This is one of the core concepts I first read about in another awesome book Your Money or Your Life. The most valuable asset we have in life is time. Anytime that you are getting paid to work you are trading your time/life for the money. This is why it’s so important to get paid what you are worth.

Thinking about this in simple terms had a profound impact in my life – literally, overnight I started evaluating each purchase based on how much of my life it would cost.

This was huge for me. I stopped buying frivolous take-out when I realized I’d worked 3 hours to buy that meal.

The cup of coffee is a pretty small example and this calculation tends to be more psychologically meaningful for larger purchases, but it works for the coffee too. Let’s calculate using the true $4 cost of the coffee above since this is what the coffee cost you in your before-tax income. Let’s assume that you make $16/hour before taxes, then just take the true cost of the coffee.

A = true cost ($4)

B = hourly rate ($16)

C = number of hours of your life

A/B = C

($4)/hourly rate ($16) = .25 hr, or 15 minutes.

LIFE PRICE: 15 minutes

Price of Convenience

How much would it cost you to make the coffee yourself? This is a fun one, since convenience is what we all end up paying a really high cost for when we purchase many items.

The markup on coffee is literally insane, as is the markup on delivery food. In some cases you are paying a 500%+ for a cup of coffee or food compared to making it yourself. The coffee that I use at home costs me approximately $12/pound, or $0.75 an ounce of beans.

Using a Coffee Brewing Ratio Chart, it would take 0.75 oz of beans to make the 12 oz cup of $3 coffee in our example.

So multiplying my ($0.75 per oz bean cost) * (0.75 oz of beans) = $0.56 to brew a cup of the same amount of coffee at home.

So the convenience for me cost a 435.71% premium! It can be tough to calculate the convenience price of an item that you can make yourself, but I hope this coffee example helps.

You can do these calculations for food preparation pretty easily too using a similar formula including costs of ingredients, BUT don’t forget to include the time you spent shopping for the item or the premium you paid for using a delivery service like Instacart.

I encourage you to start calculating your own convenience cost for items you consume regularly. I was a huge Starbucks fan and grabbed a cup on my way to the office for a few years – I mean what’s $3 right? Once I did this calculation I stopped by coffee and spent the extra 5 minutes to make it at home before I left the house.

CONVENIENCE PRICE: A 435.71% markup

Annual Cost + Annual Life Price

This is an easy one, but is a great way to analyze your recurring expenses like gym membership fees, daily coffees, and subscriptions. The annual cost really adds up.

Using Personal Capital, I uncovered that my weekly Chipotle habit cost me over $820 last year, but when I did my own convenience calculation I determined it was actually more expensive for me to cook my own lunch. So I still eat Chipotle frequently?

But now let’s look at the cost of the $3 of coffee every day for a year, then it starts to really add up when comparing to making the coffee at home and using your convenience price calculation from above.

$3 coffee out * 365 days = $1,095

$0.56 coffee at home * 365 = $204

ANNUAL COST = $891 more

ANNUAL LIFE PRICE: .25 hours * 365 days = 91.25 hours (Whoa! That’s a lot of time)

The Future Value of Money

Alright last but not least. If you made it this far you are my true personal finance homie.

Every dollar I spend could be invested, so I always try to analyze (especially big purchases) what the future value of my money could be.

Let’s look at the future value of the money from the coffee example. I am a huge fan of using a future value calculator to determine what I plan to spend will be worth in 5, 10, and 30+ years if I invested the money instead.

This is one way I have built my investing portfolio – simply doing these calculations and deciding to invest the money instead.

Let’s look at some future value calculations

1. A simple future value calculation (at 6% annual growth rate) of our $3 cup of coffee reveals the following: $3 cup of coffee (5 years: $4.01, 10 years: $5.37, 30 years: $17.23)

2. Now those numbers aren’t anything special, but let’s look at the annual cost of a daily $3 coffee ($1,095) over the same time periods: $1,095 annual coffee spend (5 years: $1,465, 10 years: $1,960, 30 years: $6,289)

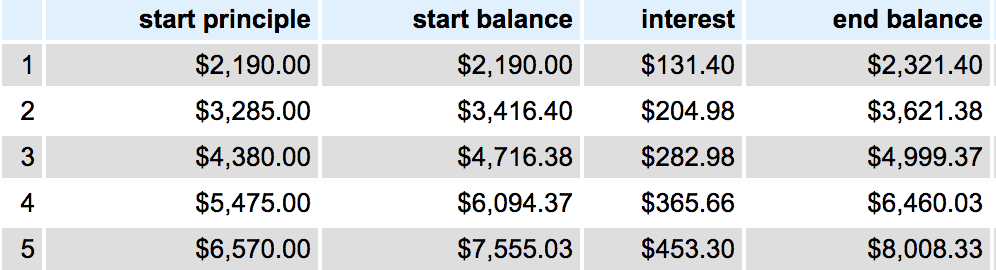

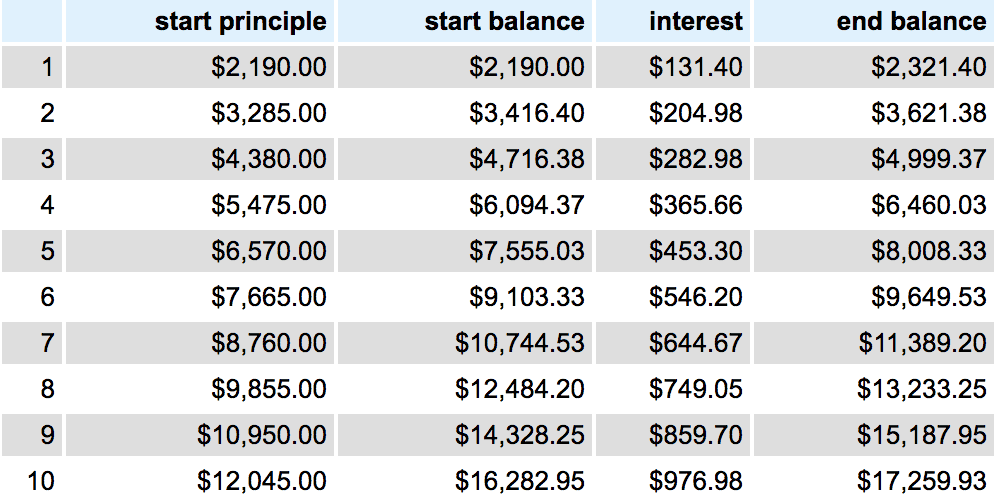

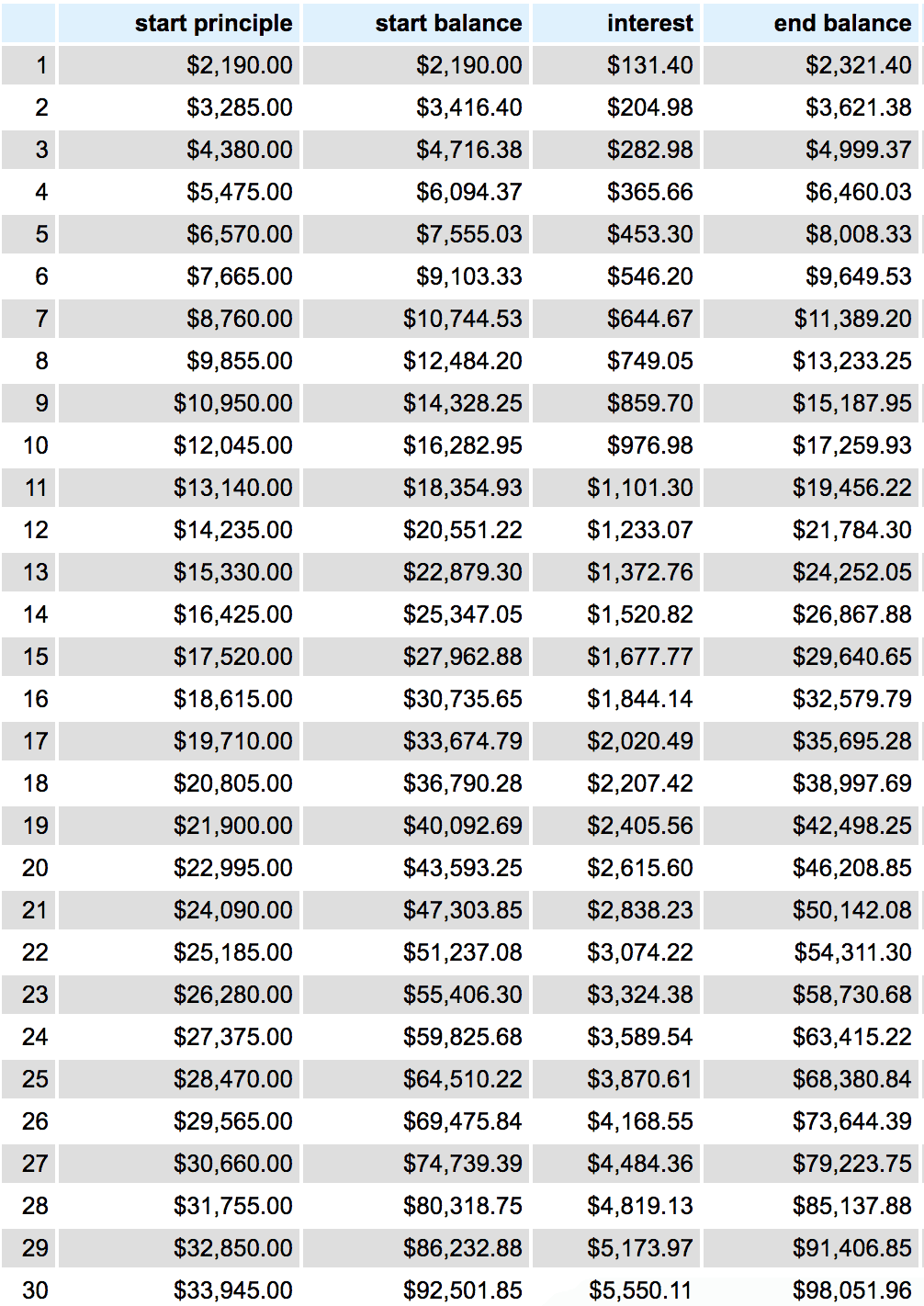

3. Now let’s look at that $1,095 invested annually at a 6% annual growth rate over the same period. I’m not advocating you stop drinking coffee, but all those coffee haters are probably banking mad money.

5 Years – $1,095 contributed annually at 6% = $8,008

10 Years – $1,095 contributed annually at 6% = $17,259

30 Years – $1,095 contributed annually at 6% = $98,051 WHAT!?!?!

I hope you found this helpful and try calculation the true cost of anything before you buy it. Let me know if there are any ways that you calculate true cost.

Read 10 comments or add your own

Read Comments