Vanguard Personal Advisor is just one of the services offered by Vanguard, and it’s a good one. After using the service myself, I created this Vanguard Personal Advisor review to help you fully understand what it is, how it works, and whether it’s a good fit for you.

What Is Vanguard Personal Advisor?

Vanguard Personal Advisor is a hybrid of a robo-advisor and a personal advisor. It offers the best of both worlds: automated investments and the support of live professionals when you need it.

Vanguard Personal Advisor focuses on goal-based investing while maximizing tax loss harvesting and utilizing proper withdrawal strategies.

Advisors are available to help with any situation, including:

- Prioritizing your goals

- Dealing with a change in income

- Minimizing tax liabilities

- Having adequate access to funds in retirement

- Managing debt

- Managing healthcare costs in retirement

The minimum balance is $50,000, and you can open individual or joint accounts and traditional, Roth, or rollover IRAs.

How Does the Personal Advisor Service Work?

Vanguard Personal Advisor starts like any other robo-advisor. You answer a detailed questionnaire about your financial status, goals, and risk tolerance. You’ll disclose how much capital you have to invest, and you can also link any outside retirement accounts to your Personal Advisor for a more holistic view and advice.

Here’s where Vanguard Personal Advisor differs from traditional robo-advisors.

After completing the questionnaire, you’ll discuss your situation with a live advisor. This provides you with even more insight into your financial goals and what strategies you must use to reach them. But don’t worry. The advisor uses Vanguard’s proprietary software to create and automate your portfolio.

If you have less than $500,000 invested, you’ll work with a team of advisors during your time with Vanguard. This means you won’t have a dedicated advisor, but every professional has equal access to your information and can easily advise you on your next steps.

Most importantly, all Vanguard Personal advisors are fiduciaries. This means they don’t work on commission and must suggest the investments that best suit your financial goals and needs rather than those that earn them the highest commission.

Vanguard offers three investment options with its Personal Advisor services:

- All-Index: This portfolio uses low-cost Vanguard ETFs® that cover most of the stock and bond market. This investment option includes the following investments: VTI Total Stock Market ETF, BND Total Bond Market ETF, BNDX Total International Bond ETF, and VXUS Total International Stock ETF.

- Active/Index: This portfolio includes active Vanguard investments, including mutual funds, balanced with index funds. Investors with a higher risk tolerance can use this portfolio for more aggressive returns. It includes the investments from the All-Index plus the following: VHCAX Capital Opportunity Fund Admiral™ Shares, VADGX Advice Select Dividend Growth Fund, VCICX International Core Stock Fund Admiral Shares, VAGVX Advice Select Global Value Fund, VAIGX Advice Select International Growth Fund, and VCOBX Core Bond Fund Admiral Shares.

- ESG: This portfolio aligns with your beliefs in environmental, social, and governance issues. It diversifies your capital across ESG ETFs and non-ESG bond ETFs. This portfolio isn’t as diversified as the others but still includes thousands of stocks and bonds. The investments included in this portfolio include the following: VCEB ESG U.S. Corporate Bond ETF, ESGV ESG U.S. Stock ETF, VSGX ESG International Stock ETF, and BNDX Total International Bond ETF.

Who Should Use Vanguard Personal Advisor Services?

Vanguard Personal Advisor services aren’t for the beginner investor. With its higher minimum balance than most robo-advisors, it’s better suited for experienced investors and those nearing retirement who need personal advice due to the detailed nature of their investment needs.

Pros and Cons

It’s always important to consider the pros and cons of any financial advisor you choose, whether a robo-advisor or a live professional. Here are the pros and cons of Vanguard Personal Advisor Services.

Pros

- Unlimited access to professional financial advice

- Automated portfolio rebalancing

- Includes tax-loss harvesting strategies

- Advisors are fiduciaries

- Many portfolio options

Cons

- High account minimum

- No option to invest in individual stocks or bonds

Features of Vanguard Personal Advisor Services

Vanguard Personal Advisor Services works differently than many other robo-advisors. Here are the features to expect.

Access to a Team of Advisors

This is what sets Vanguard Personal Select apart from other robo-advisors. While you don’t have access to a dedicated advisor, the team you’re assigned to is well-qualified to provide financial advice and help you make investing decisions.

Personalized Financial Planning

Having access to professional advisors offers more personalized service. You can explain your goals, risk tolerance, and time horizon in detail. Because you can also link external accounts, you’ll get a holistic view and more detailed investment advice to best reach your goals.

Personal advisors can help you customize your portfolio further than Vanguard’s three prebuilt portfolios. They can make tweaks that the automated system can’t, providing you with a customized experience.

Automated Portfolio Management

You still benefit from automated portfolio management despite the personal attention investors receive. The program automatically rebalances your portfolio if it varies over 5% from its target. However, the automated rebalancing only focuses on the investments at Vanguard, not external accounts.

Tax Loss Harvesting

The Vanguard Personal Advisor service includes tax loss harvesting. This helps investors with taxable accounts minimize their tax liabilities and maximize their capital gains. This is important to help you reach your financial goals.

Desktop and Mobile App

Investors have many ways to access their accounts, whether at home on their PC or traveling and using their phones. The mobile app focuses on tracking your account and goal progress. The desktop version has more features, including a visual of how your investments perform compared to your financial goals.

Customer Service

Unfortunately, customer service isn’t available 24/7, but they have extended hours from 8 AM to 8 PM Eastern Time. You also have the option to talk with a financial advisor when setting up your account, and you can access the advisors whenever you need advice throughout your investment journey.

Tools and Calculators

Vanguard offers various tools and calculators to help you make important investment decisions. They include investment analysis tools, retirement planning calculators, and education savings tools. You can play with various numbers to see how different investment decisions may affect your financial outcome.

How Much Does a Vanguard Personal Advisor Cost?

Vanguard Personal Advisor costs vary based on the chosen portfolio. Here’s an estimate of what they cost, but the actual cost may vary based on the credits they provide, which are based on the revenues they receive from securities you’ve chosen.

- All-index: $30 per $10,000 invested (minimum $150)

- Active/Index: $35 per $10,000 invested (minimum $175)

- ESG: $30 per $10,000 invested (minimum $150)

My Experience With a Vanguard Personal Advisor

I am a big fan of the Vanguard investing philosophy (which is built on investing in low-cost index funds), as well as Vanguard funds in general. Because I have always had a great experience working with Vanguard I was excited to learn about the Vanguard Personal Advisor Services.

To provide an accurate Vanguard Personal Advisor review, I deposited $60,000 with Vanguard to get a full view of the service.

Founded in 1975 by Jack Bogle, The Vanguard Group developed the first index fund for individual investors that mirrored the S&P 500 which provides a broad level of exposure to the US stock market with a low expense ratio (meaning it was very cheap to have your money invested with Vanguard).

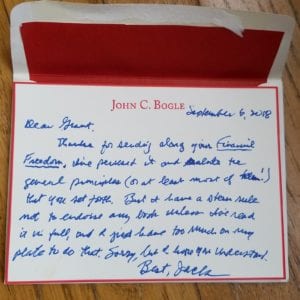

I was honored that Jack actually sent me a letter before he died.

To start, it took me a full month to get an appointment with a personal advisor. As you can assume, a lot happens in 30 days in the market. In my situation, the Dow dropped almost 2,000 points, and I lost money across most of my investment accounts.

So, I had initial concerns with the service, wondering how long I’d have to wait to speak to a financial advisor if I moved forward with their services. Since I tested the service, their wait time has decreased to two weeks, which, in my opinion, is still long.

Fast forward to my call, and I’ll tell you that it was enriching and enlightening as possible. My advisor, Monica, was knowledgeable and fully invested in getting to know me and my financial goals. She answered all my questions and asked me a TON of questions that went well beyond the traditional robo-advisor questionnaire.

Monica gave me solid advice on investing, even if it wasn’t what I had in mind, and she scheduled a follow-up call with me in two weeks. At the two-week mark, I received my custom investment plan and could move forward with it or keep the plan but do it myself. So, there’s no obligation to move forward with them, and I felt completely comfortable no matter what I decided.

While I didn’t sign up for the service, I was highly impressed with the service I received and feel completely comfortable with using it. I like managing my own investments, so that’s the only reason I didn’t move forward; however, I did use some of their investment advice and highly recommend it to anyone looking for low-cost, high-quality funds and expert financial advice.

My Custom Vanguard Investing Plan

Monica recommended that I put my money in two Vanguard funds: Total Stock Market Index Fund Admiral Shares and Total International Stock Index Fund Admiral Shares. They also suggested I withdraw my funds from the Vanguard Retirement 2045 Fund and put them into the international stock index fund.

FAQs

My Vanguard Personal Advisor Review recommends this service for anyone seeking high-quality advice and robo-advisor services. Here are some more questions investors have about the service.

Can I Cancel Vanguard’s Personal Advisor Service at Any Time?

You can cancel Vanguard’s Personal Advisor service at any time. However, you must pay any accrued fees for the quarter up until your termination date.

Is the Personal Advisor Service Suitable for All Types of Investors?

The Personal Advisor Service is best for investors who don’t have the time or patience to manage their portfolios. It’s also good for investors who aren’t confident enough to make their own investment decisions. If you’re looking for an investment plan that minimizes tax liabilities and helps you make complex financial decisions for a robust retirement, the Personal Advisor service may be a good fit.

Can I Contact My Advisor Anytime, and How Responsive Are They?

You can contact your team of advisors anytime you have questions. If you don’t contact them throughout the year, they will check in with you at least annually to review your goals, timelines, and progress. You’ll typically get the fastest response via email, but you can request a phone or video chat, too.

Is Vanguard Personal Advisor Services a Fiduciary?

Yes, all advisors you talk to are fiduciaries, so you don’t have to worry about filling someone else’s pockets with your chosen investments.

Is Vanguard’s Personal Advisor Service Worth It?

I 100% believe the Vanguard Personal Advisor service is worth it, even if you only use their initial consultation to get an idea of how you should invest. However, I fully believe millennials can greatly benefit from the service or at least get an idea of what Vanguard funds to invest in and do it yourself.

No comments yet. Add your own