On April 13th Epic Games announced it had raised an additional $1 billion in funding at a valuation of $28.7 billion. Sony added on to prior strategic investments in Epic and provided $200 million in funding in this round.

The large funding round means Epic Games remains privately owned for the time being, but the ambitious press release headline for the announcement “Announcing a $1 Billion Round to Support Epic’s Long-Term Vision to the Metaverse” is another signal of Epic’s long-term ambition. If the company continues spending aggressively to reach its goal of creating the metaverse, its likely Epic Games will have to tap public markets in the years to come.

For everything you need to know about Epic Games and when an IPO could be on the horizon, read on below!

Epic Games

What is Epic Games?

Epic Games is a videogame maker that is responsible for Infinity Blade, Gears of War, and the Fortnite gaming franchises. There have been no announcements for Epic Games stock IPO as of April 2021. Founder and CEO Tim Sweeney has said little about filing for a public offering.

Expected IPO Date:

2022 or later

- As of April 2021, Epic Games was valued at $28 billion. Epic Games has raised about $4.4 billion since its founding.

- Epic Games stock is not currently publicly traded. We’ve detailed ways to invest in Epic or similar investments below.

Bull Case

- Epic is behind the wildly popular Fortnite series of games that currently has more than 350 million players.

- Fortnite alone reportedly grossed $1.8 billion in 2019.

- Unreal is also behind the wildly popular Unreal Engine game development platform

Bear Case

- Epic is engaged in a high stakes legal battle with Apple and Google that could turn out poorly.

- If Fortnite popularity declines in popularity it could drag Epic stock down with it.

If you think GameStop is a can’t-miss stock, it’s likely you are waiting for the day Epic Games’ stock symbol debuts on the public markets. And that makes perfect sense, Fortnite might take place in a fantasy world with fake V-bucks being the currency of choice, but the profits are very real.

But it’s not just gamers looking to own this company, even Wall Street suits are highly interested in getting in on Epic Games. Epic Games stock IPO is likely to be, well, epic. However, it’s important to note Epic Games stock faces a variety of risks and could disappoint investors that buy shares after Epic Games’ ticker is available as an IPO.

Here’s what investors should consider before buying shares once Epic Games’ stock is available to the public.

Here’s Why Investors Want to See Epic Games IPO

With the game engine, creator Unity having IPO’d in 2020 and Roblox recently hitting public markets, Epic is one of the — if not the — largest privately traded gaming companies.

With a combination of powerful software that helps companies build graphically intense games (Unreal Engine) and a development studio that’s riding high on the success of Fortnite, there are plenty of reasons to be excited about an Epic Games IPO.

or, skip straight to when can you buy Epic Games stock

Bull Case: Why Buy Epic Games Stock?

Have you played Fortnite? Then it’s likely you understand why the stock will be a hot ticket once it hits the markets. The game has become a cultural phenomenon and a rite of passage for many teenage boys. With more than 350 million players, if Fortnite Nation were its own country it would be larger than the United States.

The Wall Street Journal wrote an article about the addictiveness of Fortnite, pointing out that parents are locked in an “unwinnable war” to get their kids to turn off the game. While the game is free to play, very soon players are snapping up V-bucks to buy customization gear in the game and Battle Passes to unlock additional features.

These purchases quickly add up. A 2018 study reported 70% of Fortnite users to buy digital items and those who do spend an average of $84.67. According to data from Nielsen, Fortnite alone grossed revenue of $1.8 billion in 2019.

Smart observers understand that Fortnite is more than a video game and more of a culture and lifestyle brand that has many ways to monetize its massive audience. For example, last year rapper Travis Scott grossed $20 million on Fortnite…for a nine-minute digital concert!

But this is just getting started! The video game industry has a long runway for growth. Gaming is no longer considered a waste of time… esports is quickly becoming a serious career choice, with a global market that generates more than $1 billion in revenue from an audience of nearly 500 million viewers.

The Fortnite universe will be instrumental in shaping esports and the gaming community for decades to come and that’s just one franchise.

But it gets even better for Epic Games. The company will benefit regardless of whose name is plastered on the title screen. In-the-know investors understand the power of Epic Games’ Unreal Engine game development platform. Unreal Engine has quickly become the de facto gaming development platform for publishers like Microsoft Studios, which partners with Epic Games on the Gears of War franchise.

Bear Case: Why pass on Epic Games’ stock at IPO?

The biggest risk against buying Epic Games stock centers around the epic (pun intended) battle between the company and app ecosystem companies Apple and Google. App developers have expressed anger at both companies that collect transaction fees that can be as much as 30% of the transaction value, but Epic Games has been the most aggressive in pushing the envelope.

In August, Epic Games created a payment system that cut Apple out of this fee in its Fortnite app and the tech giant quickly removed Epic Games’ valued game from the App Store. Rather than work behind the scenes to resolve the conflict, Epic Games launched a public-relations campaign to rally developers against Apple and then followed up by filing an anti-trust lawsuit alleging Apple was violating antitrust law.

Make no mistake, this is a significant long-term concern as mobile revenue is a large driver of growth and helps to introduce new players to Epic Games’ stock of video games.

To date, however, it does not appear that Apple’s bans have significantly dented demand for Epic Games’ Fortnite. In December, the company tweeted that a record 15.3 million concurrent players participated in an event with another 3.4 million watched through YouTube and Twitch.

The success of Fortnite creates a halo effect around new titles and the Unreal Engine but switching costs are low for consumers, which are fickle and could easily flock to a new massively multiplayer online (MMO) game as soon as another popular game is created.

When Can I Buy Epic Games’ Stock?

Epic Games’ stock remains private and, provided you are a non-accredited investor (those meeting the Securities and Exchange Commission’s definitions of annual income or total net worth limits), you’ll have to wait until the company files for an IPO or does a reverse merger with an existing “blank check” special purpose acquisition company, or SPAC.

Unfortunately, Epic Games’ stock market debut doesn’t appear to be in the cards for 2021. Tim Sweeney has not outlined his timeline for filing for going public but Epic Games doesn’t need to take public money as private investors have stepped up to take ownership.

Furthermore, Tim Sweeney has been outspoken against revenue-enhancing practices he considers harmful to consumers like loot boxes and user manipulation to increase monetization. These practices are common in games owned by publicly traded companies.

Even after 30 years, Tim Sweeney holds a majority stake, pointing to the fact he likes to maintain control. Ultimately, tapping the public markets means ceding control and it’s possible he views the quarterly demands of shareholders as could conflict with his long-term vision.

(However, there is a backdoor way you can own Epic Games’ stock…see below)

Epic Games Stock: Who Owns It Now?

Epic Games doesn’t have to tell the public much about its private stock, including the current investors, the current Epic Games stock price per share, or the value of the company.

However, because of intense interest, we know a lot about the company. Sweeney founded Epic Games as Potomac Computer System in 1991, and he remains the company’s CEO. According to Forbes, Sweeney is worth $5.3 billion due to his ownership stake in the company.

Epic Games stock has a large list of venture capital backers, including Lightspeed Venture Partners, Kohlberg Kravis Roberts & Company, and Smash Ventures. Even government workers are getting in on the action, those north of the border anyway. The Ontario Teachers Pension Plan Board participated in the most recent round of funding.

With an enviable list of backers, it’s understandable that many retail investors are itching to get exposure to Epic Games…and you can!

When you own shares of KKR & Company, Sony, or Tencent Holdings Incorporated, which have exposure to Epic Games. While it’s not recommended you buy companies solely due to their investments in other companies (outside of possibly Berkshire Hathaway), it is notable that Tencent has approximately 40% ownership of Epic Games.

Epic Games Stock Chart: How Much Is It Now?

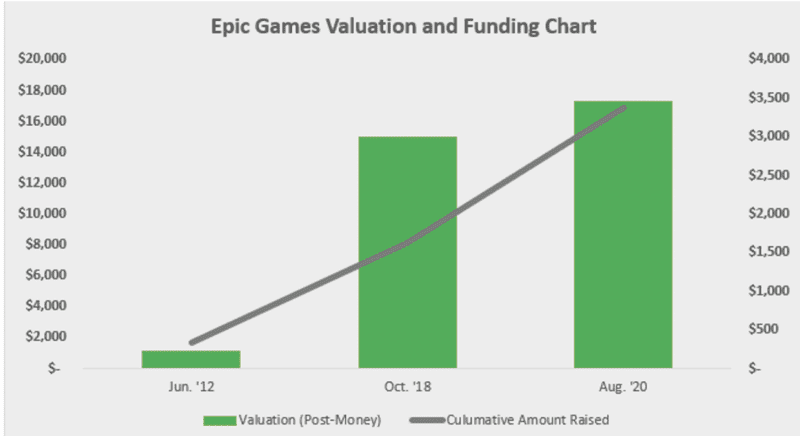

Unlike many privately held companies that will take funding from anybody willing to provide it, Epic Games takes a more strategic view. Despite a history that stretches back nearly 30 years, it has been reported that entering 2021 the company has taken approximately $3.4 billion in funding in only three rounds with the last funding at a post-money valuation of $17.3 billion.

We know it’s likely when Epic Games IPO occurs it will certainly be at a higher valuation than current, as Epic Games stock value will change each time the company undergoes a new investment round.

However, we can look at the chart below that includes cumulative money and the valuation per round to see the significant equity growth.

With its newest funding round in April 2021, Epic has now raised approximately $4.4 billion in funding and its equity valuation now stands at $28.7 billion.

That places Epic Games among the most valuable private companies in the world, but it may still prove to be cheap. Consider that Unity recently IPO’d and is worth $28 billion as of April 2021. Roblox’s valuation is even higher, tipping the scales at $45 billion.

What is Epic Games’ Stock Symbol?

Only public companies have stock symbols because they exist to inform investors of stock price changes on public exchanges and allow investors to quickly see their investment performance amid a sea of blinking tickers. Epic Games has no reason to have a stock symbol because it remains a private company.

Epic Games will eventually have to choose a stock symbol when they decide to come to the public markets. While it’s possible they will choose the New York Stock Exchange, it’s more likely the company will list its equity on the NASDAQ exchange.

Historically NYSE, aka the “Big Board,” has been preferred by more established companies like equity investor Sony. However, newer-gen stocks want to list on the tech-focused NASDAQ exchange. Additionally, there’s precedent in video game stocks listing on the NASDAQ, most notably World of Warcraft competitor Activision Blizzard.

An NYSE listing is not entirely out of the question for Epic Games’ stock ticker when it occurs. Recently, Tim Sweeney congratulated Roblox via Tweet on their upcoming debut on the public markets. Unlike most companies that are planning to do a SPAC or an IPO, Roblox is choosing to do a direct listing with NYSE, a process that is easier than an IPO because it raises no new capital and merely places existing shares on the public markets.

Regardless of whether Epic Games chooses to do a SPAC, direct listing, or traditional IPO, the stock symbol will not be affected. However, if it chooses to list on the NYSE or NASDAQ might weigh on Epic Games’ stock symbol. New York Stock exchange-listed stocks generally have symbols of three letters or less – SNE for Sony – while stocks on the NASDAQ tend to have four letters (ATVI).

If Epic lists on the NASDAQ, it has a choice of symbols like EPIC and GAME to choose from once it goes public. If it chooses the NYSE, EPG is available and would seem like a natural fit for Epic Games’ stock ticker.

Epic Games’ Stock: Should You Buy the IPO?

Many retail investors don’t know about Epic Games’ IPO, including if it will ever happen. Without knowing the price per share or carefully reviewing Epic Games’ financials, it’s difficult to recommend buying or avoiding the IPO currently.

However, we do have some preliminary information that is helpful for potential investors. Unlike other recent IPOs, Epic Games’ stock value seems to be reasonable by traditional metrics. Earlier forecasts for 2020 revenue were $5 billion, which means Epic Games’ stock price is valued at approximately 5.6 times revenue. Compared to publicly traded companies, Activision Blizzard, at 10 times revenue and Roblox which trades at nearly 50 times 2020 revenue, Epic Games’ stock value seems like a steal now.

But risks abound. Understandably, Epic Games’ revenue is mostly driven by engagement with the Fortnite game, meaning 2020 will be a good year for the top line. However, growth is not guaranteed as it was reported revenue in 2019 was $4.2 billion, a decrease of 25% from the prior year.

Public investors prefer stocks with a solid history of revenue growth, which could be difficult for Epic to produce as interest in its games will vary over time. Finally, IPOs tend to underperform existing companies over the first five years.

This is all hypothetical as it appears Epic Games will not file for its IPO in 2021. For long-term investors, Epic Games stock is one of the best ways to gain exposure to esports and the rise of gaming in general. There’s no wonder why investors are excited to see the company debut on the public markets.

No comments yet. Add your own