For more than a decade, Fundrise has been lowering hurdles so more people can invest in real estate. Real estate is one of the best alternative investment classes.

Real estate property could help diversify your investment portfolio, and real estate returns don’t necessarily correlate with the stock market.

Some of our site’s team members are active investors in Fundrise, so their experiences will help guide this Fundrise review.

What Is Fundrise?

Fundrise is a Washington, D.C.,-based, online real estate investment platform developed and launched by brothers Ben and Dan Miller back in 2012 after receiving SEC approval in 2010.

Fundrise has become one of the best (and best-known) real estate crowdfunding platforms. On Fundrise.com, a $10 deposit could make you a real estate investor.

Fundrise was the first real estate crowdfunding platform in the United States, and it remains one of the only real estate investment portals open to non-accredited investors.

How Does Fundrise Work?

Real estate crowdfunding platforms let you put a smaller amount of money in real estate, just like Lending Club lets you invest in personal loans without starting a bank.

Investment Types

Through Fundrise you can invest your money in real estate through two different investment vehicles:

- eREITs (Electronic Real Estate Investment Trusts): Fundrise invented these non-publicly traded trusts which resemble mutual funds or ETFs minus the liquidity. A single eREIT share could include pieces of a lot of different real estate developments or properties. Shares in eREITs target short-term income growth for you, the shareholder. These funds normally hold projects such as office buildings and shopping centers.

- eFunds: Fundrise’s eFunds targets long-term growth in property value for you, the investor. In 2022, Fundrise partnered with Saltbox, rerouting their eFund strategy from urban housing to industrial properties.

Unfortunately, neither eREIT nor eFund shares can be publicly sold, making them hard to cash out. Fundrise has worked to address this issue, but, ultimately, you’d still need another investor to buy your shares. This takes time.

Investment Strategies

When you join Fundrise, you’ll get to choose an investment strategy to guide your portfolio. These strategies are based on your risk tolerance and goals.

Here’s a quick breakdown of Fundrise’s four strategies:

- Fixed Income: This plan invests in real estate financing. It’s the least risky and typically nets a moderate return of around 4-8%.

- Core Plus: Core Plus invests in residential and industrial properties for higher income and growth, with an average total return of 6-10%

- Value Add: This strategy invests in modestly priced fixer-uppers in areas with limited affordable housing, with an expected overall return of 8-12%.

- Opportunistic: Fundrise’s riskiest strategy offers the highest potential for rewards, with an expected annual return of 10+%, focusing on major undertakings like new developments in prime locations.

I was skeptical at first and invested only because Fundrise promises a 90-day money-back guarantee. Within the first 90 days, however, I was satisfied with my portfolio return, low fees, and transparent practices. So I decided to stick it out for the next 5 years!

Fundrise Investment Plans

When you invest with Fundrise, you select a specific type of portfolio and risk tolerance. You can also choose a plan. Each plan invests your money in a different combination of eFunds and eREITs, diversifying your investments and reducing your risk compared to traditional real estate investing.

Your Fundrise real estate assets could become a source of passive income, adding to your cash flow every quarter. Your shares could also grow your portfolio and your net worth through real estate deals.

Let’s look at each Fundrise account level:

1. Starter

- Minimum Investment: $10

- Advisory Fee: 0.15%

- Management Fee: Up to 0.85%

- Referral Bonus Shares: $25

With a $10 investment, you can invest in Fundrise’s Flagship Fund. The Starter Account offers dividend reinvestment and auto-investing to keep you on target.

At this level, you can’t choose specific funds to invest in, with only one Investor Goal type. Once your account reaches $1,000 in asset value, you’ll have more control using the plans below.

2. Basic

- Minimum Investment: $1,000

- Advisory Fee: 0.15%

- Management Fee: Up to 0.85%

- Referral Bonus Shares: $50

The Basic Plan offers all the features above, plus it gives you access to all of Fundrise’s Investor Goals so you can choose how and where you invest.

Additionally, the Basic Portfolio allows you to open an IRA account and lets you invest in the Fundrise IPO, buying yourself an ownership stake in the company.

3. Core

- Minimum Investment: $5,000

- Advisory Fee: 0.15%

- Management Fee: Up to 0.85%

- Referral Bonus Shares: $50

When you make a minimum investment of $5,000, you get access to a more diversified portfolio.

The Core Plan and higher let you customize your portfolio by diversifying your investments across funds with targeted objectives like growth or income. You can also start investing in non-registered funds, i.e. eREITs.

4. Advanced

- Minimum Investment: $10,000

- Advisory Fee: 0.15%

- Management Fee: Up to 0.85%

- Referral Bonus Shares: $50

Serious investors with $10,000 or more to invest can enjoy more advanced strategies and the potential for higher returns, with the same advisory and management fees as the lower tiers of plans.

Along with all the features from the lower-tiered plans, Advanced investors can directly allocate funds and access Fundrise’s eFund.

5. Premium

- Minimum Investment: $100,000

- Advisory Fee: 0.15%

- Management Fee: Up to 0.85%

- Referral Bonus Shares: $100

If you’re an accredited investor ready to invest 6 figures with Fundrise, you can take advantage of its Premium features.

In addition to all the perks of the lower-tiered plans listed above, you get priority access to Fundrise’s Investor Relations Team and periodic access to specialized private equity funds.

Once you pick a portfolio, investing in Fundrise is pretty simple. Unlike other real estate investing platforms, you’re not picking from a single property when you invest. This keeps your risk low, so you don’t have to worry about one deal going wrong and ruining your entire portfolio.

Cost and Fees

Fundrise doesn’t charge any commissions or fees for transactions. However, all Fundrise portfolios come with two annual fees—an annual advisor fee and an assets under management fee.

The annual advisor fee, which can be waived in some scenarios is 0.15%. The annual assets management fee is 0.85%, so you can expect to pay 1% overall each year to use Fundrise.

Fundrise also notes that you could be responsible for some additional fees when you invest in individual real estate projects.

And if you opt to cash out on private eREIT or eFund investments in the first 5 years, you’ll incur a 1% fee on the shares you liquidate.

My Fundrise Results

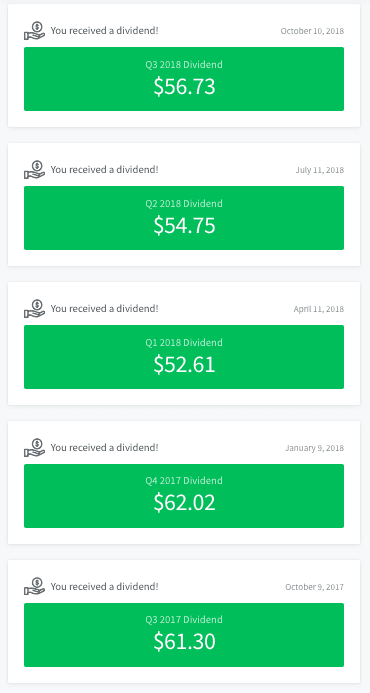

I’ve been investing within my Fundrise account since March 2017. I put $3,000 into the Long-Term Growth Plan. Every quarter since the second quarter of 2017, I’ve received a dividend, which I reinvest.

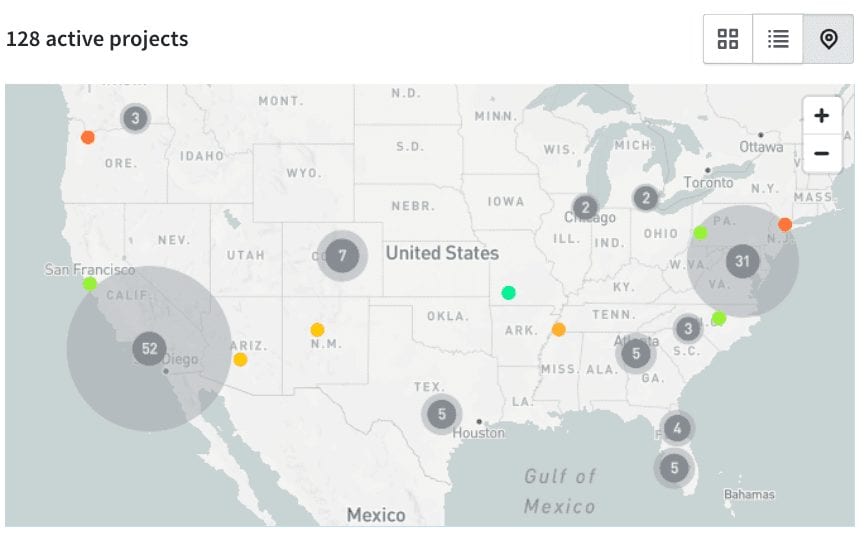

Check out all the assets/properties that I own a percentage of within the map below:

My $3,000 initial investment returned $357.56 in dividend growth in 19 months (6.3 quarters), or just over 7% annual return.

Pros and Cons

There are definitely advantages to investing with Fundrise, but there are some disadvantages too. We’ll cover the biggest pros and cons here:

Pros:

- Accessibility: Fundrise opens the door to real estate investing for non-accredited investors, letting you invest with as little as $10.

- Potential Returns: It is possible to get higher returns in the private real estate markets than in the public REITs.

- Diversification: It allows for instant diversification, so you are not stuck with one property manager or building project

- Higher Returns: Fundrise investments are harder to access than some short-term investments, paying higher returns as a result

- Dividends: Investors can earn quarterly dividends for Income eREITs.

- Customer Service: Customer service is great over the phone and through the Fundrise website.

- Excellent Ease of Use: Fundrise is my favorite platform among all the crowdfunding sites I’ve tried.

Cons:

- Lack of Liquidity: It has the right to deny your request to cash out before 5 years or charge a penalty if the real estate market is down, making your funds less accessible.

- Vague Fees: While the annual fee is relatively low, the website vaguely notes that you might incur other fees without clearly defining them unless you dig through each project’s offering circular.

- Passive Investing: Fundrise’s investment strategy may be a little too passive for real estate investors who want to get their hands dirty.

- Limited History: Despite its success, a decade isn’t enough time to know how it would perform in a true recession or depression.

Frequently Asked Questions

Who is Fundrise best for?

Fundrise could be a good fit if you check the three boxes below:

- Want to diversify into real estate holdings

- Don’t mind illiquid assets.

- Favor a passive investing strategy.

How do I get my money out of Fundrise?

You’re expected to hold Fundrise shares for at least five years, and you may be charged an early termination fee if you decide to exit early.

The Income Fund and Flagship Fund offer quarterly liquidation without any penalties. If you cash out eREIT or eFund shares before 5 years are up, you’ll be responsible for a penalty of approximately 1% of the share’s value.

Is Fundrise a risky investment?

There’s always risk involved with investing, but Fundrise has a history of solid returns. Because assets are illiquid compared to other investments, Fundrise is best for long-term investors who don’t need immediate access to their assets.

Alternatives

Thankfully, with the help of Fundrise, you don’t have to have a ton of money or time to invest in commercial or residential real estate and maintain it.

The JOBS Act of 2012 made online real estate crowdfunding portals perfectly legal. This quickly spurred hundreds of different real estate portals, letting accredited (and in some cases, every day) investors buy small pieces of many properties at once.

Alternatives Options:

- RealtyMogul

- Prodigy Network

- iShares

In the beginning, we rarely saw these portals open to the everyday investor, so there was a sense of exclusivity in real estate investing.

But nowadays, that’s all changing. A few real estate crowdfunding services have popped on the scene that doesn’t require accreditation and have small investment minimums but still offers premier investment opportunities to investors, including Fundrise and RealtyMogul.

Is Fundrise Worth It?

The Fundrise platform is one of the best in the industry and is one of the first that’s open to all investors—not just those meeting specific income requirements.

All in all, we highly recommend Fundrise to investors who want to diversify their portfolios, or to non-accredited investors that want to dive into the real estate crowdfunding space.

Considering there’s a $10 investment minimum, you can test the waters before diving in head-first (other platforms require a higher minimum!)

No comments yet. Add your own