I bought my first house hack at age 24. I moved into a duplex that I purchased in foreclosure. The duplex cost $240,000, and I was able to purchase it with a 5% down FHA loan, meaning that I brought just $12,000 to closing, which was much of my first year of savings out of college.

I moved in and began making the $1,550 monthly payment, including principal, interest, taxes, insurance, and PMI (PMI—a form of mortgage insurance that I was required to pay because I put just 5% down.

After fixing the place up, I began renting out the other unit for $1,150 per month, and half of my 2 bed, 1 bath unit to a roommate for $550 per month. At that point, I was collecting $1,700 in rent, on my $1,550 mortgage. After my portion of the utilities and the occasional repair, I broke even. I was living completely rent free!

What is House Hacking?

House Hacking is having your cake, and eating it too. It’s a mix of buying a personal residence and investment property.

House hacking occurs when you buy a piece of investment real estate, live in one of the units or bedrooms, and rent out the others.

It allows the buyer to use other people’s money (tenant rent) to pay down the mortgage and live for free. It also allows the buyer to benefit from potential appreciation.

Many of us are not escalating in our careers financially at the same pace the real estate market has accelerated. Houses are now viewed as an asset, business, & retirement plan.

5 Reasons to Start House-Hacking

There are many benefits to house hacking, here are the top 5:

1. Eliminate Your Biggest Expense

Many people focus their energies on cutting back on insignificant parts of their budgets. We’re told to cut back on happy hour, bring lunch to work, and cut out the lattes from Starbucks. We’re told that disciplined saving—of at least 15% of our incomes–is the way toward wealth and early financial freedom.

But, saving 15% of your income is too slow. Sure, you’ll be able to retire in 30-40 years if you do that and invest conservatively, but you can cut decades from that timeline by getting more aggressive.

Instead, you should be saving 50%, or more, of your income. And you should do it without cutting back on your lattes, lunches, and entertainment budget.

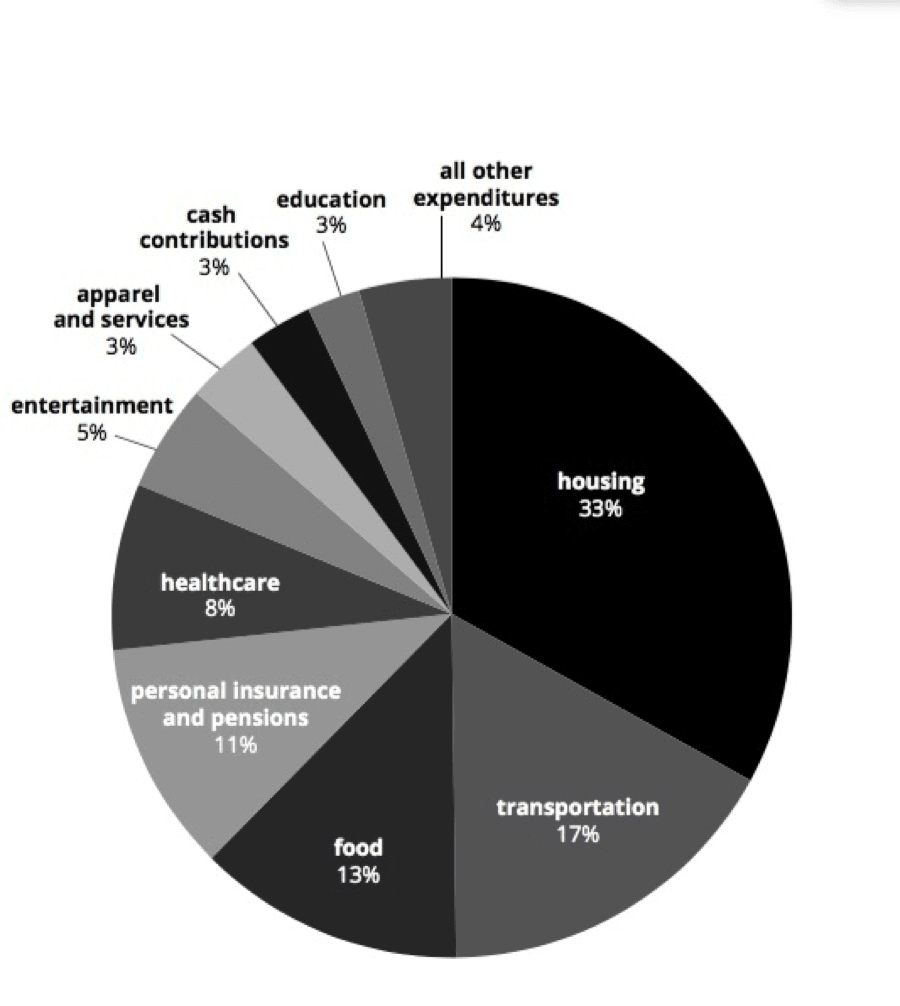

The government (specifically the bureau of labor statistics) provided the data in the chart to the right, so naturally, taxes are not included. But moving past taxes we can clearly see where the Average Joe spends most of his money.

Literally, half of the typical American’s expenses come from just two categories – housing and transportation. 33% of total spending is on housing.

Preparing your meals instead of going out to lunch, going on inexpensive vacations, and cutting back on your entertainment budget is fine, but why sweat the small stuff when a third of your spending is going out the window every month?

What if I told you that you could completely eliminate your housing expenses and live completely for free? That will make a real difference in your budget. House hacking will help you build wealth, and fast.

2. Increase Your Savings Rate Substantially

We now know that house hacking decreases your month-to-month costs significantly. The result is you’re able to save more money faster, to allocate towards your next purchase (don’t stop at one property). In fact, house hacking can be the perfect side hustle.

While already a strong saver, I was able to substantially increase my savings rate in the absence of a rent or mortgage payment, allowing me to stockpile cash very quickly.

In just 15 months the combination of my hard work improving the property, market appreciation, loan amortization (paying down the mortgage with regular monthly payments), and my rapidly improving financial position enabled me to refinance my loan to remove PMI.

My payment dropped to $1,400 per month, and rents rose, so I was able to command $2,600 per month from the property. Nowadays, in a problem-free month, I collect $1,200, just from this one property!

I moved on to purchase another duplex and repeated the strategy. I’m on track to purchase a new rental property house hacking style every 12-18 months.

It’s easy to save for the next down payment, even in the expensive Denver market, when you don’t have to pay any rent or mortgage at all, and have thousands of dollars in passive income from the first few house hacks!

3. Cost Savings on a Bigger or More Expensive Home

Mortgage payments can be expensive, having a separate unit paying rent will decrease your month-to-month costs, this is obvious, but consider this:

House Hacking will allow you to pay LESS month-to-month, even while buying a SIGNIFICANTLY more expensive house.

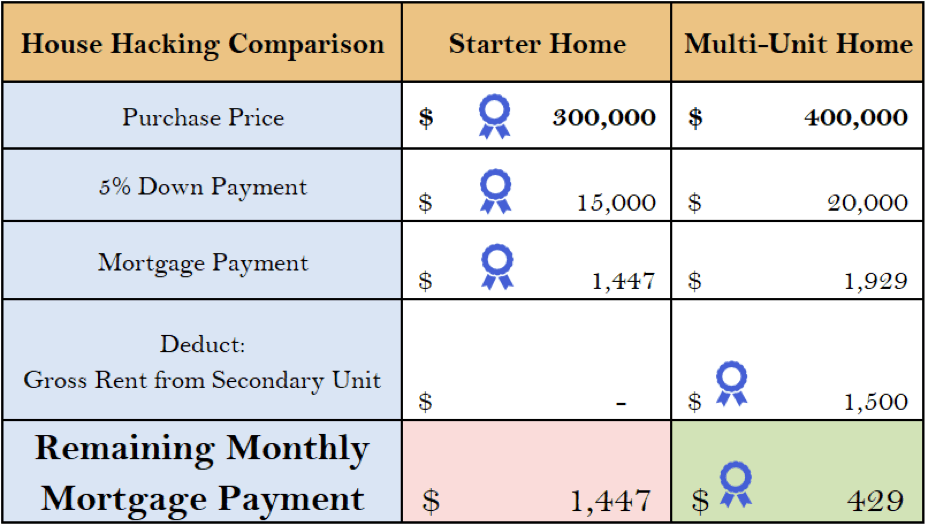

The following is a cost breakdown of buying a starter home for $300,000 vs a Multi-Unit Home for $400,000 as it relates to mortgage payments.

In this scenario – Purchasing a home worth $100,000 MORE can potentially SAVE you $1,000 per month in costs. Think about that. You pay $5,000 more in down payment upfront, to save over $12,000 in year one. Then you get your money back in 6 months. You also now own more valuable property. Later in the article, I’ll break down the other profit centers found within house hacking.

In addition to monthly savings – the versatility of house hacking is a big reason for its popularity.

4. Home Hacking Gives You More Flexibility

Your 20s & 30s bring significant changes in your life. If you’re like me, you probably have commitment issues. This is why I haven’t left my parent’s house. Committing to a home long-term is tough for me. On the other hand, I have no problem committing to something long-term if it pays me every month, which is what makes house hacking and investment properties so attractive.

House Hacking provides the flexibility needed to create a living experience that suits your life as you evolve.

- Want to save the most money possible? Live in the least desirable unit in your home, in the basement, or even on the couch if your roommates are down with it.

- Feel like you deserve the nicer suite? Upgrade yourself and rent out the less desirable unit.

- Want a new place and maximum money saved? Rent your less desirable unit, and get a roommate for your unit.

- What if you’re only comfortable with exclusive access to the backyard and driveway parking? You’re the landlord, specify the use of common spaces in your tenant’s lease.

- Received a Job offer out of town, what now? Rent your unit out, move, and use the cash flow towards your rent elsewhere while you figure out your next move.

- You love the neighborhood and don’t want to move, but your family has grown….Convert a multi-unit to a single-family residence and stay in the neighborhood you’ve grown to love.

The point is house hacking is extremely versatile, & won’t leave you stuck in one place facing a mountain of debt. It’s a no-brainer in absolutely every sense for people beginning to build wealth.

5. Financial Growth Through Passive Income

There are several ways that this passive income strategy can grow your finances.

Benefits of Increased Principal Paid Monthly

While your personal month-to-month costs are lower, your mortgage payment itself is still higher. As a result, you’re paying more principal towards your mortgage by choosing a more expensive property. Using the scenario built out earlier, even though we pay $1000 less per month, we’re still paying just over $200 more principal per month.

The result is an additional $12,000 in equity paid down after 5 years (all while saving more month-to-month). More savings to go with your savings.

Increased Benefit from Appreciation

I’ll make this simple – If your $300,000 starter home and $400,000 duplex both appreciate by 6%, which makes a greater return? Of course, the $400,000 asset.

When you factor this is compounded year over year, the difference gets a lot larger.

Ability to Refinance & Maintain Cash Flow

If you purchase the correct property, you’ll be able to receive cash flow a healthy amount above your monthly expenses with all units rented.

Having a healthy cash flow will allow you to refinance equity out of your existing home, and leverage that cash to place a down payment on your second property.

If you make enough cash flow above your expenses you’ll still be able to break even, or produce cash month-to-month on your first property with an increased mortgage payment from your refinance.

Building a portfolio of property as you upgrade from home to home will act as the building blocks toward your retirement, children’s future, or whatever projects are more in line with your goals.

Why Don’t More People House Hack?

I often get asked about house hacking—if it’s such a great idea, why don’t more people do it? I frankly have no idea why this isn’t more popular, as it seems to me to be an obvious way to easily build wealth, and the most straightforward way to move towards early financial freedom.

If you are even an average saver, with solid credit and a good job, then this can be done with very little effort relative to the financial benefits.

But sometimes, I hear arguments against house hacking. Here are three:

1. “Won’t I be responsible for maintaining my property?”

Yes, you will. You will be responsible for making sure that everything works well and is well maintained.

I’d encourage you to understand that every single homeowner in the world is responsible for this basic maintenance and that folks should not be scared to pick up the phone and call the handyman/plumber/electrician when problems arise or even tackle certain problems themselves! Consider it an extraordinarily high paying job.

If you are able to live rent-free in a space that would cost $700 per month otherwise and have to do 1 hour of work every month to maintain your property, that’s $700 per hour!

2. “What if the tenants don’t pay rent or I don’t like them?”

This is actually the beauty of house hacking, not a downside! You get to choose your neighbors. Too many folks think that they have to manage tenants.

But it’s really much better than that. You get to select quiet, friendly neighbors that will be kind enough to pay down your mortgage for you AND treat your property and you with respect. If they don’t, you can evict them!

Obviously, it’s wise to learn how to properly manage tenants, perhaps by reading a book on the subject and asking local landlords how they handle problems. But, managing tenants well should not be a big problem for folks willing to act reasonably and intelligently.

Don’t allow fear of tenant management prevent you from taking advantage of one of the best ways to build wealth while working a full-time job and living your life.

3. “I don’t want to live in a crappy investment property!”

Um, excuse me, that’s my home you’re talking about! All kidding aside, buying a house hack, like buying a home, falls across a spectrum. The guy willing to go into a more up-and-coming neighborhood might be able to live totally rent-free, as I did.

But the guy that house-hacks in a more posh neighborhood can still live there for far less cost than others in his market. If he lives in a place with a $3,000 mortgage, and only collects $2,500 in rent, he is still living in a great spot and/or a luxurious space for an exceptionally low cost.

And don’t try to tell me that there are no investment properties in your market. I’m in Denver, CO, and I see deals hit the market every day. That just tells me that you’ve dismissed this idea before even bothering to look.

Top 3 House Hacking Books

If you want to learn more about house hacking check out these great books to learn the ins and outs of aligning house hacking with your ideal lifestyle.

- Set for Life: Dominate Life, Money, and The American Dream by Scott Trench

- The House Hacking Strategy by Craig Curelop

- Retire Early with Real Estate by Chad Carson

Live For Free & Invest in Real Estate Using Other People’s Money

Your month-to-month costs are determined by the type of home you buy, as much as the purchase price.

House hacking is done by design, can suit any lifestyle, and will keep you flexible enough to pursue the many opportunities that will come your way in life.

Buying an owner-occupied investment property and renting out the additional bedrooms and/or units is probably the single most effective hack that a median wage-earner can make to begin moving towards financial freedom rapidly.

It takes the largest expense in your life and wipes it out entirely. Why would you bother to remain disciplined day in and day out with the fun stuff in your life, when you can automatically save yourself tens of thousands of dollars per year through the combinatorial benefits of house hacking?

There’s a ton of upside to this strategy and little downside. It’s low risk because even if the market crashes, the house hacker stands a great chance of keeping his head above water just fine. He’s got rent coming in from his tenants to help him offset his payment. His friends who own single-family homes with no tenant assistance will be far more financially devastated than he.

This is the ultimate low-risk, high-reward way to buy your first or next property if you want to fast-track your financial freedom.

Read 14 comments or add your own

Read Comments