The best physician mortgage loans help doctors and other medical professionals purchase their dream homes without waiting until they can meet the more rigid requirements of a conventional loan.

You might think that saving lives is priceless, but when it comes to medical degrees, it’s rather expensive – qualifying as a doctor leads to six-figure debt.

Fortunately, today’s lenders recognize doctors are extremely low-risk borrowers despite their high debt, so they’re willing to make special provisions.

These physician mortgage loans have special terms only offered to doctors and other high-income earners to help them along the path to homeownership.

19 Best Physician Mortgage Loans

These companies offer the best physician mortgage loans in 2025:

- FinancialResidency.com

- First Horizon Bank

- Fifth Third Bank

- Regions Bank

- TD Bank

- Fairway Independent Mortgage Corporation

- Arvest Bank

- Flagstar Bank

- BMO Bank

- Cadence Bank

- BankMD

- Fulton Mortgage Company

- Horizon Bank

- Huntington Bank

- KeyBank

- Life Michigan Credit Union (LMCU)

- NBT Bank

- UMB

- University Federal Credit Union

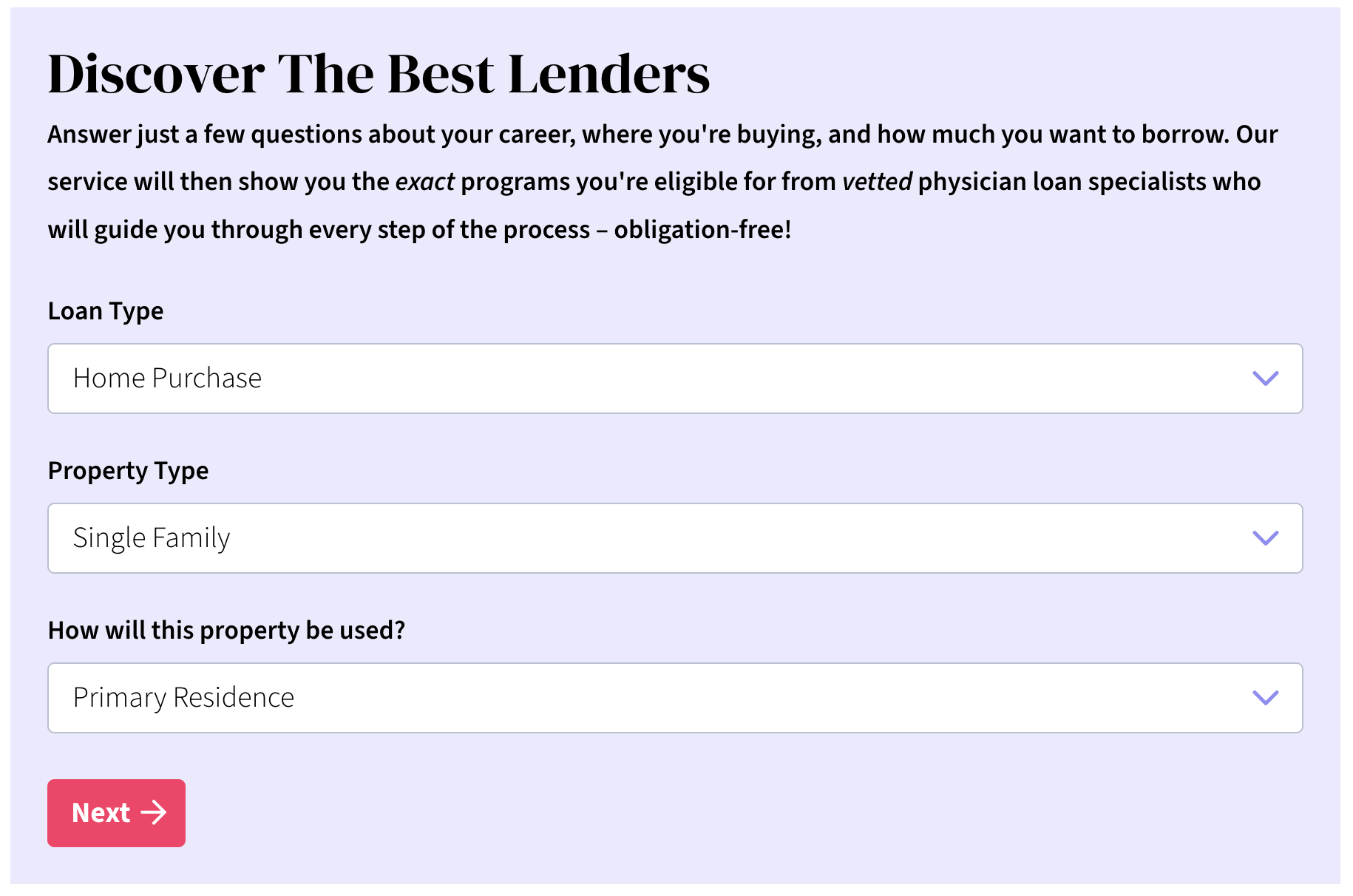

1. FinancialResidency.com

Availability: All 50 States.

FinancialResidency.com is not a lender, but they help match doctors and dentists with loan programs in their state.

The loan programs vary by state and lender, but there are many opportunities for no and low down payment options.

The loans are relatively flexible: you can choose between fixed and ARM options and move into the house up to 90 days before your contract starts.

It’s also possible for sellers to pay 3-6% of the closing costs, which helps you to save even more money.

Compare Rates with FinancialResidency.com

2. First Horizon Bank

Availability: Alaska, Arkansas, Connecticut, Georgia, Florida, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas, Virginia, New Jersey, and New York

First Horizon Bank extends its physician mortgage loan to:

- Medical Doctors (MD)

- Doctors of Osteopathic Medicine (DO)

- Doctors of Podiatric Medicine (DPM)

- Oral Maxillofacial Surgeons (OMS)

It’s important to note that First Horizon’s physician home loan program does not include residents.

This doctor mortgage loan has a loan limit of $2.5 million. Some healthcare professionals can qualify for no-money-down loan options, but the exact down payment requirements will depend on each borrower’s creditworthiness.

For example, to qualify for 90% financing, borrowers must have a minimum credit score of 720 and qualify for a lien-first non-escrowed 30-year fixed-rate mortgage. All borrowers will be required to open a First Horizon Bank account to qualify for the program.

However, First Horizon will work with physicians with scores down to 670. First Horizon loan up to $1.5 million without a down payment to qualified borrowers. Loans up to $2 million will require a 5% down payment and loans up to $2.5 million will require at least a 10% down payment.

First Horizon Bank’s underwriting is more lenient when it calculates the DTI ratio for physician home loans. It won’t factor in student loan debt deferred for 12 months or more.

Like other physician mortgage programs, First Horizon Bank does not require PMI, which can save you thousands of dollars over the life of your loan.

3. Fifth Third Bank

Availability: Florida, Illinois, Indiana, Kentucky, Michigan, Ohio, Tennessee, West Virginia, Georgia, North Carolina, South Carolina, Wisconsin, and Pennsylvania

Claiming to put 166.7% into everything they do, Fifth Third Bank offers a range of mortgage programs.

Its Established Physician and Dentist Loan program offers the opportunity to loan up to $1,000,000 with no down payment or up to $2 million with a low down payment (or $1 million for residents, fellows, and new physicians). As usual, no PMI is required.

You can choose between a fixed or ARM loan, and there are mortgage refinancing options available for new physicians. You’ll need your contract to start within 90 days of the closing date.

4. Regions Bank

Availability: Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, Ohio, North Carolina, South Carolina, Tennessee, and Texas

Regions Bank has a loan program for physicians and dentists looking to buy their primary residence.

This is open to:

- Residents

- Fellows

- Dentists

- Doctors of Osteopathy

You’ll be able to loan up to $750,000 with no down payment or up to $1 million with a low down payment.

PMI isn’t required, and student debt will be excluded from the debt-to-income (DTI) ratio used.

5. TD Bank

Availability: Connecticut, District of Columbia, Delaware, Florida, Massachusetts, Maryland, Maine, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Virginia, and Vermont.

The self-proclaimed ‘most convenient bank,’ TD Bank, offers various flexible mortgage loans for doctors.

You must be an MD, DO, DPM, DDS, DMD, oral surgeon, or resident with at least two years complete to be eligible.

You can receive 100% financing on up to $1,000,000, 95% on up to $1,000,001-$1,500,000 (with a 5% down payment), and 89.99% on up to $1,500,001-$2,000,000 (with a 10.01% down payment).

No PMI is required, and you can choose between a fixed or ARM term. Construction loans are also available.

6. Fairway Independent Mortgage Corporation

Availability: All 50 States.

Fairway Independent Mortgage Corporation is a mortgage specialist operating for over 27 years and is now ranked #1 in Mortgage Origination Customer Satisfaction by J.D. Power.

The doctor loan is available to Medical doctors (MD), Medical residents or fellows, Medical researchers, Chiropractors (DC), Pharmacists (RPH), Podiatrists (DPM), Optometrists (OD), Ophthalmologists (MD), Dentists (DMD), Dental surgeons (DDS), Osteopaths (DO), and Veterinarians (DVM) within ten years of completing their original residency. You can apply when your contract is within 60 days of closing.

Loan eligibility depends on your income and debt-to-income ratio. Even on homes costing $850,000 or more, you could be able to put down as little as 3% or 5% if you don’t qualify for 100% financing.

7. Arvest Bank

Availability: Arkansas, Kansas, Missouri, and Oklahoma.

Arvest offers various non-conforming mortgage loan programs, including physician mortgage loans.

These are suitable for physicians who have recently graduated, currently have a house, and have been practicing healthcare professionals for many years already.

You can receive up to 103% of your house value in a loan, but everything over 100% has to be used for taxes, insurance, or other closing costs.

Arvest boasts flexible underwriting guidelines with no private medical insurance and a residency program.

8. Flagstar Bank

Availability: All 50 States.

The Flagstar Bank Professional Loan program is for attorneys and other professionals with advanced degrees, as well as dentists and doctors.

You must be in the first ten years of your career with a credit score of at least 720 to be eligible. It’s also necessary to have a contract that starts within 60 days of the deal closing.

You can loan up to $1,000,000 with no down payments (and a credit score of >720) or up to $1.5 million with low down payments. There are various adjustable-rate mortgages, including a 5/1 and 7/1 ARM, but no fixed-rate options.

9. BMO Bank

Availability: Arizona, Florida, Illinois, Indiana, Kansas, Minnesota, Missouri, and Wisconsin.

A subsidiary of BMO Financial Corporation, BMO Bank is a multi-billion-dollar bank with hundreds of branches.

It offers a BMO Physician Loan Program to doctors and dentists with a FICO score of 700 or more. All loans under this offering require no PMI and no income history for approval.

You are eligible to borrow up to 95% on mortgages up to $1.5 million and 90% on mortgages up to $2 million.

There are a few options, including a 3/1, 5/1, 7/1, or 10/1 ARM loan. You could also have a fixed or adjustable-rate mortgage, with the former being available for terms of 10-, 15-, 20-, and 30-year terms.

10. Cadence Bank

Availability: Colorado, Florida, Georgia, North Carolina, and Texas.

Cadence Bank offers Mortgages for Medical Professionals with no PMI requirement and additional benefits.

Having significant student loan debt or not having enough cash on hand for a sizable down payment might make getting a mortgage difficult. Qualifying borrowers can get a mortgage with low or no down payment and no private mortgage insurance through Cadence Bank’s medical professional lending program.

11. BankMD

Availability: Texas.

BankMD is a digital-only offshoot of TransPecos Banks focused on the niche of medical professionals in Texas, thus combining 100 years of experience with a specialized product.

Their loan products boast up to 100% financing with no PMI and no prepayment penalty. It’s also effortless to apply: fill in your needs online, and you’ll find out if you’re approved in minutes.

BankMD also offers mobile banking and specialized underwriting.

12. Fulton Mortgage Company

Availability: Maryland, District of Columbia, Virginia, Pennsylvania, Delaware, and New Jersey.

Fulton Mortgage Company has a few mortgage options available, including special requirements for physicians, pharmacists, dentists, and veterinarians.

Fulton Mortgage Company offers the following:

- 100% financing for loans up to $1.5 million

- 95% financing for loans up to $2 million

- 90% financing for longs up to $3 million

You can choose a mortgage at a 30 and 15-year fixed rate or a 5/6, 7/6, 10/6, & 15/6 ARM.

13. Horizon Bank

Availability: Indiana, Michigan, Alabama, Arizona, Arkansas, Colorado, Florida, Georgia, Illinois, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, and Tennessee.

Horizon Bank offers a doctor loan for physicians, dentists, and optometrists, but it’s not available within most states.

To apply, you also need a payroll deposit with an auto-debit from a Horizon bank account, which is a significant limitation.

You can loan up to $750,000 with no down payment or up to $1.5 million with flexible down payments.

14. Huntington Bank

Availability: Ohio, Illinois, Indiana, Michigan, Wisconsin, West Virginia, Kentucky, and Pennsylvania.

Exclusively for medical doctors (with an MD, DO, DDS, DVMM, or DMD), the Physicians Only Loan Program from Huntington Bank has all the benefits you’d expect.

You can loan up to $750,000 with no down payment or up to $2,000,000 with flexible down payment options.

There’s also no PMI and no prepayment penalty, as well as the chance to choose between fixed or variable rates.

15. KeyBank

Availability: Alaska, Arizona, California, Colorado, Connecticut, District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Kentucky, Maine, Massachusetts, Maryland, Michigan, North Carolina, New Hampshire, New Jersey, Nevada, New York, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Texas, Utah, Virginia, Vermont, and Washington.

KeyBank is one of the largest banks in the US and offers a variety of home mortgage options, including a doctor loan program.

The KeyBank loan is one of the most generous available in terms of the amount of money you can borrow; you can obtain a loan of up to $3.5 million, although this requires a more conventional down payment.

Otherwise, you can receive 100% financing for up to $750,000, 95% financing for up to $1 million, and 90% financing for up to $1.5 million.

16. Lake Michigan Credit Union (LMCU)

Availability: Florida and Michigan.

A credit union is a financial cooperative, which means members rather than private investors own unions.

This generally results in favorable terms, which is the case for the LMCU doctor mortgage.

You can loan up to $2,000,000 with loan down payment options, but there’s an option for 100% financing or higher loan amounts.

No PMI is needed, student loan debt is excluded from debt calculations, and you can receive up to $650 in closing cost credits.

17. NBT Bank

Availability: Maine, Massachusetts, New Hampshire, New York, Pennsylvania, and Vermont.

The NBT Bank mortgage loan is designed for the following with a credit score of 700 or more:

- Physicians

- Dentists

- Optometrists

- Podiatrists

You can loan up to $850,000 with loan down payment options, but there’s an option for 100% financing or higher loan amounts.

The loan, therefore, isn’t suitable for all medical designations and budgets.

18. UMB

Availability: All States, except Alaska, Hawaii, New York, and Washington D.C.

UMB is a multi-billion-dollar financial services company with over a hundred years of experience in the industry.

Although the bank doesn’t offer a specific mortgage loan for physicians, it does provide a Mortgage Portfolio Professional Loan program for various doctorate professionals licensed in their careers, which includes medical doctors.

To be eligible, you’ll need a FICO score of 700 and a debt-to-income ratio of 43% or less. You won’t have to pay PMI and can loan up to $2,000,000 depending on the equity you already have. To borrow the full $2,000,000, you’ll need a down payment of 10%, but this drops to 0% for those loaning up to $750,000.

There are products with a fixed interest rate for 15-, 20-, and 30-year terms. You’ll need to have a contract with a start date 60 days prior.

19. University Federal Credit Union

Availability: Texas

The University Federal Credit Union offers mortgages that ‘offer more.’

Doctors and nurses can choose a Medical Community loan alongside other loans tailored to various professions.

Residents, fellows, and practicing physicians can loan up to $424,000 with no down payment or up to $1.5 million with low down payments.

No PMI is needed.

Benefits Of Physician Mortgage Loans

The benefits of physician loans are certainly appealing, but they don’t necessarily make sense for all doctors. The decision ultimately comes down to personal circumstances.

Because doctors are deemed as being low-risk, physician loans have more favorable terms than conventional loans. For example, certain providers let you access as much as 100% financing without private mortgage insurance (PMI), which is normally charged to anyone who can’t afford a down payment of 20% or more on their mortgage. PMI typically falls between 0.58% to 1.86% of the original loan amount, which can add up to thousands by the time you hit 20% equity. Physician loans save borrowers from paying this fee by waiving the requirement.

Another difference is that conventional loans count student debt within the debt-to-income ratio, making it easier for physicians to get approved as long as they have a good credit score.

Physician loan applicants are also unlikely to need current employment; a signed contract to prove you’ll start employment soon is generally sufficient.

Pros and Cons of Physician Mortgage Loans

Weighing the pros and cons of physician home loans can help borrowers make an informed decision throughout the home-buying process. Physician mortgage loans have many benefits, but they’re not the ideal fit for all financial situations.

Consider the following points before choosing a home loan program that fits your needs.

Pros

- Low down payment options: Borrowers can often qualify for 90–100% financing with a physician loan program. Lower down payments can make homeownership much more accessible for early career healthcare professionals.

- No private mortgage insurance: Physician mortgage programs don’t require private mortgage insurance––even when you put down less than 20% of the home’s purchase price.

- Can be used to refinance: Doctor mortgage loans may be used to purchase a new home or refinance a property you already own.

- Lenient on student loan debt: Many medical doctors, dentists, and other healthcare professionals graduate with significant student loan debt. Physician mortgage programs often exclude deferred student loan debt or use the income-driven repayment amount when calculating DTI.

- Higher loan limits: Physician loans are non-conforming, so they are not held to the loan limits set by Fannie Mae and Freddie Mac.

- Thoughtful home-buying process: Physician loan officers are knowledgeable about medical professionals’ unique needs, so they will work with every borrower to help them gather the necessary documentation and streamline the process.

- Buy before you start your new job: Doctor loan programs will often accept employment contracts as proof of income for applicants who don’t have a sufficient work history. Generally, borrowers will have to start their new jobs within 60–90 days of closing.

Cons

- Higher credit score: Conventional, VA, and FHA loans have much lower credit score requirements than physician mortgages. In general, doctor loans require a 700 minimum credit score.

- Higher interest rates: Physician mortgage loans often have higher interest rates to offset the lower down payment

- High monthly mortgage payments: Because physician loan lenders will extend millions of dollars to qualified borrowers, the monthly mortgage payments can easily become a financial burden without careful planning.

- Age limits: Many physician loan programs are tailored to new doctors within the first 10 years of their careers.

- Every program accepts different healthcare professionals: Each lender decides the medical designations to extend its program to, so it’s important to talk to a loan officer to confirm the programs you’re eligible for. For example, not all programs will accept medical residents.

- Property restrictions: Physician loans are intended to purchase or refinance a primary residence, which means they can’t be used for investment properties or second homes.

How To Qualify For A Physician Mortgage Loan

Although the requirements vary slightly between mortgage lenders, certain perquisites are consistent across all providers of physician mortgage loans:

- Proof of a Medical Degree

- A signed employment contract proving you have a job as a doctor that will start within 60-90 days of closing

- FICO score of 700 (sometimes 710–720 for 100% financing)

- Deferred student loans or income-driven repayment plan

- A debt-to-income ratio of 45% or less (excluding student loans)

Frequently Asked Questions

Does Chase offer physician mortgage loans?

Chase doesn’t offer a particular loan for physicians. However, it does provide a range of mortgage options: fixed-rate mortgages, ARMs, jumbo mortgages, DreaMaker (with low down payments, and reduced PMI options for those with low-to-moderate income), FHA mortgages (a loan insured by the government), and a Veterans Affair loan.

Jumbo mortgages share similarities with physician mortgage loans because you can borrow more than you’d normally be able to. Chase offers to finance up to 85% of the value of a home as long as borrowers have a good credit score and significant reserves. Many doctors may fit into this category. However, PMI is required.

How much student loan debt does the average doctor have?

According to the Association of American Medical Colleges, the average doctor in the US has a total debt worth an astounding $190,694. It’s easy to see that it would be difficult for doctors to get approved for mortgages without student loan debt being excluded from the debt-to-income ratio.

How long does it take to pay off student loans for doctors?

Since the average salary of physicians is more than $200,000, doctors can pay off their student loans relatively quickly if they’re motivated to do so.

Of course, the exact amount of time it takes will depend on the individual circumstances, such as if they live in a city with a high cost of living and how much they’re willing to save. Aggressive repayment strategies can have financial benefits, but it may also be possible for you to pursue loan forgiveness if you work in a non-profit or hospital setting.

You can expect it to take about thirty years to pay off medical school loans, but this could be reduced to half or even a third of the time if the borrower is suitably diligent through the Public Service Loan Forgiveness Program (PSLF).

Is a 10/1 arm a good idea?

A 10/1 ARM (also known as a 10-year adjustable-rate mortgage) has a fixed interest rate for the first ten years, after which the interest rate changes every year or at the frequency outlined in the mortgage documents. This fluid interest rate makes it a hybrid mortgage because it combines features from an adjustable-rate mortgage (ARM) and a fixed mortgage.

The major benefit is that you’ll initially start with a low fixed interest rate, which is almost always preferable over a variable interest rate.

However, since you’ll ultimately end up with a variable interest rate, you could end up paying more interest on your loan term than if you had locked in a fixed rate, especially if the rates rise in the years after you purchase.

An important factor to consider is how fast you’ll be able to pay off your loan. Shorter loan terms often have lower interest rates but higher monthly payment amounts.

Generally, a 10/1 ARM is tied to an index, an interest rate based on investment returns, so the amount you’ll be paying depends on economic conditions, such as global interest rates.

You need to be sure that you’ll still be able to meet your interest rate payments when the variable interest rate is introduced, as you could end up getting hit by rates too high for you to manage if you’re not careful.

Are Physician Mortgage Loans for You?

If you know you’re going to stay in the same area for a long period, and you have a contract as a doctor, getting a physician loan can seem like a no-brainer.

However, keep in mind that many doctors leave their jobs after just a few years and that it’s tough to figure out where you want to live when you’re just beginning your career. If you end up moving homes in five years or fewer, you might not be able to build up enough equity to make a profit should you choose to sell.

You should also be careful only to buy a house you can really afford – just because you could get a $1 million home with a physician loan, doesn’t mean that you should. If your FICO score is low, you’ll struggle to get approved anyway. Talking with a qualified financial advisor can help you take charge of your current financial situation, plan for the future, and make a reasonable decision about the right home for your needs.

For doctors who are confident they’re ready to put long-term roots down in their communities, a physician loan can be a viable path to homeownership and the start of building equity.

No comments yet. Add your own