I’m not going to waste your time. This post could make you a ton of money. Analyzing whether to rent or buy using this simple process has made me a lot of money. It’s simple, free, and easy to follow.

Deciding whether it’s better to rent or buy is one of the most important investment decisions of your life. If you’re reading this post I know you are taking it seriously.

Most people rent for way too long. It’s one of my own 7 Millennial Money Mistakes. I think in a vast majority of cases if you are going to live in a house at least 2 years it almost always makes more sense to buy. Of course, it depends on where you live, but in most places buying even with 5% down and paying PM (private mortgage insurance) is a good decision.

Although it didn’t make my list of 7 Best Money Books for Millennials, the best book I’ve read on how to search for a home is Zillow Talk: The New Rules of Real Estate. It’s jam-packed with awesome advice that pushes against traditional wisdom using actual Zillow data. If you read one book read this one.

Also, here is a recent Millennial Money Minutes podcast episode on rent vs. buy for a quick perspective (but there is a lot more data in this entire post):

When I was 27 I asked this same question – should I rent or should I buy? I decided to buy and it was the third best investment decision I have made so far in my life.

Over the past 4 years, my condo has increased 147% and increased $350,000+ in value.

Not only did it appraise for that much, a unit below mine the same size sold for even more just a few months ago. And in my neighborhood are projected to increase another 8% this year. Of course, I understand that I haven’t yet sold this investment, but I was very close to not buying and renting (BECAUSE OF ALL THE CONVENTIONAL WISDOM TOLD ME TO RENT!)

It’s still a better idea to buy instead of renting in most markets.

“Most people rent too long. In most markets you should buy as soon as you can. – millennialmoney”

How did I do this? Not bad for a bit of online research. Did I get lucky? Sure I had a little luck – but I also made an incredibly calculated decision. In this post, I’ll show you exactly how I evaluated this question and how you can too.

A lot of the data shared in the media is super generic – like you should rent in San Francisco and buy in Des Moines Iowa. It’s actually not that helpful. Forbes publishes an annual article on the Best Buy Cities and is worth checking out, but too many people only use this advice.

So what did I do?

We’ll I can’t show you what I did for my neighborhood because then all you internet stalkers would know where I live. While I love you all, I don’t want you showing up at my doorstep!

So, since I’ve gotten quite a few recent reader questions on this topic I decided to pick one of them and use it as an example to show you exactly how you can evaluate whether it makes more sense rent or buy in your own market.

Here is the exact process I used to decide whether it was better to rent or buy

Reader email (anonymized of course!):

“Hi, My name is Steve Wright and I am a recent graduate of Boston College. I have been reading your blog for the past few months. I am fortunate enough to have been offered a full-time position working as a policeman for the City of Syracuse, only days after graduating. Of particular interest to me is your advice on purchasing a home instead of renting; I am required to live within city limits for the first five years of my employment.

I am currently trying to decide between continuing to rent and purchasing a home since I will be living there for a minimum of five years. In my search for houses within city limits, I have come across many multi-family homes. What is your opinion on renting out a portion of the space you live in? Let me know what you think! Thank you, Steve”

Let’s dive in and answer them (and a few others) to help Steve determine whether it makes sense for him to rent or buy in Syracuse. I just replied back with the following links and information, which mirror the process that I went through when deciding whether it was better to rent or by a condo. These are all great questions. I got a little crazy researching this so I decided to turn it into a post.

5 Step Rent vs. Buy Decision Process

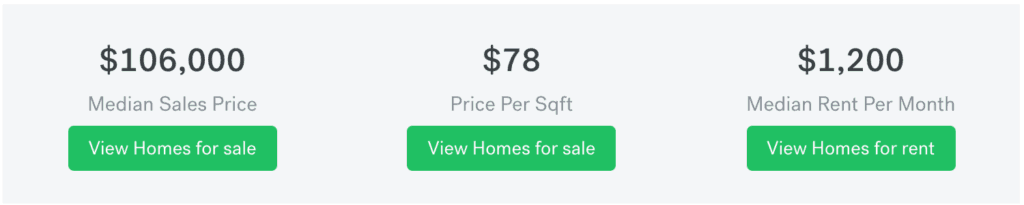

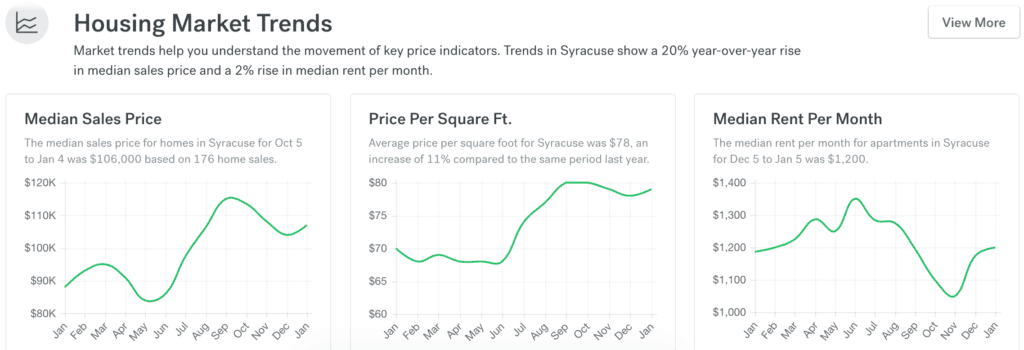

1. Check out the individual market trends using Trulia

This is a simple way to analyze any real estate market, and you can actually get super granular and zoom into more defined neighbors to do you own specific rent/buy calculations. Here is an analysis of the Syracuse market that I sent to Steve. https://www.

Diving a bit further into the data it shows that the Syracuse market is growing like most real estate markets in the US have been growing over the past few years. So while Steve wouldn’t be buying at the bottom of the market, the data is pretty compelling that buying a house is more affordable thank renting – even if he only lives in the place for 2 years, which given his personal situation that he is going to be a police officer his employment is closely tied to (and he is required) to live in Syracuse.

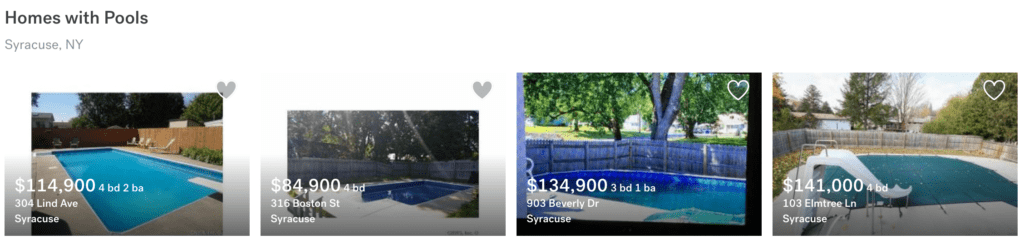

Then search for homes that have a pool! Because who doesn’t want a $100,000 house with a pool? 🙂 Some of these look pretty nice. I had to stop myself from getting too lost in the vortex of Trulia homes. I knew that once I clicked on that $84,900 deal below I was done – so I didn’t click. One piece of warning – there is nothing quite like a house-hunting addiction. I personally deleted my Zillow and Redin apps from my phone because I couldn’t stop searching in my neighborhood or when I go to my friend’s houses to see what they paid!

2. Determine how long you are going to live there (it can be less than 5 years)

Conventional wisdom is that you should ONLY buy a house or a condo if you are going to live in it for at least 5 years. This is just plain wrong. I think it can make sense to buy even if you are only going to live in a place for 2+ years in some markets (as you will see from a more detailed analysis of Syracuse below).

And even if once you do all of the calculations that say you should be renting instead of buying, buying probably still makes more sense. Who knows, maybe you will end up living your city longer or you could keep your home and rent it out if you have to leave. Always lean towards buying a home if the numbers work. NOTE: I am not a professional 🙂

3. Determine your potential down payment (it doesn’t have to be 20%)

ANOTHER MYTH: Too many people wait to save up 20% before buying a home. You don’t need 20%. After having only $2.26 in my bank account I finally had saved up a decent amount of money to afford at least a 5% down payment with some additional padding I was investing in my emergency fund.

Yes, I only put 5% down on my condo and bought as quickly as I could because I live in Chicago and I was certain that prices were going to keep going up. Yes, I had a lot of advantages buying when the market was down, but if I had waited one year until I had 20% saved then I would have missed out on at least $125,000 in growth.

The reason I felt comfortable doing it is because I was confident in my income and the growth of my businesses. Think careful if your job is secure and if you can afford to buy a home (5% down payment + 3 months of expenses saved + stable job). Once I had those three locked down, I went searching for a property immediately.

4. Get pre-qualified for a mortgage before decided whether to rent or buy

This may answer the question for you. It’s a lot harder to get a mortgage now after 2007 and even if you have awesome credit and a great job, you still might not get approved. It’s just weird sometimes. So I recommend that you go out and see what kind of mortgage you can pre-qualify for. Then you can see what a bank is willing to lend you and at what rate.

ALWAYS SHOP AROUND. Just some simple shopping and calling around for 30 minutes I was able to qualify for a mortgage that was 0.87% less than the first rate that I was quoted. The value of that difference over 15 or 30 years is likely hundreds of thousands of dollars. I KNOW FOR A FACT that a lot of people don’t shop around for mortgage rates and just use the bank they bank with. This is a big mistake, especially if you bank with one of the big banks because they tend to have the highest rates AND fees.

Getting prequalified will also help you best leverage the calculators below because you will have specific rates to use. One mistake I made was that I assumed because I had great credit that I could get the mortgage rates that are published on bank websites. There is always a catch to those rates and they are typically the lowest rate possible they could offer, but for some reason with an 817 credit score I couldn’t get them?

Note: Mortgage rates still remain close to historic lows so if you are considering buying a home in the next few years I would recommend doing it as soon as possible. Rates will go up and so buying any home will cost you more money.

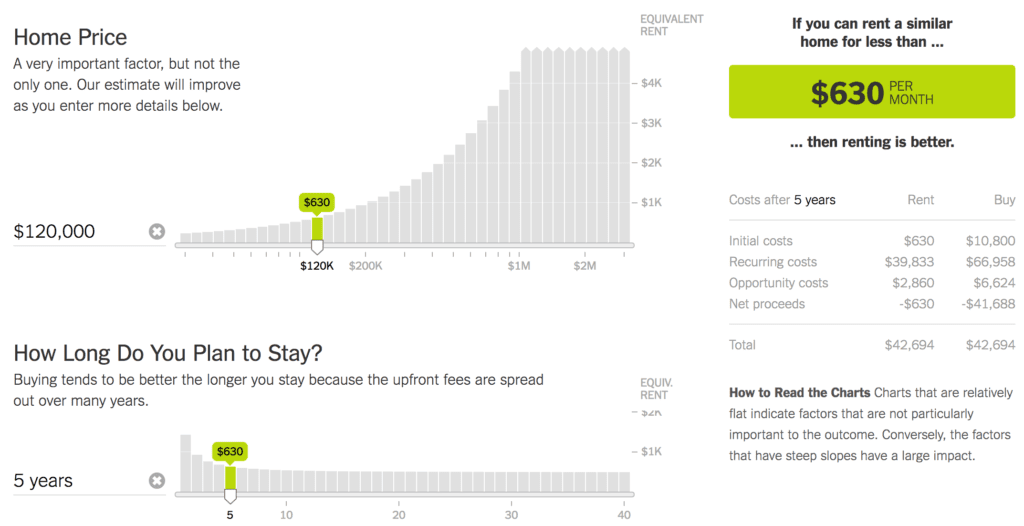

5. Check the two best free rent vs. buy calculators

So what about the popular rent vs. buy calculators? I tried 7 different rent vs. buy calculators (each with their own methodologies) and the ALL TOLD ME TO RENT. Did I listen? Nope.

But they are worth checking. My two favorite free rent vs. buy calculators from Zillow and The New York Times. Let’s check out the results for Steve (making some assumptions about salary as a policeman in Syracuse and using the average home price + 20% to give him some flexibility!)

New York Times Rent vs. Buy Calculator – Buy!

Zillow Buying vs. Renting Calculator – Buy!

![]()

Well there you have it. Steve should definitely be buying in Syracuse.

FYI Steve: It’s a no brainer to buy a multi-family home and renting part of the space where you live. A vast majority of the properties for sale in the Syracuse market have 2-3 bedrooms, so renting one out and putting that rent towards the mortgage makes buying an even better decision.

Happy house hunting!

Read 10 comments or add your own

Read Comments