Some things just don’t fit into a 2-week vacation! If you have ever dreamed of biking through Croatia, taking a coast-to-coast road trip, volunteering overseas, or taking a month to brush up on your Spanish in Barcelona, you’ll know the struggle is real.

Our vacation days are being pulled in a hundred different directions. We often need to catch a flight to visit friends and family. Summers are full of wedding travel. And if you’ve bought a home, there are big projects that need to be tackled every year.

Two weeks of vacation end up being 4 days of stuff we really need to get done, 7 days of family visits, and 3 days for “vacation”.

But there are other big dreams we want to tackle while we have the chance. Adventures that don’t fit into the 3 days of time off left over.

Enter the Mini-Retirement!

A mini-retirement is when you strategically save money and plan to take an extended time off of work (could be from 1 month to 6 months or more), so you can follow your passions – whether that’s traveling the world or launching a non-profit.

The reality is that if we try to wait till retirement at 65, we will have missed the window of opportunity for most of our dreams and goals.

And even if you are following an early retirement strategy to try to fast-track retirement, it will still take some time and there are many things we can only do in our 20s or 30s.

There are experiences that can only happen when our kids are little. We need to lean into each season of life and create some space to cross items off our bucket list that might not be possible in even 10 or 20 years.

How to Start?

Start with something that if you don’t do it in THIS decade, you might not have another chance at.

For your first mini-retirement (yes, we will make sure we can take a few of these!) start with the most pressing. Make it (1) compelling, (2) time-sensitive, (3) a one-time thing.

Plan your Budget

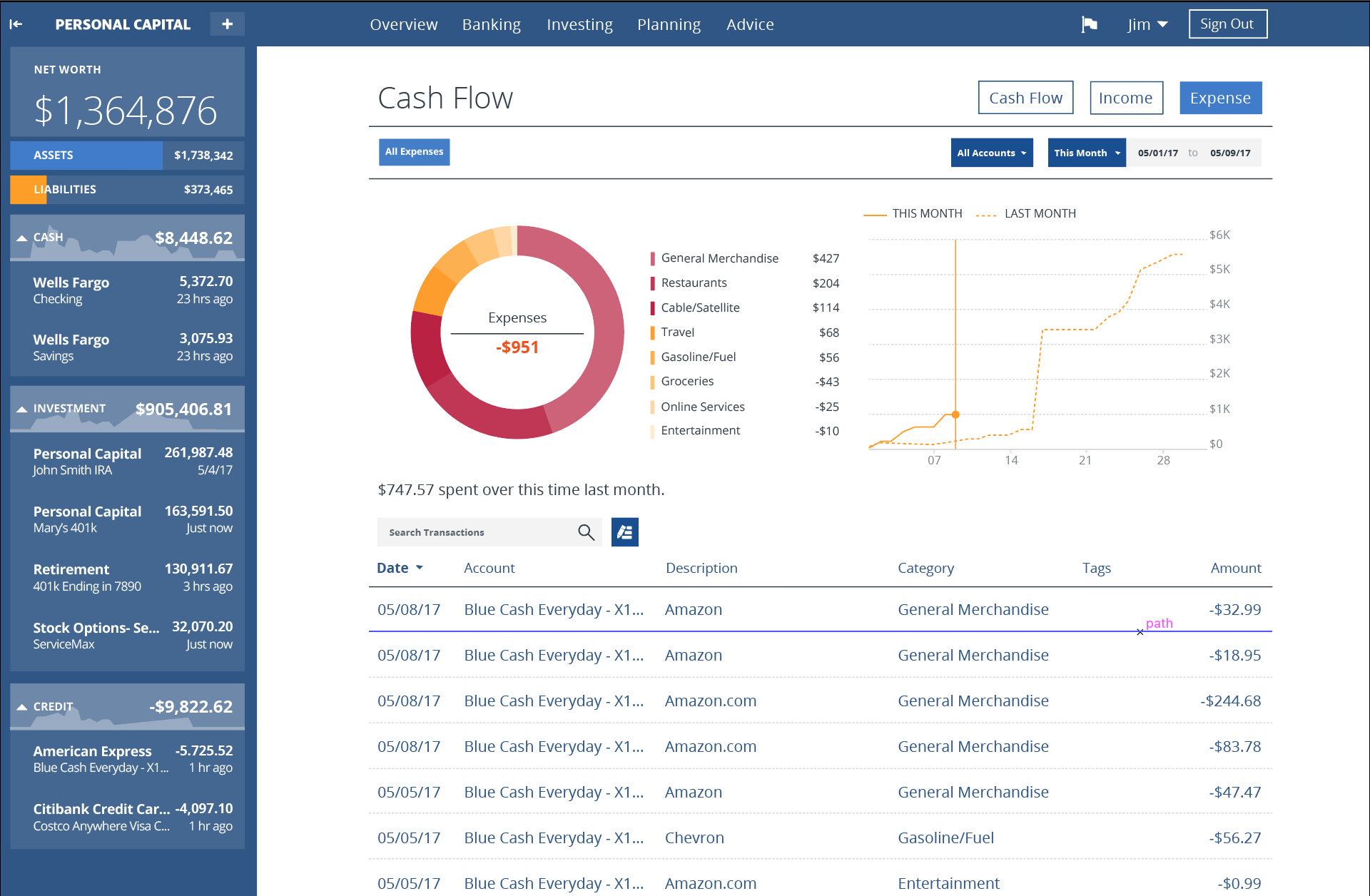

You will be using mostly unpaid time off. So you will need to cover your basic expenses plus the cost of your adventure. First, you have to know what your monthly expenses are!

The easiest way to do this is by using an online net-worth and expense tracker – the free one I use is Personal Capital.

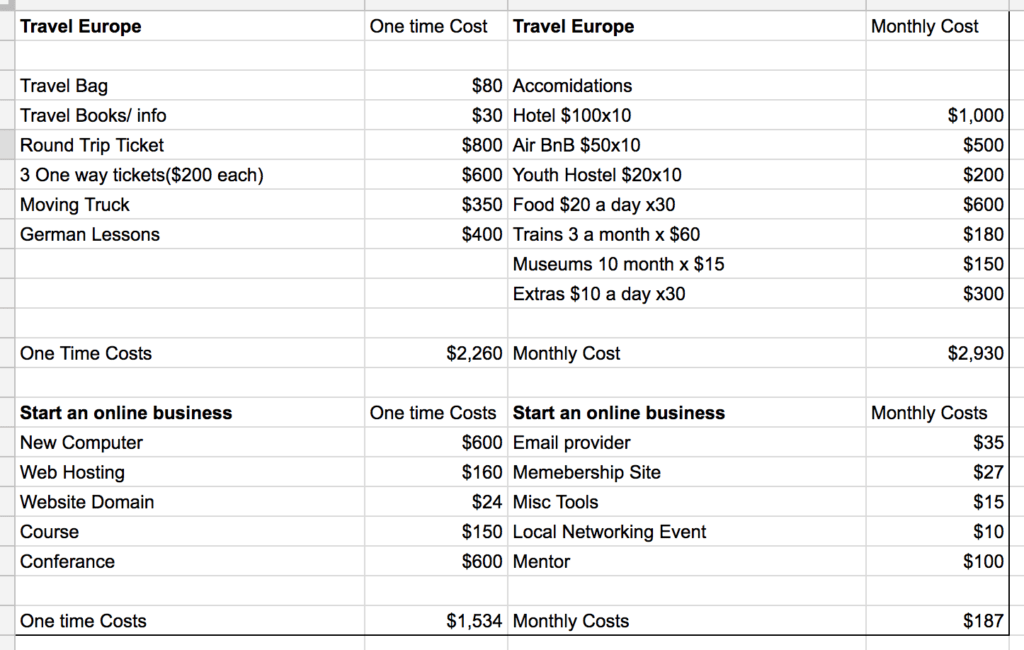

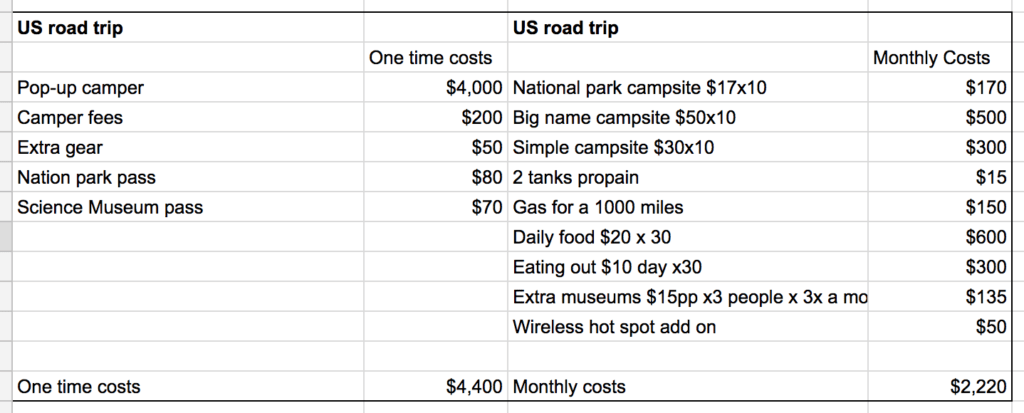

Then you start a Dream Budget. It’s easy to create. Open up an awesome spreadsheet, and research the cost of each aspect of your month off. Hotel costs, flights, gas, etc. Maybe you just need a month to finish writing a book or grow a side project.

What would the costs look like for that? If you want to take a month to travel and promote a book or CD, what are those costs? List out the cost for each element.

After you figure out what the total cost will be (basic expenses + dream budget), you can divide that by the number of months you have to save. If you need $6000 in a year, you need to find a way to come up with $500 a month.

Putting Expenses into Persepective

Every time you pack your lunch or turn down drinks out, you will know exactly what that saving will pay for from your Dream Budget. $30 saved is a night at a campground or youth hostel in Amsterdam. If you earn $50 babysitting or on your side hustle, that can go straight towards a national park pass. $1,000 from a tax return will pay for all your gas costs.

You can even find ways to cover some of the costs. Maybe your mom buys you a travel bag for Christmas. Or you start finding credit card offers that will help earn you points toward your flights. If there is a big project you want to tackle during this time away, you can start doing professional trades now so you’ll have the help you need when the time comes.

The Big Ask

In the months before you actually pitch the idea to your employer, make sure to lay the foundation at work. Even a year before or the next time you are negotiating a raise, Be extra awesome in your work responsibilities and extra helpful to your coworkers. Your coworkers will be helping to cover your work while you are gone, so you’ll want some goodwill built up there.

You’ll also want to make sure when it does come time for the Big Ask, it’s not the very first time your boss is hearing about this (1) compelling, (2) time-sensitive (3) one-time thing. It’s hard to sell the idea of an amazing, once-in-a-lifetime experience if you’ve never mentioned your interest in it.

On the other hand, if your coworkers and boss know how passionate you are about justice work in India, they might rally behind a month-long volunteer trip there. People love to help others achieve their biggest dreams. It makes us all feel like maybe it is really possible!

Make it a “Hard No”

By “hard no” I mean, you have laid out such a well-thought-out, compelling, detailed plan (backed by supportive coworkers) that it would be VERY hard for your boss to say no. Consider these two examples.

Example of Hard NO

“Boss, you know I have always dreamed of hiking Kilimanjaro for my honeymoon. I’ve been saving my time off up in preparation, but I only have 8 days at this point. It would be amazing if I could have a month to take this trip! Bill and Carl have offered to help cover these areas of my work while I’m gone.

We have already worked out a plan of what I can do before I leave, and how they will fill in. This is something my fiance and I talked about on our very first date and it is such a big dream for us! This will only be a one-time thing.

I have loved my two years here, and know I’ll return even more excited about my work if I can just have this time. It would mean the world to me if I could get the other 3 weeks off, unpaid of course.”

That is a hard no. If you have done all the prep work, how can they say no? Even if it isn’t something they typically offer, a well-planned Big Ask can make you the exception to the rule.

Example of an Easy No

Verses this example, which would be an easy no.

“Boss, I’m really burned out. I use to think I loved this job, but now I’m just not sure. I need some time to think and look at other options. Maybe travel. I haven’t really planned it. And I know it will make it hard while I’m gone, but I feel like my work is slipping anyways. It would be great if I could get a few weeks off, maybe more. Also, I haven’t really saved up much money, so I’m going to need that to be paid time off.”

Um…no. And you might get fired. If you really want to do this, you need to do it right.

Plan your next mini-retirement

In reality, everyone will probably get a mini-retirement at some point. If you have your dream nailed down, a budget ready, and money set aside, you can jump at the chance. A few months between jobs becomes a perfect opportunity to cross things off your bucket list versus sitting home and binge-watching Netflix.

In each season of life, there are opportunities we have to seize or watch them pass us by. My husband and I are on our 5th mini-retirement right now. We have used them to do big road trips with friends, travel through 27 countries, invest and renovate rental properties, adopt kids and take an epic 6-week road trip with our 5 little kids.

By keeping our expenses low, creating some passive investments, investing in index funds, and building a small lifestyle business, we are able to mix in mini-retirements anytime we want now. It didn’t happen overnight! We started with $55,000 in debt. I’m 34 now, and I can honestly say, this is the life I have always dreamed of.

Mini-Retirements bridged the gap until we hit financial independence. They are still a core element of our lifestyle. Next spring we are planning an 8-week road trip. The year after we hope to take a full 9 months to travel the US. (My oldest is 9 and I can see that window closing quickly!)

Don’t put off the most important things until the end of your life! A month-long mini-retirement is the perfect way to get started. Once you see how this process can work, you’ll find ways to sprinkle mini-retirements into every decade of life.

Read 5 comments or add your own

Read Comments