Wealthsimple is an online investment management firm based in Canada. They were established in 2014 and have since grown to manage over $5 billion (CAD) of investments.

This investment firm acts as something of a hybrid between a robo-advisor and an actively managed fund. The investments themselves are automated, but its service offers access to real investment advisors who can answer all of your questions.

Wealthsimple is primarily available in Canada and the US; while those in other countries are free to use the service, certain features may not be available.

Is Wealthsimple a Good Investment?

Wealthsimple provides a variety of investment options, allowing highly customizable portfolios to suit your individual needs.

Depending upon which risk profiles you choose, your returns will, of course, be different.

But how do you know how that looks in the real world?

Luckily, Wealthsimple has reported on the investment performance of each level of risk:

- Conservative Portfolio Performance – 16%

- Balanced Portfolio Performance – 17.7%

- Growth Portfolio Performance – 23.5%

Because Wealthsimple has not been around all that long, the data, unfortunately, doesn’t go back very far. In each report, the data spans from January 30, 2017, to December 31, 2019.

Despite the relatively short time frame, it is encouraging to see such strong returns for all three portfolios. Plus, the percentages increase with the level of risk, which is what you would hope to see.

It’s also worth mentioning that while there isn’t much history on these particular portfolios, if you view each of the performance reports linked above, you can see which ETFs you’re investing in. Most of them are Vanguard, and we do have a lot more history on Vanguard funds.

For example, the main stock fund in Wealthsimple’s portfolios is VTI (one of the most popular ETFs), and we can see from Vanguard’s website that $10,000 in VTI would have more than tripled in the past ten years.

Wealthsimple Plans

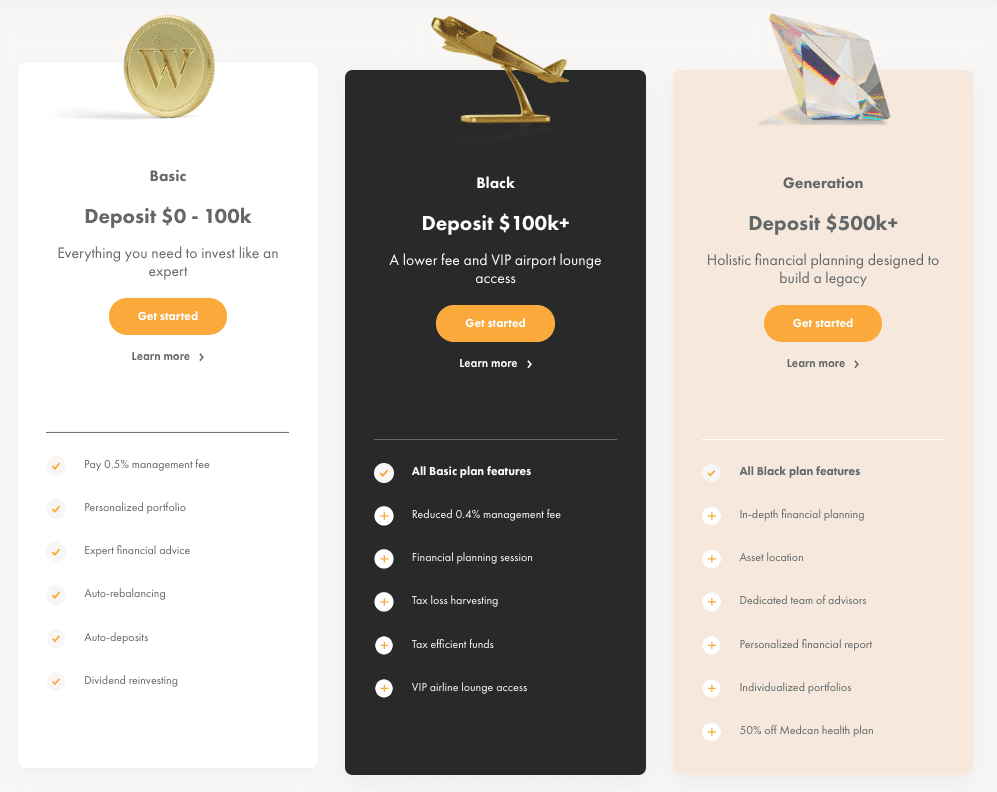

Wealthsimple offers three different plans based on how much you invest: Basic, Black, and Generation.

As you move up the ladder, each plan includes all of the benefits of the ones below it, plus additional perks. Here’s a quick rundown of what you need to qualify for each plan, plus the benefits of each:

Wealthsimple Basic

As its name implies, this plan is the most basic one Wealthsimple offers. What’s nice is there is no minimum, so you don’t have to deposit a certain amount to qualify.

This account is for portfolios of $0 to $100k. Because this is the basic plan, though, it doesn’t have any additional features. Still, you’ll get access to useful features through the Wealthsimple platform, such as:

- Tax-loss harvesting

- Automatic rebalancing

- Dividend reinvesting

- Automated deposits

When you consider the $0 minimum, the Basic portfolio gives you quite a bit of value.

Wealthsimple Black

The first venture into Wealthsimple’s premium experience, the Black portfolio, is for investors with $100k to $500k.

The immediate benefit of this level is that the management fee drops from 0.50% to 0.40%. That may sound like a small difference, but over a lifetime, it can be significant.

Perhaps more interesting is that you’ll also be given the opportunity to sit down with one of Wealthsimple’s advisors for a financial planning session.

Yet another benefit is VIP lounge access through Priority Pass. This can be a nice perk, especially if you travel a lot. Depending on the airport, VIP lounges may allow you to escape the congestion.

Wealthsimple Generation

You must be doing something right if you’ve made it to this point! Generation, Wealthsimple’s most premium service, is for investors with $500,000 or more in their portfolios.

The management fee is still 0.40% at this level, but they will up the human interaction for you.

Rather than just one financial planning session, you’ll gain access to a dedicated team of financial advisors who will help you build a custom portfolio.

You’ll also get the following:

- Personalized financial forecasts

- Custom portfolios

- VIP lounge access

Risk Profiles

When you invest with Wealthsimple, you’ll be able to choose from three different risk profiles: conservative, balance, or growth.

The difference between risk levels comes down to the mix of stock and bonds. Here’s how they look:

- Conservative: 65% bonds/35% stocks

- Balance: 50% stocks/50% bonds

- Growth: 80% stocks/20% bonds

It would be nice to see slightly more customizable portfolios here – some investors prefer 90% or even 100% stocks. While you would see that as unnecessarily risky, the point is that your options are somewhat limited. Other managed portfolios allow a greater level of granularity.

Regardless, it’s nice to have some level of choice.

Asset Classes

The asset classes of the stocks in which you are invested vary depending on your risk profile. The majority of the asset classes are present in all portfolios, but some are not.

One example of this is that US Treasury Inflation-Protected Securities (TIPS) are absent from the growth portfolio. This makes sense because while bonds are a more stable asset class, that means they provide a lower return over time.

Value-Based Investing

Another feature you have access to with Wealthsimple is value-based investing. This style of investing is growing increasingly popular and can be a draw for many.

Traditionally, investing has been centered around the idea of earning the best return possible. With value-based investing, the idea is to invest in a way that aligns more closely with your values.

Socially Responsible Investing

One of Wealthsimple’s choices for value-based investing is socially responsible investing. Also known as environment, social, and corporate governance (ESG), socially responsible investing is about creating a more sustainable world.

Specifically, Wealthsimple’s socially responsible portfolio invests in stocks with the following qualities/values:

- Low Carbon

- Environment

- VIDI – Human Rights

- Cleantech

- Government Securities

Depending on whether you choose a balanced, conservative, or growth portfolio, the percentage in which you’ll be invested in these different types of stocks changes.

Halal Investing

Wealthsimple’s other main form of value-based investing is halal investing. If you aren’t familiar with this style of investing, it is investing which adheres to Sharia law.

Also known as Islamic law, these principles are followed by Muslims, who practice the Islamic faith. Muslims are by far the world’s fastest-growing religious group, so it makes sense to have investments that are compatible with their faith.

One thing that is important to note about Sharia law is that it prohibits profiting from debt. Because bonds are a form of debt, halal investing excludes all types of bonds. Bonds and bond funds are very often used to reduce risk, so halal investors may need to find other means of diversification.

Wealthsimple Features

Many people ask, “How Good is Wealthsimple?”, well, here are some features that make it stand out amongst the crowd:

Wealthsimple Portfolio Review

For example, they offer a free portfolio review. This is not necessarily limited to Wealthsimple investments; they will review any other investments you may have as well.

Broad Range of Investment Options

They also give you a broad range of investment options, including value-based investment portfolios. All these different options mean you can find a portfolio that works best for you.

Plus, their portfolio review can help you find the right investment options if you feel overwhelmed.

Automatic Rebalancing

Another nice feature is automatic rebalancing – a feature which many robo-advisors have, but it’s nice to know you won’t have to go in and manually rebalance your portfolio. Instead, it’s always in sync.

Access to Financial Planners

Wealthsimple gives you access to financial planners – something robo-advisors usually don’t. That could be the reason for its slightly higher fees; if so, they are relatively reasonable. “Offline” portfolio managers have historically charged 1% fees or more.

Free Portfolio Management

Not only that, but Wealthsimple also offers free portfolio management even if you don’t already have an active portfolio with them.

Thus, the answer to the question “How good is Wealthsimple?” depends on your needs. Its fees are much more than you’d pay to manage your own portfolio, and still higher even than many robo-advisors.

However, its highly customizable portfolios and excellent customer service can be valuable for those who find investing a bit overwhelming.

Can you Lose Money on Wealthsimple?

You can lose money on Wealthsimple, but that potential is no more significant than it is for any other form of stock market investing. Your Wealthsimple portfolio will be invested in funds from popular investment firms like Vanguard and Blackrock.

The stock market regularly experiences dips, which means you can lose money in the short term. However, 100 years of stock market history show us that it has always recovered and then went higher than it was previously.

You will also be in broadly-diversified funds, which minimize risk as much as possible. That said, everyone has a different risk tolerance; if yours is lower, you may want to opt for a lower-risk portfolio. Having a less risky portfolio means short-term losses will be less, but you may also sacrifice some degree of long-term growth.

How Much Does Wealthsimple Cost?

The biggest downside to Wealthsimple is probably its fees. Although there are no fees to use the service, they charge 0.5% management fees (0.4% for investments of $100,000 or higher). That may not sound like much, but it can have a significant impact on your portfolio in the long run.

With ultra-low-cost index funds out there, some would consider these fees high.

Still, they are actually on the low end, given that real people manage these funds. Nowadays, there are several different ways to invest:

- Manage Your Own Portfolio

- Use a Robo-Advisor

- Invest in an Actively-Managed Fund

Each one of these options requires less work on your part as you go down the list, but the fees are usually higher as well.

Technically, Wealthsimple’s core product is a robo-advisor, but it sits somewhere between the second and third options. As such, fees are slightly higher than some competitors have, but you do have comprehensive support any time a question arises

Pros & Cons of Wealthsimple

Pros

- Customizable Portfolios

- Great Customer Service

- Invest Based on Your Values

Cons

- Higher Fees

- No Goal Tracking

- Certain features only available in US & Canada

So, Is Wealthsimple A Good Idea?

Wealthsimple provides a, well, simple investment strategy that’s great for the beginner investor. It has three different portfolios meant to cater to your risk tolerance: conservative, balanced, and growth.

Each one of its portfolios uses a mix of bonds and ETFs that are broadly diversified and have shown a history of success.

You’ll also get automatic rebalancing, great customer support, and options for value-based portfolios such as Halal and ESG.

At 0.5%, Wealthsimple’s management fees are a little higher than what other robo-advisors charge, but you get access to financial planners and free portfolio reviews. Other robo-advisors may be cheaper, but they don’t typically have these features. So while you do pay a bit more, you get what you pay for here.

Overall, Wealthsimple is a solid portfolio management system that is great for someone who’s looking to great started with investing.

No comments yet. Add your own