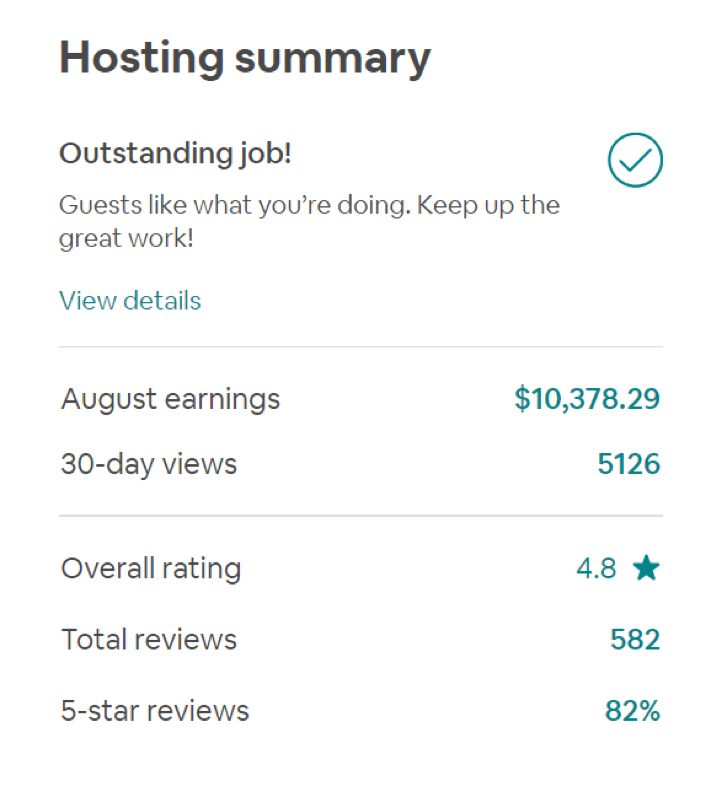

MM Note: This is a guest post from my buddy Jerry who is an extremely experienced Airbnb super host who makes over $10,000 per month and is on pace to reach financial independence using Airbnb rentals! I asked him to write a complete guide about making money with Airbnb. This is legit!

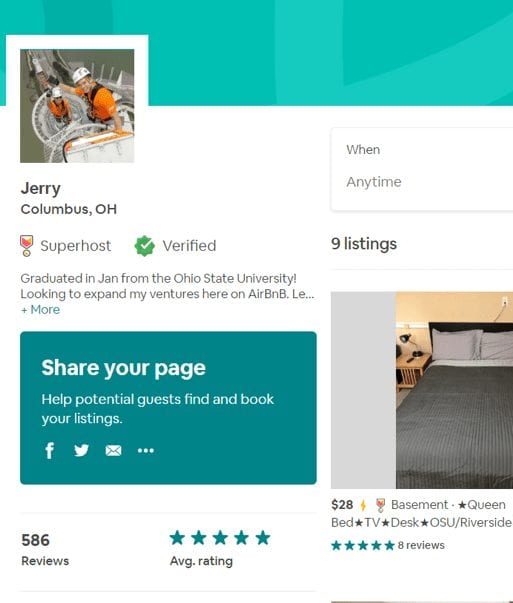

Here’s a little information about me: My name is Jerry Xiong and I am a Super Host with 9 listings in Columbus, OH. I am a millennial who graduated from Ohio State and was a real estate agent before moving to Los Angeles. While I’m not the largest Airbnb host by any means, I believe many people looking to get into the Airbnb business are similar to myself.

Within 2 years I have amassed over 500 five-star ratings and generated a six-figure income with a minimal investment in both time and capital. I’ll go over the various steps I took to acquire the properties as well as tips on managing the properties remotely so you can still keep your day-to-day job.

If I can manage my Airbnb listings from across the country, you will be able to manage it while having a full-time job if you choose!

What is Airbnb?

Airbnb began in 2008 as an online marketplace to arrange lodging between individuals looking to rent out their space and those looking for accommodations.

It seems like a lot of work to manage an operation that is effectively a mini motel. The truth is, you don’t have to have experience or a ton of capital to get started. The sharing economy is in its primitive stages right now and if you get in on this side hustle while the market is yet to be saturated, you can build a nice nest egg for your journey towards financial independence.

How Does Airbnb Work?

Have you ever wondered how people are renting their apartments or homes on Airbnb?

The business model is very simple: individuals like yourself have extra space in their property and want to utilize it in a way to subsidize their cost of ownership, just like house hacking. Travelers need an affordable place where they can rest for a quick trip to town or an alternative option to corporate housing if they need longer accommodations.

Airbnb was created with a sharing economy in mind – it started out just as a small startup in San Francisco but is operating more listings than the largest hotel chains in the world!

Should I Become an Airbnb Host?

Where do you fit in this equation?

Airbnb is almost completely dependent on potential hosts like yourself. The company itself does not hold any property and effectively acts as a middleman to connect travelers with hosts. Over the past few years, the popularity of Airbnb has continued to rise resulting in a shortage in inventory on Airbnb. As a Super Host myself, I have seen my occupancy rates shoot up to over 90% during peak demand months! Even as I increase the price of my listing to allow my cleaners some rest time and allow for renovations, it seems like the demand never stops.

This indicates a HUGE opportunity for prospective hosts to capture their piece of the pie and increase your passive income.

How To Make Money With Airbnb

Now that I have your attention, I want to run through the financials of operating an Air B and B. One of the most important things to do before you tackle any side hustle is planning your business. Of course, don’t be too risk-averse but you need to take calculated risks to achieve maximum profitability as well as ensure success.

Make sure your market has demand for your listing. Don’t try to rent a fancy mansion in the middle of nowhere. You need to understand your market and make sure you can cover the expenses you incur.

Traditional Lease vs. Short Term Airbnb Rental

The example will assume we are financing the property, but if you need a low capital venture you can rent the property. Of course, you will need permission from the landlord but if you can pitch your proposal correctly most landlords will allow it!

For our analysis purposes, we will look at my property located near OSU Campus. Most properties around that area traditionally rent to students at a 1% of property cost when it comes to monthly rent. That means a house that is worth $300,000 will generally receive $3,000 in monthly rent – while it seems like it wouldn’t be a significant return, you have to remember that you wouldn’t actually be investing the full house value.

Airbnb as a Real Estate Investment

Here’s where “other people’s money” comes into play. When you acquire an investment property, you will generally put 15-25% down. If you want to apply for a mortgage as a primary resident (this works extremely well if you want to maximize your return by living in one room and leasing out the others) you may even only be required to put as low as 3.5% down using an FHA loan for a property up to 4 units. By leveraging your debt capacity, you will be able to effectively invest more money than you would otherwise be able to.

Still, need convincing? In this article, Grant goes over how you can create a real estate empire. You can also get some more detailed information regarding the specifics of stepping into real estate investing (avoiding PMI, expansion, etc).

Airbnb vs. Traditional Leasing: Case Study

Let’s use a property that’s worth $300,000 for our comparison purposes. Our initial costs will be a 20% down payment as well as the associated costs of closing a property (inspection, insurance, etc). Let’s just estimate the cost to be around $70,000 to acquire this property.

Don’t worry! This house is nearly double the cost of an acceptable property. You can easily find properties in thriving markets for under $150,000.

Traditional Tenant Revenue

Assuming you find a traditional tenant for a 12-month lease at a rate of $3,000 per month, you would have a revenue of $36,000 for the year. Of course, there will be expenses that you will incur. Let’s just assume we follow a standard maintenance cost of 1% of the house value. That takes away $3,000 from our revenue. We also will have to either pay a management company or value our time when it comes to managing the property. Management companies will charge $500/start and $100 per month for full-service management. Accounting for those expenses will leave you an approximate revenue of $31,300 for the year.

What’s the Return on Investment?

In our first year of operation, we brought in over $30k when we invested a total of $70,000. That sounds like a GREAT number! Hold on: you still have to account for your mortgage payment, insurance, as well as property tax. For this property, the average monthly cost of the three payments is around $2000. That means we only take home a net of $7,300. Given our initial cost of $70,000, this will yield us a pre-adjusted net cash return of 10.42%.

What…? That’s it?

If you’re thinking that’s a bit low and you’re 100% right. The return of 10.42% is not our actual return.

Remember those 12 monthly payments we made? Each one of those payments has an unrealized principal included in them. That means if we were to sell the house, our basis would be the balance minus accrued capital cost reduction! In simple terms: we’re paying off the house by making these payments! In addition, if you file your property on your taxes as an investment property your CPA will be able to deduct interest expenses, depreciation, and other costs from the total revenue generated by the property.

If you aren’t a tax wiz and need help, there are CPAs that specialize in offering sharing economy accounting. Disclaimer: I haven’t used them but from my communication with them I think they can be a resource.

Unrealized Gain and Tax Opportunities

This will yield a much higher return than 10.42%, which will make it a significantly more attractive investment opportunity. Note: Bear in mind that most mortgages will be amortized, this means that your principal/interest spread will be heavily skewed towards interest during the early stages of the loan (you may be paying mostly interest for the first few years of the mortgage). This is to protect the bank and reduce their risk. Sneaky, I know.

Please note: these numbers are all estimates. They may differ in your market but for most areas outside of large cities, I have found these numbers to be indicative of the rental market. Another factor you must consider before considering acquiring a rental property is your personal career mobility. There are large transaction costs associated with selling a house (realtor fees, funding, closing costs, etc) so when you are analyzing an opportunity you must be cognizant of this risk.

How Does an Airbnb Rental Compare?

Using the same property as an example for our short-term analysis we start by considering our market. Use tools like AirDna or Airbnb search listings to check for comparable properties in your area. We will list our example as a shared house with private rooms. Simply check the map function in your area with a filter set for private rooms to check out nearby listings. Look at the reviews as well as the availability of the properties you’ve selected as comps.

Identify Your Comps

To ensure the most accurate comps, you need to make sure the properties are actually similar in terms of amenities, cost, and location. Once you’ve determined the average nightly rate, you need to check out their calendars to see if the cost is actually representative of what is listed. Check their calendars and look for discrepancies in pricing (some hosts will put a specific date at a very low price just to have Airbnb list a price that is not bookable).

Now that you have an average daily rate, we can move on to the financial analysis going on the short-term rental path.

In the Columbus market, you can see that the average daily rate is around $50 per night. Of course, this number fluctuates significantly based on the time of reservation, but we can use it for simplicity’s sake. I will be using numbers that are relevant for August 2018 for this article.

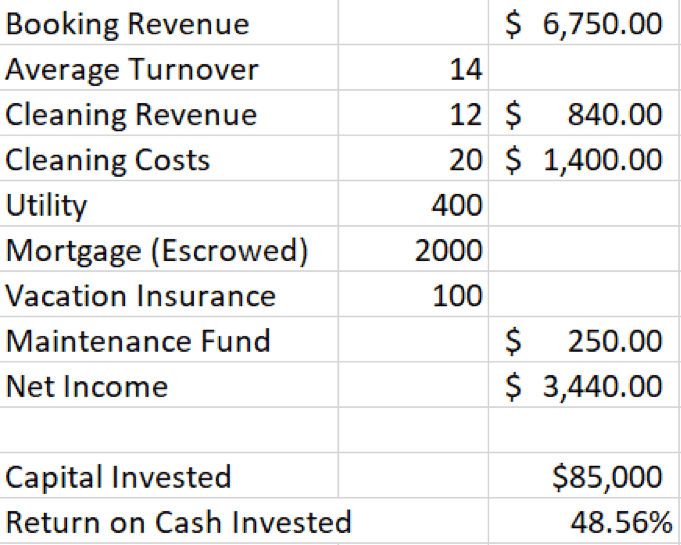

Estimating Airbnb Operation Costs

For the $300,000 property, we will average out our rooms to cost $50 per night before cleaning costs are added in. This means our property will have a total of 150 bookable nights per month. Assuming an average turnover rate of 14 (I used a rolling 3-month average on a private room in one of my listings) we can calculate our average revenue. Assuming a 90% occupancy rate we can expect 135 booked nights for the month. Multiply that by $50 per night and you will get a pre-cleaning income of $6,750.

Additional Expenses of an Airbnb

We now need to account for the expenses of operating a short-term rental. Unlike the traditional lease, you now will have to pay for supplies, utilities, as well as cleaning turnovers. Thankfully, Airbnb allows hosts to collect a cleaning fee for each stay to help with the added expenses of cleaning. I generally set my cleaning fees high enough to discourage short-term stays while still being able to reach max occupancy. Each turnover can be estimated to generate $12 in cleaning fees.

How many times does an Airbnb listing get cleaned each month?

Given this, you can assume that there will be approximately 70 turnovers for your property over the course of a month. You will receive an additional $840 in revenue from Airbnb which now brings your total income to $7,590.

Now we can account for the expenses. If you’re paying a cleaner to turn over private rooms you will spend approximately $20 per room. This will fluctuate depending on your area, but a generally speaking “acceptable” cleaning will take around 15 minutes to complete. This will cost us $1,400 per month in cleaning expenses.

Airbnb Utility and Supply Cost

Next up: Utilities. Our utility bill will be higher due to the sheer volume of people in the house. Internet will be $50 per month, water averages out to be $100 per month, electricity is $150 per month (this might flip-flop with gas if your house’s HVAC system is focused on one or the other), and finally gas at $100 per month.

Another expense that you must account for is the cost of supplies. Air b and b owners must provide sheets, towels, soap, and other essentials to their guests. We can just put aside 10% of each month’s revenue towards expenses.

Today’s analysis is going over the approximation, not the specifics. Given a revenue of $6,750, we will put aside $250 this month for variable expenses (1% property value rule).

Now to our net income calculation. Similar to our traditional lease, we will be paying our mortgage as well as insurance and property tax. Bear in mind, that although Airbnb offers a $1 million dollar host guarantee, you should consider getting vacation rental insurance to hedge your risk in cases of catastrophe.

Is Airbnb Profitable?

Here is the incremental cash flow from short-term rental conversion:

Airbnb revenue of $7,590 – cleaning costs ($1,400)- utilities ($400)-supply cost ($600) – mortgage ($2,000) yields a net income of $2,515. Factor in your additional insurance premium ($100 per month extra) and you will get a monthly income of $3,440.

Similar to our traditional rental, we will put $70,000 into acquiring the property. Keep in mind, that you will be furnishing the property so your total cash investment will be higher. Assuming a decoration budget of $2,000 per room + $3,000 living room our total investment will reach $85,000. Using the same calculation as the traditional lease, we can now see our annual cash-on-cash return will be 48.56%. Talk about a gigantic improvement. Note: that’s before we even account for unrealized capital gains!

Wait a minute….Airbnb is profitable!

I bet you’re now interjecting in your mind: but there must be large amounts of time required to run an Airbnb! There must be more risk involved when it comes to short-term rentals!

I will now give you a rundown on why I think a planned short-term rental is actually LOWER in risk and time requirements than traditional rentals.

When is a Traditional Lease a Good Option?

Dependable Renters – once you carefully vet your potential tenant and run their credit you can generally expect a monthly rental check to come in. In high-demand areas, you will have the next set of tenants in place before the first ones move out! You can plan aggressively throughout the year using projected cash flow from your property.

Low Initial Investment – unlike short-term vacation rentals, your initial investment will be lower. You do not have to provide furniture for most traditional leases. You just hand them the keys and start making money!

Easy access to management – Long-standing management companies are abundant in most areas. Finding a qualified management team will not be an issue for traditional leases. Given this competitive landscape, you can also be sure that your management cost will not be exorbitant.

Low risk of regulation – Most properties are approved for traditional leases. You don’t have to worry about not being able to rent out your property when it comes to the city. As long as your property passes city inspection and follows code a shutdown order is extremely unlikely.

3 Reasons to Become an Airbnb Host

High potential revenue – as we can see from our financial analysis, the potential income of a short-term rental is significantly higher. If you’re able to correctly operate your business your return will be magnitudes higher than a traditional lease.

Low variance revenue– A misconception that many new hosts have is that there is a huge risk when it comes to making money, especially in the starting months. Short-term rentals are actually a LOWER variance route than traditional leases. This is because your average occupancy will not fluctuate nearly enough throughout the year if you price your listing correctly. In a traditional lease, if you are unable to rent out the property for a month you will lose 1/12 of your yearly income! A bad month for Airbnb would just result in a 10% loss in your monthly revenue.

Less damage and wear on your property – you heard that right. I just said that short-term rentals result in LESS damage and wear on your property than traditional leases. Hear me out: short-term rentals require your property to be constantly turned over. Any damage will be immediately identified and sorted out through you and the guest. The guests do not stay long enough to inflict sustained damage (ever seen those bathrooms where people don’t turn on the vents?). Any small damage is settled between the host and the guest or by the Host Guarantee.

Part-Time Airbnb Listings

While I would recommend most people go the short-term rental path at this moment, you can also consider a mixed approach with it comes to renting out your property. If there is a cap on the total amount of days you can rent your property out on short-term rental platforms, this may be a way to capture the best of both worlds.

One example: some cities have proposed a cap on the total amount of days that one can rent their properties out. Many hosts thought this would be an end to the profitability of hosting but I’m here to tell you it’s not.

If you’re in an area that has a large student population, you can offer a 9-month lease. This is a highly sought-after lease in that most students will either go home for the summer months or have internships in other parts of the country. By offering a shorter lease that caters to their needs, you will be able to charge a premium. In addition, you will have furniture in place for short-term rentals in the off months. This will result in higher monthly rent as tenants would no longer have to incur transaction costs of moving large pieces of furniture!

Rent on Airbnb When Demand is HIGH

Additionally, you will be able to operate your short-term rental during the months with the most demand! Summer months have traditionally been the highest occupancy months for Airbnb. You will have a reliable stream of income during the low-demand months and still be able to capture the excess value in the months where short-term rental demand is at its peak.

For example from my own experiences, I have been able to charge a significantly higher daily rate during the summer due to the fact that people need a place to stay before moving into their long-term accommodation.

What Are the Risks of Airbnb?

As with all investment opportunities, you will need to understand there are risks that are involved. Investment properties are no exception.

With traditional leases, you will need to plan for periods of vacancy as well as potential nonpayment from your tenants as well as unexpected repair bills. A savvy investor needs to be able to plan accordingly to address any issues should they arise.

For short-term rentals, a host must secure ample coverage for operating a business. Do research to make sure you are protected when it comes to liability.

Have a plan if your city regulates the vacation rental market. Be ready to convert to a hybrid or traditional lease if platforms like Airbnb become prohibited. Adjust your expectations and budget for any unexpected expenses and reinvest your additional profits back into the business via expansion or mortgage paydown.

Are You Ready to Be An Airbnb Superhost?

I hope this article has convinced you to consider becoming an Airbnb host. Sometimes you just have to tackle a challenge head first and take a risk. The sharing economy is here to stay and I want each one of you to join me in this adventure.

Airbnb is just one of the best side hustles and it’s easy to start making money with Airbnb. It complements other platforms like Turo and Uber. The freedom from a rigid schedule allows you to take advantage of any opportunity that arises. Thank you for reading and good luck in your journey towards financial freedom and early retirement.

Jerry Xiong runs a blog called SharingEconomySecrets where he helps new hustlers start their businesses. Learn how he integrated various opportunities to make a full-time income using apps like Airbnb, Turo, and Uber.

Read 17 comments or add your own

Read Comments