Wondering how to save a million dollars? Here’s my story and how I did it…

I started my financial independence journey in 2010 and saved $1.25 million in 5 years, reaching financial independence at the age of 30. I get asked a lot how I did it and how someone else can too, so I decided to outline the variables and scenarios that impact how fast you, depending on your income, can save $1 million.

As it turns out, my $1 million savings goal wasn’t far off from the amount of money I determined I would need to retire early.

While your number will likely be different than mine (a simple calculation is to use 25x your annual expenses to determine how much you will need to retire), I’ve used $1 million as the example in this post because it’s a nice big round number, the goal I picked when I started saving, and who doesn’t want to be a millionaire?

How Long Does it Take to Save $1 Million Dollars?

This all depends on how much money you are making, how much you are saving, and how much your investment grows.

Here are the variables that matter most:

- Income: How much money you are making

- Expenses: How much money you are spending

- Savings: How much money you are saving

- Savings Rate: = Savings divided by income (check out my savings rate calculator)

- Investment Growth Rate: How much your investments compound annually.

For the purpose of these examples I’ve set the growth rate at 7%, but as you’ll see from my specific situation, the higher your compounding rate, the faster you will reach 1 million.

Time to Save $1 Million Calculator

Use this calculator to determine how long it will take you to save $1 million dollars based on your current ability to save.

How Fast Can You Become a Millionaire?

Here’s a simple example using these variables.

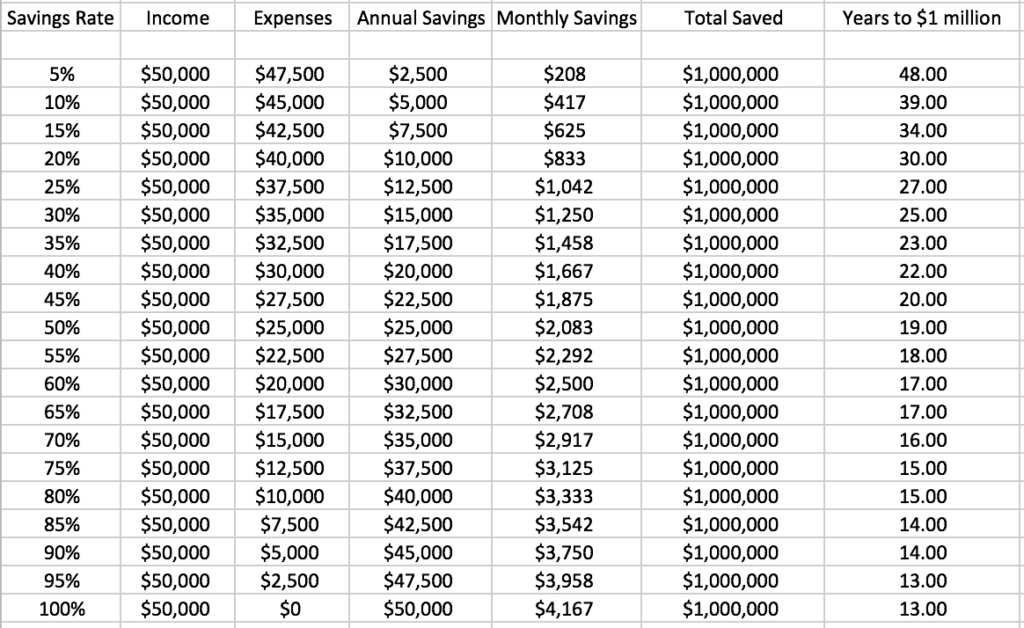

Trevor is making $50,000 per year after taxes and his annual expenses are $40,000, so he saves $10,000 per year and his savings rate is $10,000/$50,000, or 20% of his income.

That’s a solid savings rate, but given how much money Trevor is making, it will still take him 30 years with his investments compounding 7% each year by investing in stock market index funds.

Your compounding rate has a huge impact on how fast your money will grow and for these examples, I’ve chosen 7% because it’s a more realistic and likely sustainable investment growth rate based on historical performance than the 12%+ we’ve seen over the past few years.

The higher your savings rate, the faster you will be able to retire.

How To Save a Million Dollars with a 50K Salary

As you can see in the chart below, Trevor’s savings rate has a dramatic impact on how quickly he can reach $1 million.

Look at the massive difference between saving 10% of his income and reaching $1 million in 39 years compared to saving 50% of his income and doing it in 19 years.

Have you ever thought about how much money you should save or how your savings rate impacts the growth of your investments?

I first did this calculation back in 2011 when I started my savings journey and quickly realized that making $50,000 after taxes was going to be enough to get me to $1 million in 19 years at a 50% savings rate, but I would need to make a lot more money to do it in less than 10 years (which was my goal).

How to Save a Million Dollars with a 100k Salary

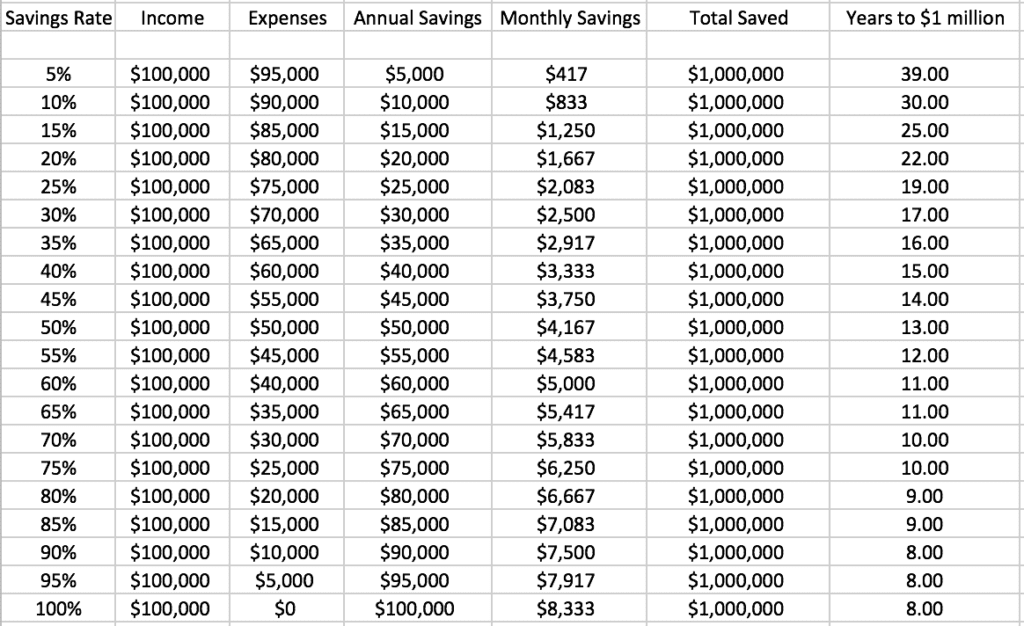

Next, I ran the same numbers with $100,000 after-tax income to see how long it would take to save $1 million. Here’s what I found.

If I could make $100,000 after taxes and save 10% of my income, it would take me 30 years to reach $1 million, but if I could save 50% then I could reach $1 million in 13 years. That’s a huge difference!

And my goal to save at least $1 million in less than 10 years also made an appearance at the $100,000 after taxes income level, but I would need to have a savings rate of at least 70% in order to make it possible.

Could I live on $30,000 or less – while it’s definitely possible, my target spending threshold is $50,000 per year (I find I’m able to balance my happiness per dollar ratio at this spending level). So for me living in Chicago on $30,000 would be really tough, not impossible, but tough.

Alright, so $100,000 after taxes clearly wouldn’t be enough money to get me there. Let’s take a big step up and look at the impact of savings rates on years to $1 million at the $200,000 after-tax income level.

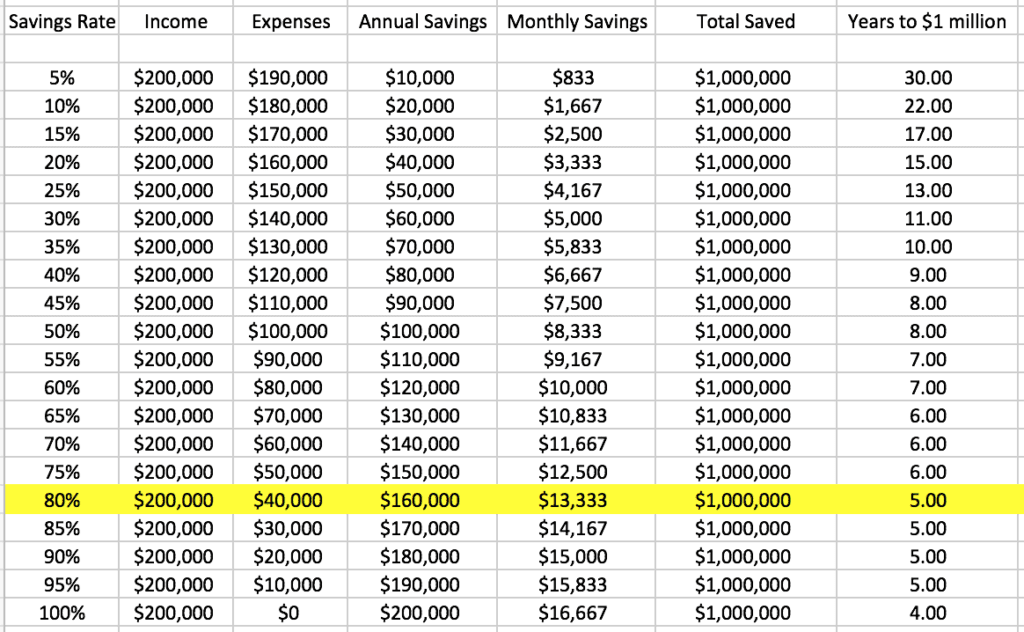

If you are making at least $200,000 per year after taxes, then saving $1 million in 5 years starts to be a legitimate possibility – if you can live on $40,000 per year and invest the difference.

How to Save a Million Dollars with a 200K Salary

Check out how fast you can save $1 million dollars if you are making $200,000 after taxes:

While $200,000 in after-tax income is a lot of money, if your primary focus is to save as much money as possible over a short period of time, then you can dramatically shorten not only the number of years it will take you to save $1 million, but also retire a lot earlier.

If you haven’t already, definitely check out my 1% early retirement strategy.

How I Saved a Million Dollars in 5 years

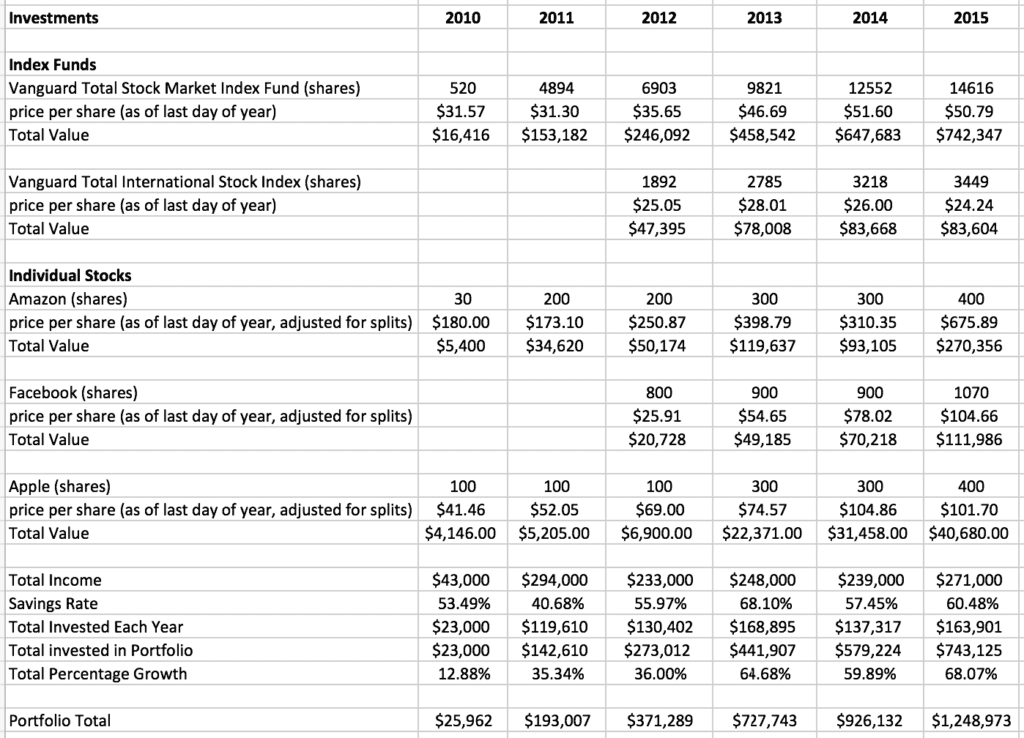

Now that we’ve covered the connection between income, expenses, savings rate, and investment growth to the number of years it will take you to save $ 1 million, I want to share the investments that helped me get there in 5 years between 2010 – 2015.

While I am a huge advocate of index fund investing and recommend that most people invest for the long term using index funds, between 2010-2015, I was also investing in individual companies that I believe in, like Amazon, which happened to increase an insane amount in value over that time period.

I typically only recommend that you invest less than 10% of your portfolio in individual stocks if you are new to investing, I currently have about 50% of my portfolio in individual companies, because the total percentage of stocks as a percentage of my overall portfolio has gradually increased to this level as the stocks I’ve invested in have risen in value.

I also happen to believe in the long-term potential of the individual companies that I’ve invested in.

Get an Education in Investing

FYI, here are the best two books I’ve ever read on index fund investing that you should definitely check out to get more background on the strategy:

- The Bogleheads’ Guide to Investing

- The Coffeehouse Investor: How to Build Wealth, Ignore Wall Street, and Get On with Your Life

Did I get lucky over this five year period? Definitely – there is no way anyone can predict the stock market returns of the future and I happened to start investing at a period when the market was low and it has gone on to grow considerably over the past 7 years. The US stock market was on a complete tear during this period and still continues to grow until this day.

Build Your Investment Portfolio

Many people who have kept their cash on the sidelines (outside of the market) in recent years have been asking are stocks too expensive, but have missed out on big gains while doing so? I am still almost entirely invested in stocks for the long haul and I’ve been happy to see how much more my portfolio I’m about to show has grown even over the past 2 years.

But while you can’t know if you will get lucky, you can certainly set yourself up to take advantage of luck if it happens, or if it doesn’t, your investments will continue to grow consistently over the long-term. Alright, let’s check out my investments and portfolio growth from back in the day when I was able to go from $2.26 to over $1 million saved in 5 years.

Invest as Much Income as Possible

During this period I saved and then invested an average of $144,500 per year – which is a lot but was the primary reason I was side-hustling so hard. Note that I didn’t just save the money in a savings account (where returns are often really low and you are likely to lose money to inflation), I invested as much money as I could into the stock market.

Some of my investments during this period were pre-tax (in a 401k and SEP IRA) and other was post-tax (Roth IRA with a traditional conversion) and after-tax investment accounts. My average income during that period was approximately $257,000, so while my savings rate fluctuated throughout this period, sometimes going as high as 80%, my total average before-tax savings rate across that 5 year period was closer to 56%. I always calculate my savings rate as a percentage before tax, but you can also do it after tax as well. If I did it after taxes, then my savings rate during this period would be closer to 80%.

A few notes. The Vanguard Total Stock Market Index Fund returns (with dividends reinvested) was 13.53% – so considerably higher than the 7% average used in the calculation examples earlier in the post. An average return of 13.53% is insanely strong performance and well above the average annual stock market returns over the past 100 years.

But investing in the Vanguard Total International Stock Index didn’t yield any gains. I was and still do, invest in this fund to add more diversification to my portfolio. Although, the current share price as of this writing is $29.92, so it has gone up in value over the past two years.

Invest in Stocks with Growth Potential

Also, both Amazon and Facebook stocks went on a tear during this period. Amazon ended 2010 at $180 and by the end of 2015 had increased $675.89, a 275% increase in value. With Facebook stock, it started 2013 at $26.62 and ended 2015 at $104.66, a 293% increase. Also note that during this 5 year period, I was continuing to contribute to most of these investments.

Amazon ended 2010 at $180 and by the end of 2015 had increased $675.89, a 275% increase in value. With Facebook stock, it started in 2013 at $26.62 and ended 2015 at $104.66, a 293% increase. Also note that during this 5 year period, I was continuing to contribute to most of these investments. Combining all of the investments the $743,125 that I invested during this period grew by 68.07% to a final portfolio value of $1,248,973 in November 2015.

So I was able to make $505,848 in investment gains over a 5 year period or $101,169 per year! While this portfolio growth is pretty likely unsustainable long term, the past 2 years have also been strong so my investments continue to grow and are the foundation for my early retirement – where I project that I will be able to live off of 4% of the portfolio each year for the rest of my life. Even during the years when my investments have grown by 15%+, I still plan to be able to live off the 4%+(2-3%) inflation, so I can keep some of my investment gains in my portfolio compounding well into the future.

5 Tips How To Save a Million Dollars Fast

These are the 5 best tips to save $1 million dollars.

1. Track Everything

I use the free retirement planner in the Personal Capital app to track my investment portfolio progress and make adjustments. To the right is the projected glide path of my investments over the next 60+ years.

Sign up for the Free Net-Worth Tracker, Personal Capital, and start tracking your income, expenses, savings rate, and investing performance regularly.

I do it every morning, but you can do it as frequently as you like. Once you sign up they will even send you a weekly email to give you updates on your progress.

2. Make More Money

Try to make as much money as you can and invest as early as possible, so you can take advantage of the fuel of compounding, which is time. $1 invested at 25 is worth at least 2-3x than $1 invested at 35. The more money you can invest now the more it will grow.

If you haven’t asked your boss for a raise, then use this strategy to get a raise or get a new job. Start developing the best skills that lead to more money and make you more marketable.

If you already have really valuable skills launch a consulting company or start side hustling.

3. Invest More Money

Increase your savings rate 1% every 30 days, so you are saving at least 12% more each year. While that may seem like a ton, by escalating your savings rate 1% every 30 days, you aren’t likely going to feel it in your everyday finances.

If you are starting at a 10% savings rate, and you increase your savings rate 1% every 30 days, you will be saving 46% in 3 years! This will make a massive difference in how quickly you will save $1 million and how quickly you can retire.

Check out this calculator I built to see how quickly you can retire.

4. Keep At It

Don’t day trade stocks or look for a quick immediate return. The market will go up and down unexpectedly, but stick with it and keep investing as much as you can. The growth will continue to compound and accelerate over time.

5. Don’t Lose Sight of The Big Picture

Money is not the goal, time is. One of my biggest money mistakes I’ve made it valuing money above all else. While I am all about trying to make as much money as possible, just remember why you are doing it in the first place. Life > Money

To learn the exact steps that I took to become I millionaire at 30 and the steps you can take, check out my book Financial Freedom: A Proven Path to All the Money You Will Ever Need (Penguin Random House).

LEARN MORE: How Much Should I Have In Savings?

Read 34 comments

Read Comments