How much money should you save each month? I get asked this question all the time. Here’s my answer: “Save as much as you can.”

Seriously, every 1% you save will have a huge impact on your future net-worth. In fact, increasing your savings rate by only 1% could help you retire up to two years sooner.

Ideally, in your 20s and early 30s, you should save at least 25% of your income. I know that’s not easy, or even possible, for some people. But you can probably save a lot more than you think.

You may just need a new way of thinking about savings.

Saving Money First: It’s An Opportunity, Not A Sacrifice

Yes, it’s tough to save money, but I think the biggest obstacle is the cultural idea that tells us saving money requires a huge sacrifice.

When you think about all the things you aren’t able to do because you’re saving money, you’re setting yourself up for disappointment.

To reach your financial goals, you can’t see saving money as an afterthought. You shouldn’t wait until the end of the month to see how much you have left in your bank account. Instead, save money first – 5%, 10%, 20% or more of your income — as much as you can.

And then spend what you have left.

This mindset accomplishes a number of important things:

- You save more: Your savings account gets a steady boost every month or every pay period.

- You enjoy spending: Once you’ve set aside your monthly savings, you can spend the rest of your money without feeling guilty — without having to assess every transaction you make, wondering whether it’s worth cutting into your potential savings.

This simple switch in your outlook makes all the difference. You’ll be on the road to your financial goal, whether it’s building an emergency fund, feeding a retirement account, growing a private investment account, or saving for a down payment on your own home.

When you save money first, you are not only paying yourself first, you’re guaranteeing you will have more money in the future than you have now. Then if you invest your savings intelligently, you will generate even more money for the future.

In my case, every dollar I invested in 2010 when I started is now worth $3.25. My investments have tripled and all it took was a few clicks on my phone.

Assumptions

Saving Money Gets Easier Over Time.

Once you start saving part of your monthly income each month, you’ll get used to not spending that portion of your income.

You’ll stop missing this money just like you probably don’t miss the income tax and Social Security payments that get taken from your paycheck every month.

When the money never makes it into your checking account to start with, you don’t even think about not having it.

This philosophy works best if you start saving slowly and escalate over time. Choose a percentage of your monthly income that you know you should be able to live without each month. Maybe it’s 10%. Maybe it’s just 5% or less.

You’ll need a month or two to get accustomed to living without this part of your income. After three to four weeks saving will become a habit. Habits hack your brain. Just keep repeating something daily and after 3 to 4 weeks you’ll want to do it.

When you turn saving money into a habit — just like brushing your teeth or taking a shower — you’re on the fast road to financial freedom.

So start with a manageable amount and then make saving this amount a habit. Then you can try to increase your savings rate.

This is how I developed the $50 a day early retirement strategy for myself. I built up to it.

Here’s another take on how much money you need to save from the podcast.

Almost Anyone Can Save Money by Starting at $5 a Day

Now, I know some people simply don’t make enough money to save because everything they make pays for food, housing, childcare expenses, insurance, and other living expenses. Living as Americans — especially in a high-cost city — is expensive.

If you are making $30,000 or less per year, you’ll have a harder time getting ahead of the financial curve. But you can still do something.

You’ll need to start small and try to escape living paycheck to paycheck. It can take a very long time to save up enough money, but even $5 a day adds up to $1,825 per year.

Almost anyone can save $5 per day if you really focus on it. I found $5 on the ground the other day, flipped out, and then invested it immediately via my phone. If you invest just $5 a day for five years you will have $9,125!

According to the U.S. Census bureau, the average annual salary in the United States for a millennial is $35,000, which is not a lot to live on depending on where you live in the country, but it’s definitely enough to save $5, $10, or even $20 a day.

Don’t get ahead of yourself. Just save something small every day. For someone making $35,000 a year, saving $5 per day is only 5% of your income.

Chose Vanguard Over The State Lottery

The average American spends almost $800 per year on lottery tickets and people who make $20,000 or less spend an average of 10% of their income on the lottery. That’s the $5 a day right there.

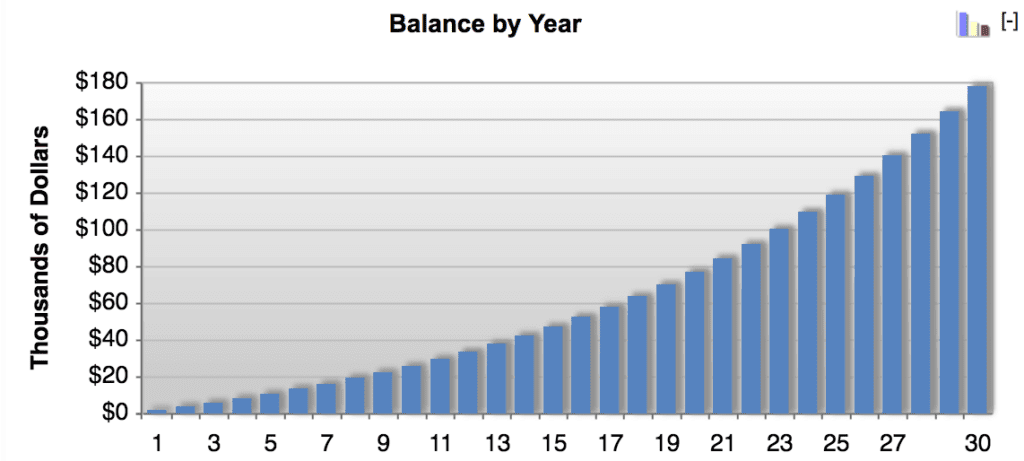

If you just save $5 per day and invest it in a Vanguard Total Stock Market Index Fund with an expected 7% annual compound rate of return, you will have $10,840 in 5 years, $77,263 in 10 years, and $177,082 in 30 years. All from $5 a day — the cost of a fancy coffee drink or sandwich.

If you know you can’t save $5 a day, pick a savings goal you can live with — $1 a day, maybe. The key will be to find an amount you can save consistently, habitually, without even thinking about it.

3 Ways To Save More Money and Build Wealth

1. Cut back on living expenses

This is the source of a lot of fear when it comes to saving any amount of money. People think about saving money like they think about diets: it’s something you have to do for a while — something that’s going to hurt.

You have to avoid this way of thinking. It’s tough to get ahead by just being frugal. Cutting out all of the little extras in your life may not be sustainable long term — and financial freedom is a long-term goal.

But most of us can cut back somewhere. Way too many of us have too much stuff, buy too much stuff, or live beyond our means.

Cutting back is all about balance and finding areas of your life where you can save money and start investing in yourself. One of the biggest ways I personally cut back was by downsizing my home when I went from a $1,500 a month apartment to an $800 per month apartment.

Sure it was smaller, but I decided that the $700 a month that I would save, invested, was a better use of the money. I paid myself first. I made that decision in 2011 and every $700 I invested then is worth $2,500 today.

Since I did it for a full year, the money I saved and invested by downsizing is worth $27,000 today. That’s a lot of money for just moving to a smaller apartment.

I didn’t think about the smaller apartment as a cut back. I saw it as an investment in my future.

2. Make more money and invest the increases

Increasing your monthly income is more important than cutting back or being frugal. It will help you get ahead a lot faster, especially if you invest all the additional money you make.

You can find infinite ways to make more money, but I recommend starting a side hustle and getting a raise.

Every salary raise has an impact on your future income potential, so even a $2,000 or $5,000 annual raise can have a huge impact over the life of your career. But what’s even more important will be to invest 100% of your salary raises, bonuses, or any extra income you make.

If you can keep living on your current salary as long as possible and invest the difference you will come out way ahead. Sure investing 100% might be extreme. If you really need the extra money the raise brought in, maybe you could try investing only 50% or 75% of your extra monthly income.

When you get a raise, tell your HR department to increase your 401(k) contribution by contributing 50%, 75%, or even 100% of your recent salary bump.

If you’d rather reward yourself for getting the raise, that’s fine too. But keep the reward in check. Set aside 10 to 20% of your bonus or raise to spend on whatever you want, and invest the rest.

If you can keep living on your current salary as long as possible and invest the difference you will come out way ahead.

3. Or do both! Spend less and make more

This is how you get the biggest bump and build wealth a lot faster. This is where the real personal finance magic happens. When you spend less and earn more, you’re widening the gap between how much you earn and how much you spend.

The wider this gap the richer you can get. The key is to save and invest the difference. This is why the richest people I know are the most frugal – they get it.

Warren Buffett, the world’s second-richest man, never spends more than $3.17 on breakfast. The takeaway from this post? Be more like Warren! But don’t eat too much McDonald’s. Opt for a green smoothie instead.

Savings Goals Can Help You Get Started

My blog focuses on helping you reach financial independence and early retirement — that magical financial situation in which your next paycheck no longer holds all the power over your life.

But this might not be your savings goal. I have a feeling it will eventually be on your radar, especially as you get older. But for now, you might need another source of inspiration for earning and saving extra cash.

Here are some really good reasons to develop a savings plan:

Retirement Savings

No matter how much you enjoy working, you won’t always be able to do it. As you grow older you may start to crave more free time and more freedom in general.

Saving money for a comfortable retirement can help you unlock this freedom. All of the habits I’ve discussed in this post so far can be adapted to enhance your retirement savings.

But you also have additional tools and tax advantages you can use:

- Employer Matches: Most employers offer 401(k), 403(b), or some equivalent fund. When you make regular deposits from your paycheck into these funds, your employer will match a percentage of your contributions. This employer match is free money that your employer will invest for you — plus you don’t pay income tax on the earnings you deposit. If you aren’t already contributing to a 401(k) or equivalent, don’t wait to sign up. Contact your HR staff right now.

- IRAs: Individual Retirement Accounts work a lot like 401(k)s except you own the account and it’s not connected to your employer. You can deposit money tax free each year and then pay taxes on the money you withdraw later in life. Or, with a Roth IRA, you can deposit after-tax money this year and then withdraw money tax-free later in life. Most banks have IRAs. A lot of robo-advisors now let you invest within an IRA instead of a taxable account. You can also put certificates of deposit (CDs) into your IRA to enhance your interest rate.

Emergency Savings

Personal financial experts recommend setting aside three months’ worth of monthly expenses in an emergency fund. I recommend doing this before you start a retirement fund if you can’t afford both.

For best results, set up an online savings account that pays a healthier interest rate compared to your ordinary bank. Then determine how much money you’d need to survive three months with no income.

Having this kind of savings fund gives you some peace of mind. If you lost your job — the epitome of a rainy day — you’d have a little extra time to pick up the pieces.

I recommend UFB Direct, CIT Bank, and several other online banks for their interest rates on your emergency savings fund. Whatever bank you choose, make sure it’s FDIC insured and has a good app so you can transfer money easily.

A Down Payment

Unless you’re a veteran who can get a VA loan, you’d probably need a down payment to buy a house. It’s also smart to make a down payment if you have to get a car loan.

The same savings strategies I outlined above — spending less and earning more and saving the difference — will accelerate your down payment savings goal.

When you’re buying a home, you won’t have to “spend” the down payment you save up. You’ll just be transferring the money into your real estate investment where it should continue to grow. In fact, your home’s value could be a cornerstone of your retirement plan.

So saving for a down payment on your home can contribute to your financial freedom. A car loan is more of a necessity than an investment. But putting down some money will get you out of car debt sooner.

Paying Off Student Loans

For a lot of millennials — and more than a few Gen Xers — paying off student loans is still on the to-do list. This kind of debt has a way of lingering for decades and undermining your long-term savings goals.

The savings philosophy I outlined in the first half of this post can be adapted for the purpose of paying off old student debt. Instead of investing the money you generate by earning more and spending less, put this money directly onto your student loan account.

When you get the student loans paid off in full, you can then redirect all that money into your future — which is probably why you went to college in the first place.

Paying Off Credit Card Debt

Just like student loan debt, heavy credit card debt can spoil your future financial plans. Depending on your credit card interest rate, your credit card debt may be a lot worse than your student loan debt.

Get out from under this debt as fast as you can because it is dead weight. It’s keeping you from really blooming into a life of financial independence.

There is a silver lining here: The discipline you learn by paying off your credit cards will serve you well when you start investing this money into your future.

Increasing Your Credit Score

What does saving money have to do with your credit score? Nothing. Well, at least there’s no direct connection between your savings account balance and your credit score.

However, there is a very real indirect connection. When you have an emergency fund, you won’t have to rely on credit cards when the car breaks down or you need a new clothes dryer.

Less reliance on borrowing can increase your credit score. A better credit score means you can borrow at lower interest rates when you buy a house or a car.

Lower interest rates mean you pay a lower payment and can afford to save and invest more into your future.

You see where this is going. When you get out ahead of your financial needs, you open up more opportunities for saving. All the best savers know this because they’ve experienced it.

And that’s the entire point — the bottom line — of this post and my philosophy on saving. Setting aside money in a savings account, and investing your savings, won’t guarantee a smooth financial future.

But doing this will give you the tools you need to improve your financial life even when something unexpected gets in the way.

Other Savings Techniques People Talk About

So now you know my philosophy:

- Make a habit of saving: It takes only three to four weeks to change your ways and make saving money a way of life.

- Use the habit to increase your savings: Once you’re in the habit of saving, increase your savings rate every month or so, as possible.

- Set savings goals if helpful: Financial independence, retirement savings, debt payoffs, down payments — these are all good reasons to develop new habits.

- Invest savings: Investing your savings opens a third dimension into your financial future.

I used and continue to use this way of thinking but there are other ways to look at it, including:

The 50/30/20 Rule of Thumb

A lot of financial bloggers talk about the 50/30/20 rule. As you may already know, this technique recommends using 50% of your monthly income on bills, 30% on discretionary spending, and putting the remaining 20% in a savings account each month.

This idea checks some important boxes — particularly setting aside a healthy savings rate and keeping discretionary spending in check.

But it’s just too rigid for real life in a lot of cases. What if you can’t afford to save 20%? What if you can’t cover all your bills with 50% of your monthly income?

This is a sound philosophy, but if you can’t do it, don’t worry about it. Just do something. Save your 5% or your 2%. It’s more important to get into a habit of saving than reaching somebody else’s pre-set savings goal.

The ‘Save Money ‘Til It Hurts’ Idea

This idea says if you aren’t feeling the burn of going without something you want, you aren’t saving enough money. This philosophy plays into the idea that saving money requires a sacrifice. Like I said up top, saving money is an opportunity and not necessarily a sacrifice.

Yes, you should save as much as possible. And if you need financial pain to tell you’re saving enough that’s fine. But it’s more important to develop healthy and sustainable savings habits.

How long can you go without eating out? What happens if you wake up late and don’t have time to make coffee at home? Will this derail your savings plan?

The real power in saving money comes from consistency — from growing your savings account balance month after month without even thinking about it. That’s why I recommend starting with an amount you can afford to save consistently.

How Much Should YOU Save Each Month?

Should you push yourself to increase your savings rate? Should you cut back on spending in order to save more? YEP!

But your savings strategy shouldn’t rest on going without all the little things you enjoy.

Be patient with yourself. You’ll get there!

LEARN MORE: How Much Should I Have In Savings?

Read 26 comments or add your own

Read Comments