M1 Finance is an online financial services company and self-directed investing service. With an M1 Finance account, you can invest, borrow, and spend all in one place.

The platform offers commission-free trades, a cash back credit card, and no management fees on the funds you invest. There’s also a premium account with additional features.

Digital investing tools are one of my favorite topics to write about, and M1 Finance is one of the rising stars in the fintech industry.

What is M1 Finance?

M1 Finance was founded in 2015 by Brian Barnes. At the time, Barnes wasn’t happy with the services provided by other financial services companies, so he created his own. They’re currently headquartered in Chicago’s Loop district.

M1 Finance is designed to help folks invest and save money with innovative online tools that most traditional investment firms don’t offer.

The company charges minimal fees, but some services are free.

Let’s take a closer look at how you can invest with M1 Finance.

How Does M1 Finance Work?

M1 Finance works like most other financial services firms.

First, you deposit money into your account. Second, you pick the funds you want to invest in.

The platform then automatically invests your funds in the investments of your choice and rebalances them based on performance.

You can also borrow money from M1 Finance and spend money with an M1’s cashback rewards credit card.

M1 Finance Features

M1 Smart Money Management

Smart Money Management is the central platform for managing money with M1 Finance.

Customers can use the company’s web platform or user-friendly investing app, which has a 4.7-star rating (out of 5) the App Store and a 4.5-star rating (out of 5) in the Google Play Store.

M1 Invest

M1 Invest enables customers to build investment portfolios with commission-free trades on over 6,000 stocks and funds.

You can also invest in fractional shares or choose from over 80 customized portfolios. Best of all, there are no fees to park your funds with Invest.

Invest also includes automated investing options and automated rebalancing. After choosing your preferred investing strategy, all that’s left to do is sit back and let the platform do all the work for you.

Four Types of M1 Invest Accounts:

- Individual is a taxable account for single investors

- Joint accounts are designed for investing with your spouse or family member

- IRA account options include traditional IRAs, Roth IRAs, and SEP IRAs

- Trust accounts are designed to help you manage your trust

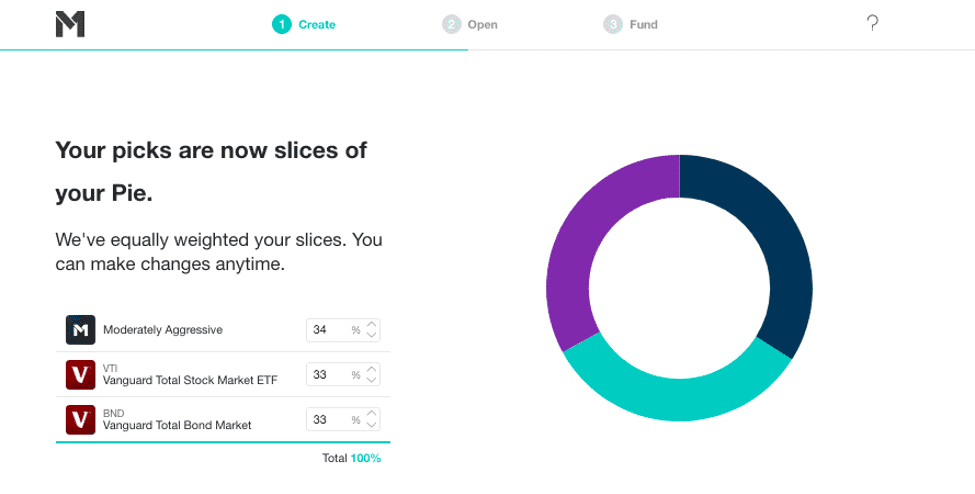

Once your account is set up, you’ll use M1’s Pie feature to visualize and optimize how your funds are invested. When you add a new fund to your portfolio, it appears as a new slice in your pie.

Well-performing funds appear as larger slices and low-performing funds appear as smaller slices. You can also choose between model portfolios and Custom Pies, depending on your investment goals.

There is an elephant in the room when it comes to trading stocks with Invest.

M1 clients can get access to two different trading windows: a morning and an afternoon window. All clients have access to a single trading window each morning or afternoon. Clients that have $25,000 or more in equity in their account gain access to both trading windows.

In other words, you are only able to buy and sell securities at these specific times, whereas many other sites let you trade throughout the day when the markets are open.

M1 Borrow

M1 Finance’s Borrow service lets you borrow cash from your portfolio—so you don’t have to sell or trade your investments if you need immediate spending power.

Other lenders call this borrowing on margin. Keep in mind that you’ll need at least $2,000 invested in your portfolio to borrow money and you can take out up to 50% of your portfolio holdings with an interest rate of 6.75%.

M1 Finance Fees

Signing up for an M1 Finance account is completely free and, in most cases, there are no annual fees or transaction fees.

You will need to deposit at least $100 to open a portfolio.

I’m reading that there might be a $100 fee for terminating IRA accounts. I haven’t had to do that myself, but as always, do your research before making any drastic moves.

Getting Started

Create an account by entering your email and password.

After that, click continue to begin the three-step account sign-up process.

The first step is creating a Pie.

To create your first Pie, pick at least three stock investments from the popular stocks list. You can also search the 6,000 available funds in the search window or select from professionally curated Pies.

After you pick the stocks you want to invest in, you can adjust the “weight of your slices” according to your investment goals.

After creating your first Pie, it’s time to confirm your identity by entering your phone number.

Once that’s done, enter your first name, last name, address, date of birth, country of citizenship, and employment status.

Next, you’ll be asked about your annual income, net worth, and investing experience.

After sharing those details, tell the company about your investment strategy.

Finally, you’ll have to enter your Social Security number to confirm your identity.

After that’s done, you’ll be able to fund your account by connecting your external financial accounts. You can also elect to do this later.

There you have it! Your account is now ready and you can start building your portfolio. Keep in mind you will have to deposit funds to make any transactions.

The entire sign-up process took me around five minutes and was pretty painless.

Signup Promotions

M1 Finance is currently offering a new account signup bonus for up to $500.

You can see the details of it using the link below.

Occasionally M1 offers an ACATS transfer bonus as well, but the most recent one has expired.

Is M1 Finance Safe?

I feel pretty safe trusting my data and funds with M1 Finance. The platform features military-grade 4,096-bit data encryption and optional two-factor authentication.

The company is a registered broker/dealer with FINRA. They’re also a member of the Securities Investor Protection Corporation (SIPC), which protects up to $500,000 in brokerage funds in the event the firm goes under.

M1 Finance Customer Service

Most customer support issues are handled online. I’m not seeing any customer support phone numbers or email addresses listed in my account.

If you search hard for it, there is an option to submit a request online. It looks like their client success team is available to reply to these requests from 9:30 a.m. to 4 p.m. Eastern Time.

Truth be told, I’m a little leery about the lack of customer support options when compared with some of the more established firms that offer phone support, live chat, and email support.

Pros and Cons

Pros

- Free trades and no asset under management fees

- You can invest, borrow, and spend money all in one place

- Intuitive app and web platform appeal to tech-savvy investors

Cons

- Limited customer support options

- No human-based advisory services

- Limited trade windows

Alternatives to M1 Finance

M1 is not a robo-advisor and only offers self-directed brokerage services. The most popular robo-advisor alternatives to M1 Finance include:

Learn More:

Each of these companies is unique in its own right, so you’ll have to do your homework to figure out which one is right for you.

Major investment institutions like the following offer robo-advisory services, too:

FAQs

Is M1 Finance Legit?

Yes, M1 Finance is a legit investment services firm. They have more than $6 billion in client assets under management and over several hundred thousand customers.

Can You Make Money With M1 Finance?

Yes, you can make money investing with M1 Finance. As with any investment firm, you can also lose money. It all depends on which funds you invest in and how they perform in the market.

Is M1 Finance Good For Beginners?

Yes. I would say that M1 Finance is good for beginners. The company requires a very low minimum balance to fund an account, and the Pie feature makes it very easy to select funds and initiate a hands-off investment approach.

On the other hand, they don’t have the best customer support. So if you’re the type of person who might want to ask questions or seek guidance on the phone, M1 is probably not the best choice for you.

Is M1 Finance Right for You?

Overall, I find M1 Finance to be an interesting company that’s worth keeping an eye on as the trend of robo-advising and self-directed investment platforms continues to rise.

On the road to early retirement, it’s all about finding places to make your money work for you. Whichever institution you trust with your funds, if you do your due diligence, it’s unlikely you will experience any major unforeseen hiccups. Happy investing!

No comments yet. Add your own