Empower, formerly Personal Capital, is a wealth management firm that offers free financial planning tools to all users, as well as a paid advisory service for high-net-worth investors.

The Empower app is widely used by the financial independence retire early community and is the most helpful tool that helped me become a millionaire!

Empower (Formerly Personal Capital) Overview

Empower is a U.S.-based investment service company headquartered in Greenwood Village, Colorado, and dates back to 1891, when its parent company was founded.

They were primarily an insurance company back then, but as of 2014, they became one of the world’s largest wealth management and retirement plan providers.

Empower seems well-positioned to capitalize on the growing trend of online-only financial services companies (which is especially popular among millennials).

As of today, Empower serves over 17 million people and 69,000 companies. Let’s take a closer look at the company’s services and how you can use them to handle your finances better.

Products & Services

Empower, formerly Personal Capital, has products and tools within these three specific service areas:

Wealth Management Services

Empower’s Wealth Management Services can be broken down into three tiers:

- Investment Services ($100k to $250k Investment)

- Wealth Management ($250k to $1M Investment

- Private Client ($1M+ Investment Assets)

1. Investment Services

Investment Services is Empower’s entry-level wealth management offering for investors with between $100,000 and $250,000. The benefits of the basic investment services account are as follows:

- Customer support from their team of financial advisors whenever you need it

- An ETF portfolio professionally managed

- Access to state-of-the-art tools

2. Wealth Management

If you have over $250,000 to invest, you can open an Empower EWalth Management account and enjoy the same benefits as a standard account, as well as the following benefits:

- Access to two dedicated financial advisors

- Free consultations are available to speak with sector-specific investment specialists, like real estate and options

- Ability to invest in individual stocks in addition to ETFs

3. Private Client

Investors with over $1 million will have access to Empower’s highest level of wealth management service: Private Client.

In addition to the benefits included in the Investment Services and Wealth Management plans, Private Client account holders receive:

- Exclusive access to an Investment Committee

- More in-depth estate, tax, legacy, and wealth planning advice

- Access to invest in private equity

- Private banking services offered only to private clients

- Ability to trade individual bonds (in addition to ETFs and individual stocks)

Here’s a more complete comparison chart of these plans.

Empower’s Wealth Management gives investors access to their robo-advising service and personalized advice from the company’s certified financial advisors.

Wealth Management Account Holder Notable Features

- Smart Weighting limits your risks by making sure your funds aren’t overly invested in one sector. This makes your portfolio more resilient to potential market shifts.

- Dynamic Portfolio Allocation helps meet your evolving financial needs by adjusting your investment account as your financial situation changes.

- Tax Optimization lets account holders take advantage of tax-advantaged investing strategies, such as tax-loss harvesting.

- Intelligent Rebalancing automates investment management by rebalancing your accounts at the best times without any work required from you.

Socially Responsible Investing

Empower offers Socially Responsible Personal Strategy accounts that aim to invest funds with companies aligning with your values.

In the past, a socially responsible investing strategy might include a blanket rule of “no investing in oil funds.”

Empower takes this idea further by factoring in what you value the most. For example, if you want to focus on companies that have embraced renewable energy or if you want to avoid investing in conflict minerals, your funds can be routed into assets that align with these values.

Cash Management

Empower also offers a high-yield online savings account called Empower Personal Cash.

This account has no minimum balance requirements, no monthly fees, and offers 4.70 APY as of September 11, 2023. You also get the peace of mind of having your bank account funds be FDIC-insured (up to $5.25 million, too!).

For most clients, the withdrawal limit is $25K per day; however, personal advisory clients can withdraw up to $100K per day. Deposit limits are $250,000 per transaction. See their site for more details.

Financial Planning Tools

Empower’s most popular product is its personal finance software, which offers a variety of free budgeting and retirement planning tools.

You can access a spending tracker with your online account, along with a variety of other tools. However, the easiest way to access these tools is in the Empower Personal Dashboard app, which has a 4.7-star rating (out of 5) in the App Store and a 4.2-star rating (out of 5) in the Google Play Store.

Here are the main financial tracking services you can use:

- Investment Checkup: A tool that automatically monitors the performance of your investment portfolio and suggests opportunities for better allocation when needed. It helped me discover that my Roth IRA held the wrong asset classes and that I needed to invest in a total stock market ETF like VTI.

- Retirement Planner: Empower monitors your financial progress as you progress toward your stated retirement goal. You’ll have real-time access to information that will let you know whether you’re spending too much or saving the right amount.

- Net Worth Tracker: (One of my favorite features Empower offers!) Your financial dashboard gives you real-time access to your net worth, which is a tally of all your assets and liabilities from various accounts displayed in a neat, single financial dashboard. Having an automated tool at your fingertips saves time vs. manually using a net worth calculator.

- Fee Analyzer: An interesting feature that tracks the fees you pay within your financial investments and alerts you if the fees are higher than average. The fee analyzer will also help you realize the total impact that certain fees might have throughout the lifetime of your retirement account.

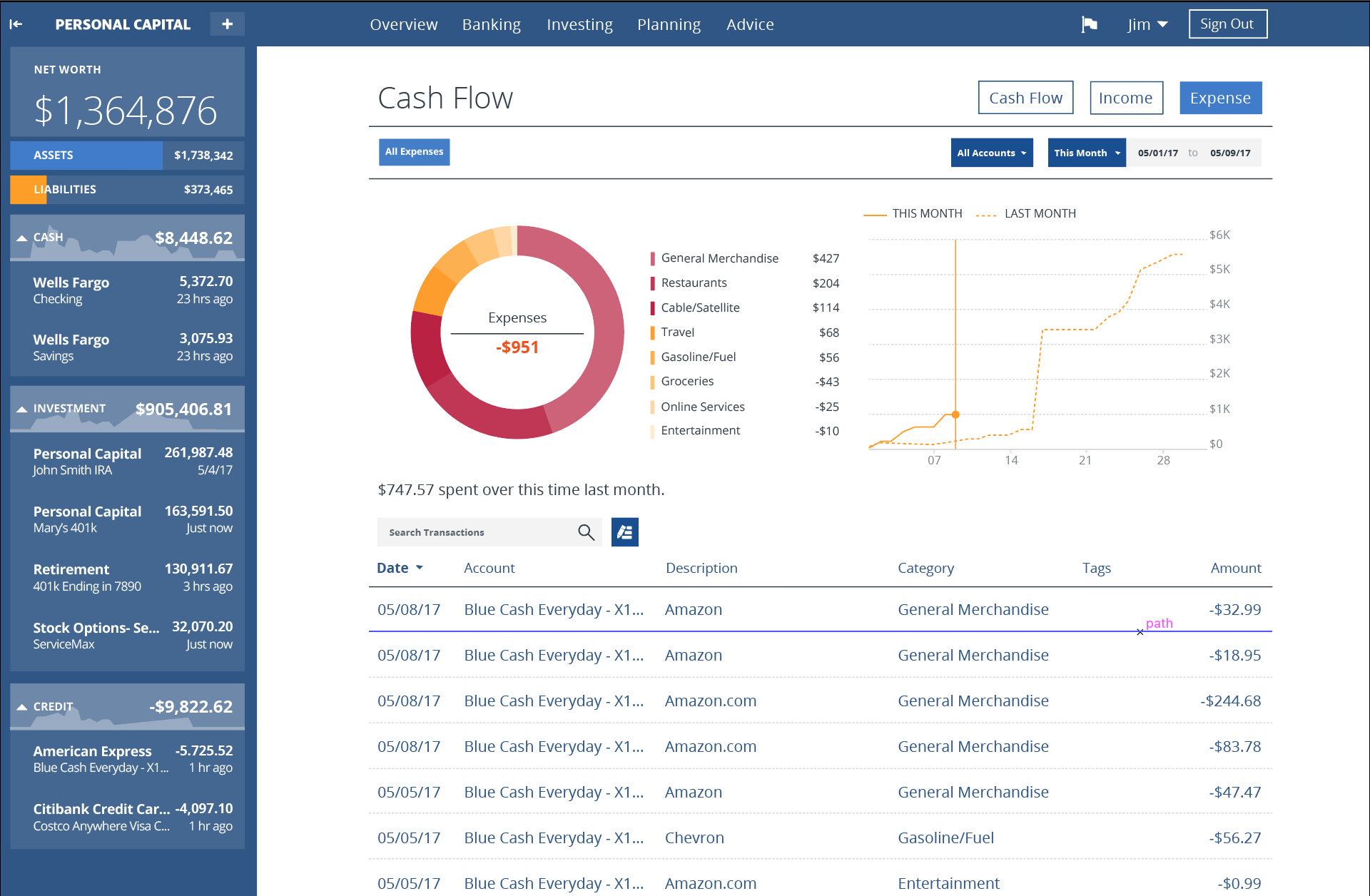

- Cash Flow Monitoring: This keeps track of all the incoming and outgoing money in your accounts, giving you insight into your monthly cash flow.

- Education Planner: Education Planner helps you determine how much you need to save for upcoming education expenses.

How Much Does Empower Cost?

One of the coolest things about Empower is that the spending and budgeting tools I mentioned above are all free to use. You only pay money if you have a Wealth Management account.

On that note, Wealth Management account fees operate on a tiered fee structure depending on your account balance, ranging from 0.49% to 0.89%.

Fees and Costs

Tiered fees for Empower are:

| Balance | Annual Fee |

|---|---|

| First $1 Million | 0.89% |

| First $3 Million (for private clients) | 0.79% |

| First $2 Million (for private clients) | 0.69% |

| Next $5 Million (for private clients) | 0.59% |

| $10 Million+ | 0.49% |

Get Empower’s FREE planning tools today.

My Favorite Features

There are a ton of amazing features in the app, but here are my favorites that I use every day and had to highlight within this Empower review:

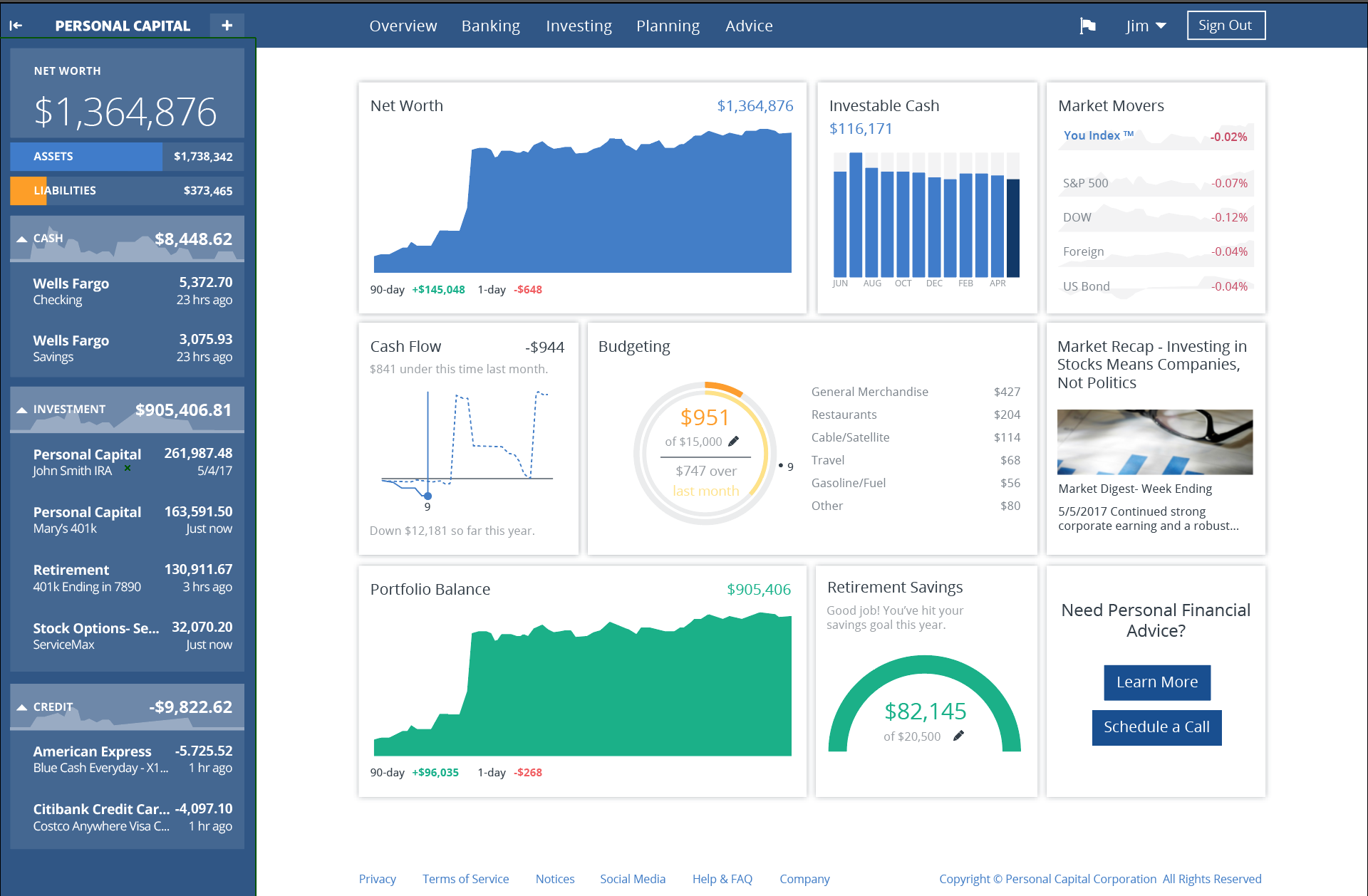

The Dashboard

Every morning, I start my day with a cup of coffee and spend 5 minutes checking my finances.

It’s a routine I’ve kept up with for over seven years, and I always start with the Empower dashboard on my phone.

The dashboard has changed significantly over the years and has several amazing features. Some of these features include the ability to see your net worth (assets-liabilities), cash to invest, and the performance of your investments (the “You Index”). You can also see the amount you owe on your credit cards, the amounts you have in your bank accounts, your monthly cash flow, the amount you’ve contributed so far this year to your retirement accounts, and your monthly budget that you can customize.

It’s an enormous amount of information that has been essential in helping me reach financial independence and become a millennial millionaire.

The Retirement Planner

The hands-down beast of the Empower app is the retirement tracker, which is my favorite online tool.

It also helps me track whether I’m maintaining my investing path growth to sustain early retirement. It can also help you figure out when you can realistically retire, depending on a bunch of variables.

Here’s my actual retirement investment path, which I’ve set to walk away from work at the age of 35.

Even though I’ve already reached financial independence, I’m still making and investing money, but I have set my Empower retirement date as 35 for future forecasting purposes.

It says I have an 88% chance that my current investment portfolio will last me 60+ years. This percentage will likely increase as I add more money to my investments.

I’ll take it! I have so much fun playing with this one tool. It’s my personal finance dashboard.

Investment Allocation Tracker

Investing growth is the OG passive income, and diversification is a central component of my investment strategy and any solid investing strategy.

One excellent Empower feature I used early on when setting up my own investing portfolio was the target allocation feature that makes free optimal investment recommendations based on a series of questions you answer when creating your profile.

It recommended I get more exposure to international stocks as a way to hedge only US performance. It motivated me to study the idea further and eventually buy shares of Vanguard’s Total International Stock Index Fund (VGTSX) to diversify my portfolio.

While I am always naturally skeptical of any tool recommending an ideal investment allocation, none has been more spot-on than Empower. It’s definitely worth checking out and comparing it to your current strategy.

The Retirement Fee Analyzer

Did you know that the average investor is paying at least 3-4x more in fees in their retirement accounts?

Yup, it’s insane, and over time, the fees you are potentially paying to manage your investments can add up to you having hundreds of thousands of dollars less in your portfolio once you retire.

That means just your 401k and retirement fees alone can stop you from retiring up to 5-10 years early. Yeah, seriously, these investment management fees really add up.

You can use this feature to identify where you are paying too much in fees, how your fees compare to others, and how much of your investment earnings you lose to fees (which is most shocking for most people).

Check out how much you pay to manage your investments, and then you can attempt to reduce your fees as much as possible.

The Monthly, Quarterly, and Annual Review

At the end of every month and quarter, I quickly analyze my spending patterns to see what I’ve spent too much money on so I can make adjustments over the next period.

Then, at the end of the year, I pour a glass of wine and do a massive year-end review, where I analyze my spending patterns across all categories and make adjustments for next year’s strategy.

Unfortunately, my spending went a little rogue last year because I got married, and it messed up my previous three years of maintaining my spending target, but so far this year, I’ve stayed on track.

Here’s a snapshot of the Empower (formerly Personal Capital) cash flow dashboard that you can easily customize to show how much you’ve spent in the past week, month, or year.

Weekly Cash Flow & Investing Performance Email Updates

Another excellent free feature that I use is the weekly cash flow and investing performance update. These are some of my favorite emails I get all week – haha, I know, I’m such a nerd.

But seriously, the updates are legit and give me a high-level snapshot of how well my investments are doing relative to the market, how much money I’ve spent compared to last month, and how my cash flow compares to last year. That’s a ton of info in an email.

Financial Scenario Analysis

The financial scenario analysis is a great new feature that I’ve just started playing around with that could help you make better financial decisions – or at least understand what impact it will have on your finances.

It can be difficult to predict how a certain decision can impact your finances, but now you can test/compare multiple incomes or spending scenarios.

I mean, who doesn’t like A/B tests for your money? You can compare all kinds of scenarios with the tool – like the impact of selling your home, inheriting money, paying for a wedding, doing a big renovation, or really anything you can come up with. You can also save the scenarios to edit later.

How To Sign Up

Empower has a very slick website and a seamless sign-up process.

- To get started, click the Sign Up/Register button on the top right-hand corner of your browser.

- Choose either ‘Access my retirement plan,’ ‘Create a dashboard,’ or ‘Open individual account’

- Complete the easy sign-up form with your email, password, and phone number to create an account.

- Next, you’ll answer a questionnaire about your personal details.

- Finally, you’ll link your external financial accounts. This is how Empower will access and populate your financial data.

Security Measures

Security is Empower’s top priority, and they utilize multiple layers of security protocols to keep your account and data safe. For starters, they have a dedicated security team constantly testing the system for vulnerabilities. The company also uses leading-edge encryption, user verification, and fraud detection technology. Empower does not sell user data, either.

Customer Support

Empower offers self-service support to free account holders.

Phone & Contact Information

Only Wealth Management clients have access to phone support. If you’re interested in becoming a Wealth Management customer, call this number: 1-855-855-8005.

Pros and Cons

Pros:

- One of the best spending trackers on the market (and it’s free!)

- Fantastic budgeting tool and financial planner tools (and they’re free, too!)

- Personalized Wealth Management services are available

Cons:

- Very high buy-in for Wealth Management or Robo-advising account ($100,000 to start)

- Wealth Management and Robo-advising fees are higher than most competitors

- You’ll still have to keep track of some of your finances by hand

Frequently Asked Questions

Let’s take a second to answer some of the most common questions I hear about Empower.

How does Empower work?

Empower’s financial planning and retirement tool combines all your financial institution account balances under one roof — including your checking account, savings account, 401k account, IRA accounts, brokerage accounts, credit card accounts, student loan accounts, mutual funds, etc.

This results is a clear overview of your entire financial life.

For example, if you’re interested in tracking your investment strategy, you can easily see your expense ratios or assess your risk tolerance based on your asset allocation. You can also see where you spend money and how well you save. It’s also easier to determine where you can cut back on spending to save more.

Is Empower trustworthy?

Absolutely. All data is secured using AES-256 encryption, using U.S. military standards, and Empower’s login requires two-factor authentication and biometric ID.

They’ve been in business since 2014, and have over 17 million customers. What’s more, their bank account is FDIC-insured.

Is Empower worth the fee?

First of all, there is no fee to use Empower’s app, retirement planner, or budgeting tool. You will only pay a fee if you have over $100,000 to invest with their Wealth Management division.

That being said, if you prefer to take a hands-off investment approach, but also want the benefit of having access to a certified financial advisor, the advisory fees (0.89%, decreasing with higher account balances) might be worth it to you. If that seems steep, I recommend researching the other best Robo-advisors.

How does Empower make money?

Empower makes money by charging advisory fees on Wealth Management accounts. If you sign up for a free account, be ready to get ads that encourage you to enroll in a Wealth Management account.

Can Empower be hacked?

Empower is no more or less likely to be hacked than any leading online financial company. With that in mind, the company does seem to have a very robust security platform.

Is Empower A Good Tool For Investing?

If you want to get a better handle on your finances and don’t mind sharing your data, an Empower account is a no-brainer. Having access to all of your financial accounts in one place might make it easier for you to achieve your financial goals.

At the very least, it’ll prevent you from having to log in and out of several accounts regularly. There is a reason I log into Empower every day – it helps me track everything I need to know about my money – investment performance, cash flows, budgets, and early retirement trajectory.

When it comes to the Empower Wealth Management division, due to the relatively high fees that they charge, you might want to do your homework there to see if it makes sense for you.

If you’re interested in learning more about what funds I recommend, check out my Millennial Money Portfolio post.

Thanks for reading our Empower review, and if you’re interested, check out our full review of other personal finance software (free and paid) that might suit your personal situation.

Read 3 comments or add your own

Read Comments