MM Note: This is a guest post from 29-year-old Millennial Money reader Todd Kunsman, sharing the steps to financial freedom. To learn more about achieving financial freedom, check out the Financial Freedom Podcast, and my book Financial Freedom: A Proven Path To All The Money You Will Ever Need.

Back in 2013, I found myself living in an apartment I could barely afford, with student loans, and a car loan — which doesn’t leave much room for saving. Essentially after all my bills were paid each month, I’d have about $50 in my checking account left. Not good.

Every day I hoped to not have some kind of emergency expense come up and as many people know, that is a terrible feeling to have. Worrying about money sucks.

(Note: I did have a small company 401k started, but I knew very little about it and was contributing like 2%, not even enough for the company match (SMH). I also did have about $900 in my bank savings account, but still not where I wanted to be financially.)

But I also wasn’t completely ignorant to understanding finances. I understood the value of a savings account and building good credit (thanks Dad for the knowledge when I was a young buck), but I was definitely not making the best choices to ensure I would escape living paycheck to paycheck.

However, in late 2014 and early 2015 I started changing my perspective and figuring out how I could improve my financial situation and I knew I needed to take charge.

While I am not completely financially free (yet), I’ve been able to:

- reduce over $50,000 of debt (student loan debt + car loan) down to less than $8,500, with the plan is to be fully paid off by 2018,

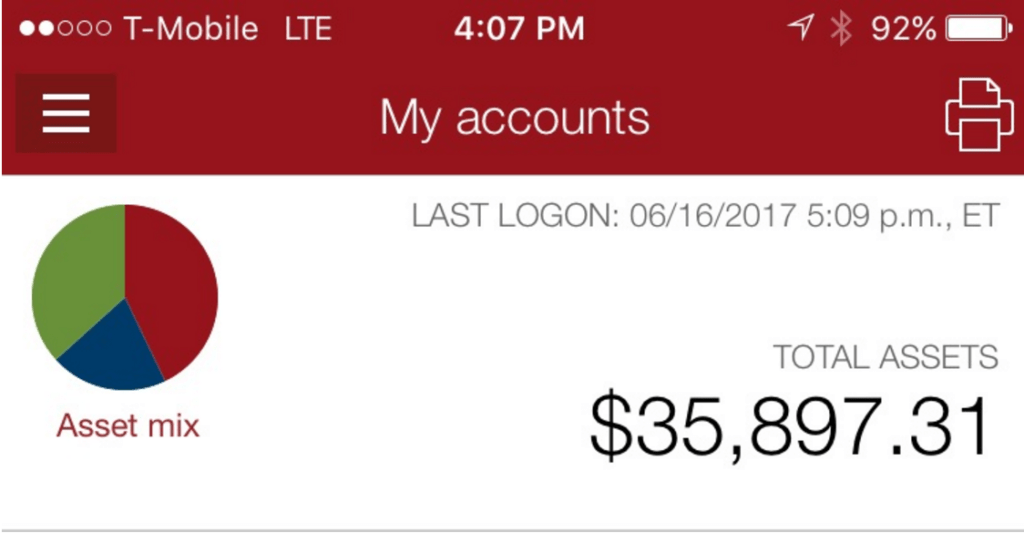

- build a Vanguard account with over $35,000 (Brokerage + Roth IRa + Rollover IRA),

- and still have additional savings in the bank for an emergency fund.

While it may not seem like a lot, a majority of my millennial friends have far less, and there are plenty of people much older than me that also have very little in savings. So I am proud of how much I have accomplished so far. With the path I have set for myself, I’m planning to achieve financial freedom and pursue early retirement in less than five years.

9 Steps to Financial Freedom

“Financial freedom means not having to worry about money.”

Anyone can turn their financial life around, and below are 9 steps to financial freedom. I’ve also included other valuable links and resources for further reading of each step in the process.

1. Calculate Your Net Worth

While your income, your savings rate, your investment returns, your debt to income ratio, and all those other numbers are important when optimizing your money, the single most important metric that you should be tracking is your net-worth.

Your net-worth is calculated by subtracting your liabilities (debt/what you owe) from your assets (what you own that has value, your cash, and investments). It doesn’t matter how much money you make or how much money you save if your net-worth isn’t increasing year over year.

One of the best (and FREE) financial tools to help track your net worth is called Personal Capital. I strongly recommend signing up for Personal Capital today and begin automatically tracking your net worth each month.

For more details on net worth tracking and why this number is so important, see our full post here: Net Worth Tracking.

2. Track Your Spending

After you start tracking your net-worth, you need to track where your money is going. Whether this is student loans, bills, food, entertainment, etc. All your spending should be tracked methodically.

This might not be the most exciting thing to do, but is CRUCIAL and actually does get more exciting the more money you are making (and seeing your investments grow!) Knowing where your money is going is more important than budgeting – it’s about accountability and adopting an optimization mindset. It really can put your spending in perspective.

Luckily, there are FREE apps and financial tools that help you track your spending. Empower, formly Personal Capital is a favorite within the FIRE movement. These tools also monitor your credit score and simplify your financial life.

Once a month, I export my spending data and write down every bill and loan I have with the numbers next to them (some obviously varied slightly from month to month) along with every time I spent money on going out, food, clothes, etc. You’d be surprised at the things you catch that have affected your spending over the last year. Slight tweaks and adjustments can make all the difference in the amount you save. This was how I was able to identify how much money interest my student and car loans were accumulating and then identified it was critical for me to start paying them down rapidly.

3. Keep building skills and growing career value

When I first started working after college in 2010, I had little skills other than what I learned in my classes and having previously worked at a grocery store. Most degrees are not going to give you a six-figure salary right away, in fact, in 2017, the average salary for a recent college graduate is just under $50,000.

Not bad though, right? However, I do not know too many people that are even making close to that right after college, but environmental factors (where you live), type of degree, etc. can affect that number. I was lucky in 2010 to get a job about a month after graduation, but it was a starting salary of $30,000 — nothing too glamorous.

Then in 2014, I was let go from my job (my department was being consolidated) and it was just a few weeks shy of Christmas (Thanks Santa!). But luckily, I was looking for additional side income just before this was happening so I was making some money on the side still.

While I was nervous and scrambling to figure out what to do for full-time work, I began looking into digital marketing (I already had a blog about music that got me into SEO, analytics, etc.) and how I could improve my overall career worth. I wanted to find a job in something that I was really starting to enjoy as well as improve my future salary options. Here are the best skills to learn for the future.

This led me to learn and acquire free certifications for Google Adwords, Google Analytics, and HubSpot’s Inbound Marketing Certification. Of course, this required studying and using the programs on my own, but once I passed everything I was able to significantly boost my employment credibility.

Now you aren’t going to make huge money overnight, but this led me to find remote work with start-ups that were willing to give me a chance. Sometimes you may have to be an intern or even work for free, but that experience and knowledge will add so much value to your resume.

Within 3 months of being let go, I was working for three different companies remotely in digital marketing that not only paid my bills, but allowed me to build a network of new contacts, and led to a new career path. In those three years since I’m now a Digital Marketing Senior Manager at a great software company called EveryoneSocial and I provide digital marketing consulting for other companies and startups that all improved my career worth.

Yet, you do not have to pursue digital marketing. There are many other career changes you can make that will lead you to advancements in your career and salary, but you’ll have to put in the work yourself to make it happen. But with so many great free resources online, you can improve your career without having to go back to school.

4. Diversify your income streams

Having more than one income stream will help you achieve financial freedom faster. It also provides you a safety net incase your primary source of income is disrupted.

Being that we are in the 21st century, it’s so easy to pick up a new side hustle, build a business, or start growing small passive income streams. If you haven’t yet checked out Gary Vaynerchuck, you definitely should. While not everything he says is groundbreaking, just watch some of his videos about creating side income and you’ll be inspired.

One of our core missions for this website is to help you grow side income, no matter your background or expeirence level. Here are some of our top posts you can check out to help pick the right money making activity for you:

- Best Online Side Jobs

- Side Hustles for Teachers

- Side Hustles for Single Moms

- Online Jobs for Teens

- Side Hustles for Couples

- Best Passive Income Ideas

5. Automate Your Savings

One of the most important steps to financial freedom is to pay yourself first. It was a concept I first read about in Rich Dad Poor Dad and I thought it was really interesting. The author essentially stated that he would save as much as possible before any bills were due and would leave just enough to make sure he had no late payments on bills.

I started small, about 10% each paycheck would be taken out for my savings accounts. Half would go to my Vanguard retirement account and the other half to my savings emergency fund. Then, I kept increasing it and diversifying where the money went. Anytime I go a raise or made side hustle income, I would do the exact same thing as soon as it cleared in my bank account.

Paying yourself first accomplishes 2 goals. First, it prioritizes investing, which is the foundation of your retirement funds. Next, you spend less overall since there is less money in your account after savings have been withdrawn.

Since everyone’s situation is different, the amount you save should be custom to you. The more you save and invest each month, the faster you will achieve financial freedom. But, there is certainly no harm in starting with small amounts — any savings is better than no savings.

Further reading to help pay yourself first:

- How Much Money Should You Save Every Month?

- How Much Should I contribute to my 401k?

- 101 Ways to Save Money

6. Create an Investment Strategy

A majority of people in this world are consumers and not investors. But investing is essential to building wealth. While there are many great investing strategies, I am a huge fan of Vanguard and index fund investing.

When most people get a raise or have extra money, we look to buy things that are not going to add much to our overall wealth. Money goes to new fancy cars, boats, clothes, you name it. While consumer spending is not necessarily a bad thing, you have to narrow this down, be selective, and ask yourself, “Will this purchase add value to my financial freedom?” Most likely the answer will be no. I ask myself this almost every time I get the urge to buy something that I do not necessarily need at the time. This allowed me to free up hundreds of dollars a month that I could put to better use and in places that can provide me with some additional income.

It’s important to create an investment strategy that suits you. Here are some excellent resources to help:

- Investing 101: How to Start Investing

- How to Invest with Little Money

- Best Places to Open a Roth IRA

7. Find Mentors (Or Talk With a Financial Advisor)

This might be one of the most important tips when it comes to financial success. Find a mentor or mentor and really pay attention to everything they do. Even if you are unsure if they will work with you, reach out and ask as many questions as you can. You will likely be really surprised by how much older experienced people are willing to teach and help you.

If you do not have any friends or family that are mentor worthy in your eyes, look online for experts and even if you do not reach out to them, follow their blogs and advice (Note: do not blindly follow advice though, always do your own research on top of what you are learning from others).

I was fortunate enough to have two friends who I’ve known for quite some time who are financially free and have been since their mid-twenties. I gravitated towards them and learned from them how they make income besides running their business and where they put their money to work. We still talk about investment opportunities, real estate, and various ways to make money.

8. Invest In Your Knowledge

As a kid, I loved reading, and being able to choose a new book from the library was the highlight of my childhood. Then something changed, I got to high school and college and reading felt more like a chore. I was rarely reading, except for the occasional blog or required textbook for school. Even after graduating, I never picked up a book much, especially about finances!

However, as I started this journey, I realized how essential reading was in developing my financial IQ. There is nothing that has a higher ROI (return on investment) in my opinion, than reading a book. In 2017 alone, I’ve already read 8 financial books, which have given me ideas that I am confident will make me a ton of money over time.

Now I’m moving on to books about real estate and business, all which are relevant to improving my finances and how to generate more income.

Here are some of the blogs and best books on money that I’ve read. I am also now starting to read through Grant’s Best Financial Independence Retire Early Books.

- MONEY Master the Game: 7 Simple Steps to Financial Freedom

- The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

- The Only Investment Guide You’ll Ever Need

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

- The Millionaire Real Estate Investor

If you’d prefer podcasts or listening to audiobooks, check out the best investing podcasts here to start increasing your knowledge. Increasing your knowledge gives you a huge advantage to achieving financial freedom.

9. Set and Forget

Being patient has been tough, but I know that I’m on the right track and the more I can save and invest the faster I will reach financial independence. Many of you may be reading this and wonder why I only have $35,000+ in Vanguard savings when I’ve been at this for almost 3 years. But I was starting from not only zero, I owed over $50,000, so I’m excited how far I’ve come in just 3 years! I had to not only invest time building my knowledge, but improve my career to the point where I could make a solid income and side income, and then start investing that money. Now it’s all about patience and optimization.

The cool thing is with compound interest and continuing to invest like I am, the growth of my account is just starting to have an exponential curve – where the rate of my investing returns are starting to accelerate. Seeing more of my efforts coming together in the next few years will it make all worth it.

So don’t be discouraged, even if you are only saving a few dollars a month, it all adds up, and in a few years you’ll look back proudly at your accomplishments. Honestly, I can’t believe how far I’ve come. This stuff really works.

Learn More:

Final Thoughts on Achieving Financial Freedom

Achieving financial freedom takes time up front, but the more you learn, the less time it ends up taking. I always find at least 20 minutes every day to read about money and I’ve learned so much in just the past year.

The amount of content may seem overwhelming at first, but you’ll start to see the bigger picture and everything will begin to make sense. There is this stigma around finances that it is complicated and the industry wants you to think it is too. But when you get down to it, it’s not that complicated. There are tried and true methods.

I’m glad I started looking at this when I was in my mid-twenties, but of course, now I wish I knew all this info when I was even younger. So don’t wait, don’t put it off, start right now. And while I may not be able to retire next year or even in five years, I am well on my way to being financially free well before the average retirement age. Let’s do it!

Learn More:

Read 11 comments or add your own

Read Comments