Millennials are front and center in a lot of financial conversations, and it isn’t always flattering. It’s true—millennial spending habits are a bit different from the older generations.

Millennials tend to spend more on experiences and convenience—but there’s a lot more than meets the eye when it comes to millennial spending.

We’ve compiled dozens of stats on how millennials spend their money, covering everything from notoriously pricey coffees to retirement savings and student loan debt. The numbers might surprise you.

Who are Millennials?

Who are millennials? Here are a few key defining stats about who makes up the millennial generation:

- Millennials, or Gen Y, are the generation between Gen X and Gen Z, born to Baby Boomers and early Gen Xers.

- Millennials are defined as people born between 1981 and 1996.

- There are 72.2 million millennials in the US, making it the largest age group in the country.

- According to Pew Research, 44% of millennials are married.

- Millennials are the most educated generation, with ⅓ of the age group having at least a bachelor’s degree.

How Millennials Spend Money

Like every generation, millennials have unique buying habits and preferences. For example, they statistically spend less on major purchases like homes, cars, and retirement.

But they tend to be bigger spenders on experiences like travel, dining out, and tech services that make life more convenient.

Millennials are also more inclined to spend money on socially responsible brands that align with their values than other generations are, which can come with a higher price tag.

And they have a lot of student loan debt to contend with, taking a large chunk of their income and hindering many millennials from buying a home.

Do Millennials Have Healthy Spending Habits?

Millennials get a bad rap for their personal financial habits. And statistics show they’re behind some of the previous generations in terms of retirement savings, home ownership, and debt.

But millennials are also faced with different financial challenges than previous generations were at their age—with different expenses, a higher cost of living, and wages that just haven’t kept up.

Millennial spending habits are also a good indicator of the way society has grown and advanced, highlighting a shift to socially minded shopping and shopping that favors convenience.

Millennial Spending Habits Statistics

Here’s a closer look at how and where the millennial generation spends its money.

Millennials spend an average of $52,000 per year, which is less than Gen X and Baby Boomers.

According to a 2020 study from SmartAsset, the average millennial spends around $52,874 annually. The study found that Generation X spends an average of $74,683 per year.

Millennials spend around $34,000 on discretionary purchases each year.

Millennials don’t spend as much on discretionary purchases—non-essential buys like gym memberships, streaming services, and concert tickets—as you might think.

A recent Equifax report found that the median discretionary spending for millennials is around $54,000, and millennials spend less on their wants like entertainment than Gen Xers and Boomers.

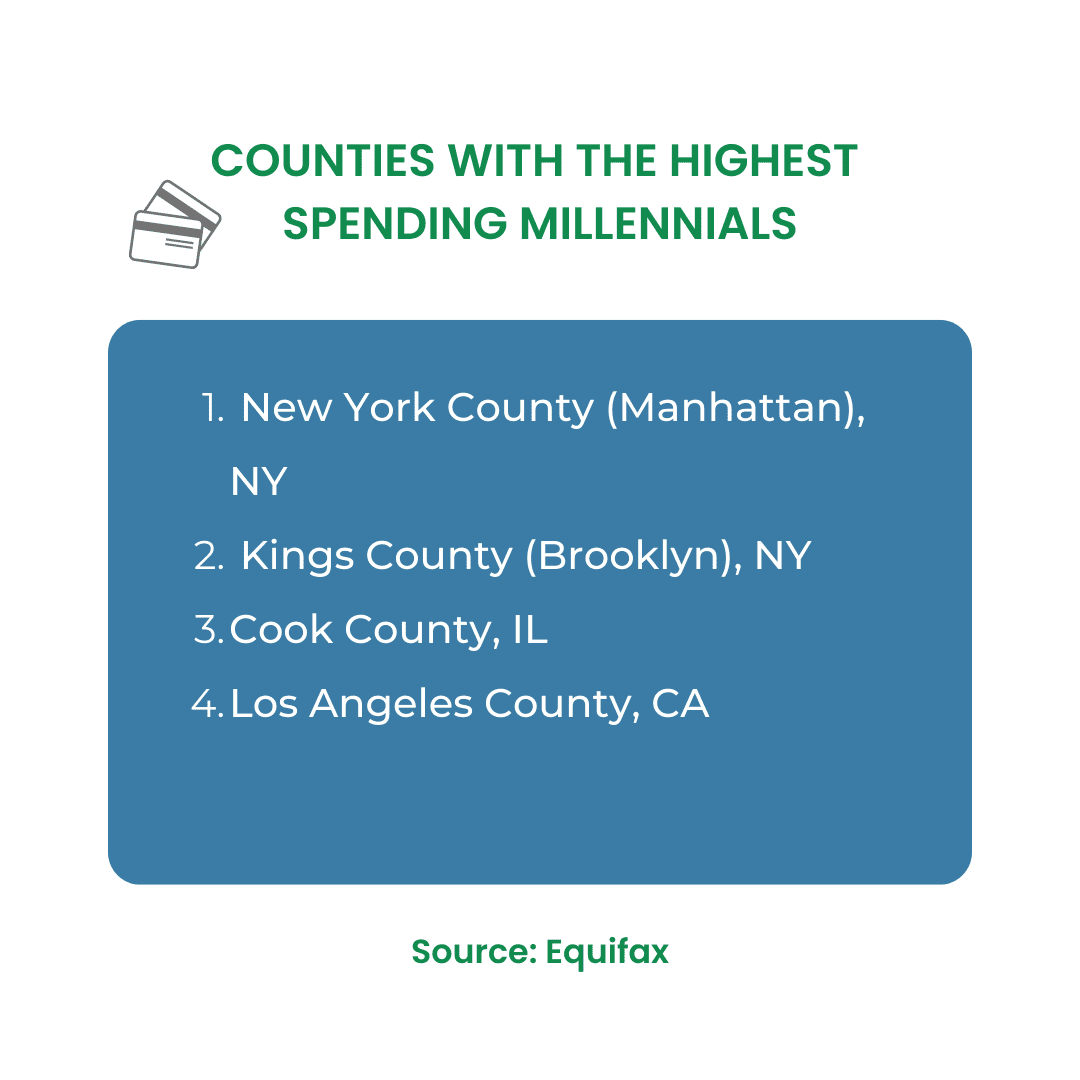

Millennials in Manhattan spend more on discretionary purchases than anywhere else in the country.

Equifax also reports that Manhattan millennials have the highest discretionary spending levels in the country.

Here are the top counties overall:

Millennials are spending less than older generations year over year.

According to a 2023 Bank of America study, millennial credit and debit card spending declined by 1.2-1.5% year over year for millennials earning less than $125,000 per year.

By comparison, spending by Boomers earning $50,000-$125,000 increased by 5% year over year.

Most Millennials spend close to $93,000 on rent in their 20s.

A 2018 study from RentCafe found that most millennials will have spent approximately $93,000 on rent by the time they hit 30.

The study also found that millennials’ rent burden is 9% higher than that of Baby Boomers. While Boomers and Gen Xers made less money in their 20s than the average millennial, they also paid a lot less for rent.

Millennials spend $164 a month on entertainment.

According to a McKinsey survey, millennials spend an average of $164 on entertainment expenses like movies and eating out each month, which is higher than Gen X and Boomers.

Millennials spend an average of $79 per month on cable or streaming, while Baby Boomers spend $114.

But the survey also pointed out that millennials spend $35 less to watch TV than Baby Boomers, turning to cheaper streaming services over pricey cable and satellite packages.

While millennials spend the most on apparel and shoes, Gen Xers outspend them on athletic apparel, cosmetics, and skincare.

Here’s a comparison of how millennials and Gen Xers spend on material goods each year, based on McKinsey’s consumer survey:

| Category | Millennial | Gen X |

| Apparel | $524 | $355 |

| Athletic clothes | $322 | $385 |

| Shoes | $264 | $185 |

| Cosmetics | $103 | $116 |

| Skincare | $87 | $134 |

Millennials spend 37% of their food budget on delivery and eating out.

Millennials love the convenience of food delivery apps and the experience of eating out. The 2020 BLS Consumer Expenditures Report found that millennials outspend the older generations in this category. And Gen Z spends even more than millennials, at 44%.

Millennials buy around $27 billion of furniture each year.

Data from Shoptelligence shows millennials spend $27 billion on furniture each year, and half of the millennials choose to buy furniture online.

35% of millennials surveyed said they wouldn’t consider hiring an interior designer, and less than half preferred to buy a furniture package for the whole room.

81% of Millennials shop online at least once a month.

The wide majority of millennials shop online—and often, according to Invesp research. The survey also showed that millennials make over half of their purchases online and prefer it to shopping in-store.

8 in 10 Millennials say they won’t buy something without reading a review first.

While older generations might think millennials make hasty purchases without thinking things through, millennials are all about research. Invesp found that 80% of millennials do their homework and scout out customer reviews before every purchase.

42% of millennials prefer to use their smartphones for most purchases.

Almost half of the millennial consumers said they make most of their purchases from their smartphones in a recent Statista survey, compared to 55% of Gen Z consumers.

Most millennials prefer digital customer service and online research to talk to retailers in person.

61% of millennials surveyed by Invesp said it’s easier to chat with customer service by email or online chat than to visit a store.

And 53% of millennials would rather look up product details on their phone when they’re in a store than ask the staff for help.

Millennial Saving Statistics

Curious about how much millennials save? Here are a few stats on millennial savings and how they stack up to other generations. They just might surprise you.

Millennials save an average of 9.8% of their income.

According to SmartAsset, millennials have a savings rate of 9.8%, which is higher than Baby Boomers but lower than Generation X.

3 in 4 Millennials are saving for milestones and their future financial goals.

Despite all the stereotypes, Bank of America’s Better Money Habits Millennial Report found that 73% of millennials were focused on saving in 2020.

24% of Millennials with savings have at least $100,000.

Nearly one in four saving millennials in the survey have at least six figures saved, and 59% have at least $15,000.

Millennials start saving for retirement earlier than Gen X and Baby Boomers, on average.

The study also found that the average millennial starts saving for retirement at 24, while Gen X and Baby Boomers didn’t start building their nest eggs until 30 and 33, respectively.

Spending Motivations Statistics

Now that we’ve talked about how millennials spend and save, let’s take a look at why.

Nearly half of millennials say they would make a purchase based on free delivery.

Global Web Index’s research shows that 48% of millennials would be motivated to make a purchase online if it came with free delivery, like Amazon Prime.

And 29% of millennials buy from brands after seeing them on social media.

According to GWI, nearly 1 in 3 millennials are inclined to buy from brands because they’ve seen them on social media.

Over half of millennials are more likely to buy products described as clean, high quality, and durable.

YPulse’s Luxury Report asked millennials if they’d be more or less likely to buy products based on the adjectives used to describe them.

Here are the top 10 words most likely to make them buy, which gives a lot of insight into the motivations behind millennial spending:

- Durable: 59%

- Clean: 58%

- High Quality: 56%

- Inexpensive: 44%

- Sustainable: 43%

- Economical: 38%

- Local: 37%

- Cheap: 36%

- Eco-friendly: 36%

- Premium: 36%

Millennials prioritize experiences and pay more for them than Boomers.

A Charles Schwab survey found that 4 out of 5 millennials are willing to shell out more cash to eat at a popular restaurant.

And 60% said they’d pay more than $4 for a cup of coffee, while only 29% of Baby Boomers would.

41% of millennials spent more on coffee than their retirement.

Speaking of coffee, 41% of respondents to the 2022 Money Matters Report from Acorns said they spent more money on coffee than they did on their retirement fund in the last year.

Nearly half of millennials say they’re more inclined to buy from a brand if their purchase supports a cause.

Millennial spending is also highly driven by social responsibility, and a lot of millennials put their money where their mouths are.

Millennial Marketing reports that almost 50% of millennials are more willing to make a purchase if some of the proceeds will contribute to a cause.

And 37% are willing to pay more for products that support causes they believe in.

More than one-third of millennials surveyed by Millennial Marketing said they’re willing to spend more for a product or service if the brand supports one of the causes they care about.

83% of millennial women consider a brand’s sustainability practices when they shop.

A study from Merkle found that sustainability is at the top of the list of millennial women’s considerations when they decide whether or not to support a brand.

More than half of millennials are willing to buy from generic brands to save money.

Millennials care less than other generations about brand names. According to AdAge, 60% of millennials buy generic over brand names to save money.

Education and Employment Statistics

How millennials spend is tied to their education and income. Here’s a snapshot of millennial education and employment trends.

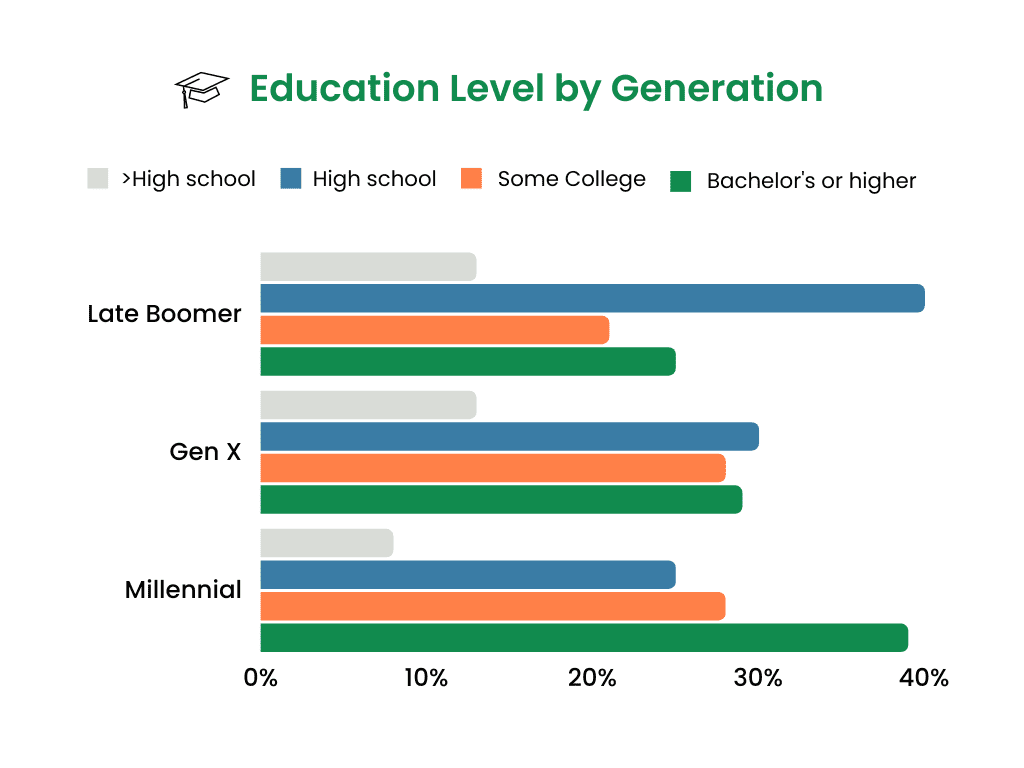

Millennials are the most educated generation—39% have at least a Bachelor’s degree.

According to Pew Research, 4 in 10 millennials have a bachelor’s degree or higher, compared to 3 in 10 Gen Xers.

Here’s a breakdown of educational attainment by generation based on Pew Research’s data:

The mean disposable income for a millennial-led home in 2021 was $84,563, which is nearly $20,000 less than Gen X.

According to a Statista study, the average disposable income for a millennial household in 2021 $84,563. Meanwhile, the mean for a Gen X-led household was $102,512.

While millennials earn close to what Gen X and Boomers did at the same age, millennial earnings fall far shorter when you factor inflation in.

83% of millennials prioritize work-life balance when it comes to choosing a job.

Millennials seek out jobs that offer flexibility and enhance their lives, and they aren’t afraid to leave behind a job that doesn’t.

In Flexjobs’ 2018 survey on workplace issues, 83% of millennials cited work-life balance as the number one factor when they considered a new job.

70% of millennials have at least considered leaving a job because it lacked flexibility.

While only half of older generations surveyed by Flexjobs said they’ve left a job or considered leaving because it didn’t offer flexible work options, 70% of millennials have.

1 in 2 millennials has at least one side hustle.

In a recent SunTrust survey, half of the millennial participants said they have at least one side hustle, and 19% said they have more than one.

Millennials make 20% more than Gen Xers and Boomers with their side hustles.

When it comes to side hustle earnings, millennials appear to do it best, outearning older generations by 20%, according to SunTrust. The average millennial side hustler earns $10,972 per year from their side gigs.

Debt Statistics

Debt is another factor that has a huge impact on how millennials spend.

Millennials had an average of $115,784 of debt in 2022, up 14.7% from 2021.

Based on Experian’s 2022 Consumer Debt Survey, millennials carry an average of $115,784 of debt overall, second only to Gen X.

The average mortgage debt for millennial homeowners is $286,906.

Millennial homebuyers had the highest amount of mortgage debt of any generation, according to Experian.

Millennials carry an average of $23,045 of auto loan debt.

Experian puts the average millennial car loan debt at $23,045, which is close to the same amount of debt carried by Gen X.

Millennials have an average of $40,247 of student loan debt.

According to Experian, the average student loan balance for millennials in 2022 was $40,614. And The Education Data Initiative Reports that millennials account for $500.5 billion of national student loan debt.

Millennial credit card debt increased by 23.4% in 2022.

In 2022, the average millennial carried $5,649 of credit card debt, which was a 23.4% increase from 2021.

Millennials have a lower average personal loan balance than Gen X, Baby Boomers, and the Silent Generation.

Here’s how the average personal loan debt breaks down by generation, based on Experian’s survey.

| Generation | Average Personal Loan Debt |

| Gen Z | $7,684 |

| Millennials | $15,101 |

| Gen X | $20,677 |

| Baby Boomers | $21,644 |

| Silent Generation | $18,211 |

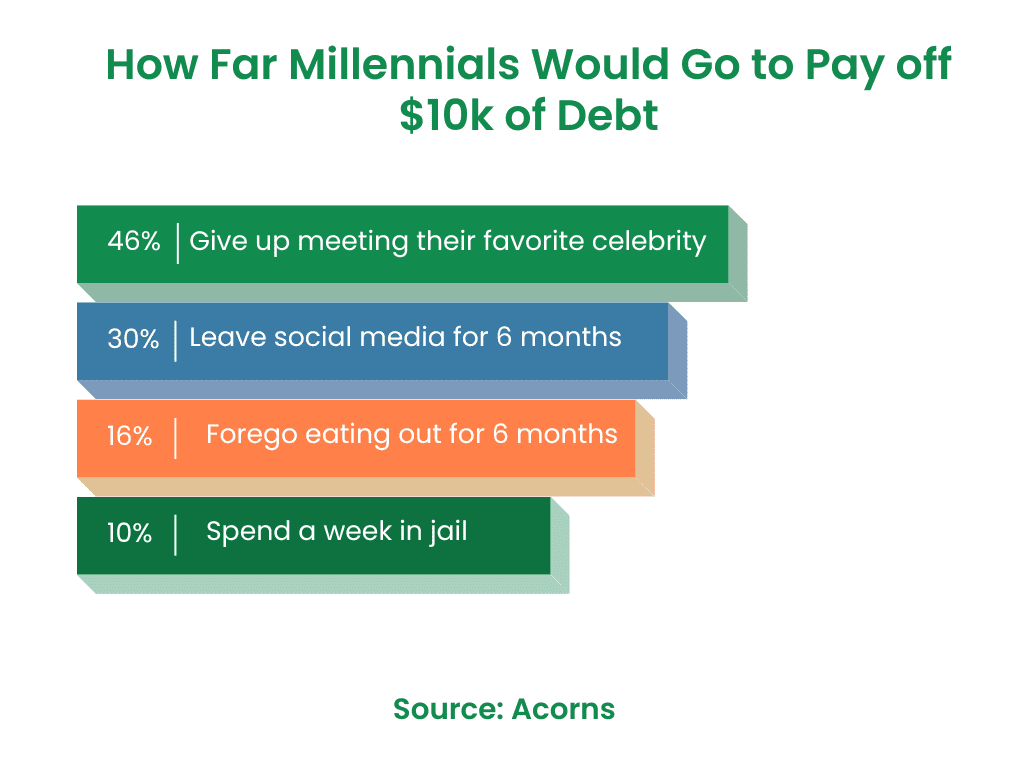

Around 1 in 10 millennials would spend a week in jail to get $10,000 of debt forgiven.

Acorns surveyed over 1,900 millennials and asked what they’d be willing to do to pay off $10,000 of debt, and the responses were wild.

Bottom Line: Millennial Spending Habits

Millennials are the largest generation alive today, and they’ve played a huge role in reshaping the consumer landscape, leading brands to rethink how they market and sell their products and services.

As you can see from the stats here, millennials are highly educated, resourceful, and willing to follow their moral compass with their wallet and prioritize their well-being. And despite appearances, they’re saving for retirement younger than their parents and grandparents were.

Sources:

Millennial Social Trends, Pew Research

How Different Generations Spend Money, SmartAsset

Millennial Discretionary Spending, Equifax

Who Are Millennials, Millennial Marketing

Consumer Checkpoint, Bank of America

Millennial Rent Spending, RentCafe

Cracking the Code on Millennial Spending, McKinsey

2020 Consumer Expenditure Report, Bureau of Labor Statistics

Furniture Purchasing Habits Across Generations, Shoptelligence

Millennial Online Shopping Habits, Invesp

Online Shopping Device Share, Statista

Financial Outlook of Millennials, WYPR

Better Money Habits, Bank of America

How to Reach Millennials in 2021, Global Web Index

Luxury Report, YPulse

Why Millennial Women Buy, Merkle

Millennial Dilemma, AdAge

How Millennials Compare with Other Generations, Pew Research Center

Mean Disposable Income by Generation, Statista

Workplace Issues Survey, Flexjobs

SunTrust Side Hustle Survey, SunTrust

2022 Consumer Debt Study, Experian

Student Loan Debt by Generation, Education Data Initiative

No comments yet. Add your own