We live in such a remarkable time. It’s never been easier in history to make enough money and design a life you love – which is what the FIRE movement is all about. FIRE stands for “Financial Independence Retire Early”.

People even 20 years ago would be so jealous of the opportunities we have today to live the life we want. We can work anywhere. Travel the world for less. This is at the core of the FIRE movement.

And there are so many incredible blueprints for living a non-traditional life where you’re stuck in a cubicle all day doing work you hate.

There’s a growing movement of people choosing to live life on their own terms. And I’m part of it. We’re the FIRE movement.

It truly can change your life. FIRE definitely changed mine. But when I started my own financial independence journey in 2010, there wasn’t a movement yet.

We were a relatively small group of people all over the world using money as a tool to create more freedom in our lives. We figured out that the higher your savings rate the faster you can retire early.

Between 2010 and 2015 I launched a bunch of side hustles, saved upwards of 82% of my income, and invested my money so it could grow.

This helped me reach financial independence and “retire” at the age of 30. I wrote an entire book about my journey and a step-by-step blueprint that anyone can follow titled Financial Freedom: A Proven Path to All The Money You Will Ever Need (Penguin Random House) and even launched a financial independence app.

What is the FIRE Movement?

FI stands for financial independence.

Financial independence is when you have built enough wealth to live a comfortable life, no longer needing to work for money.

RE stands for retire early.

Retiring early means something a little different to everyone because “retirement” looks different for many folks, and the word “early” is relative.

For some, retiring early means quitting your job at age 35 and never working again for the rest of your life.

For others, it might mean leaving the corporate world at age 55 (10 years earlier than the typical retirement age) and moving to a volunteer job that they are more passionate about.

When you put FI and RE together you get FIRE.

But FIRE is more than just about money or personal finance optimization, it’s more about life optimization. The central question is “What makes you happy?” and aligning your spending and saving, and financial life around maximizing your happiness.

With that goal in mind, the FIRE movement also integrates psychology and philosophical concepts from other movements like Stoicism and even Buddhism.

Financial Independence Retire Early (FIRE) is ultimately a personal journey.

Different Types of Financial Independence:

There are also many facets of FIRE that have sprung up over the years:

- Traditional FIRE

- Lean FIRE: For super frugal people who have very lean expenses, typically living on less than $25,000 per year.

- Fat FIRE: For those who are building much larger nest eggs to support a more luxurious lifestyle want higher spending in retirement.

- Coast FIRE: When you’ve reached a point where you no longer need to contribute any more to your retirement accounts, letting compound interest naturally bring you to financial independence over time.

- Barista FIRE: Named for people who retire early and use side hustles or a part-time job (like a barista) to supplement their income and get health insurance.

New pockets of the FIRE movement seem to be popping up every day.

As you can see what FIRE means is ultimately up to you. That’s the beauty of it – you truly can create your own path and design your own life.

The Beginning of the FIRE Movement

While the origins of the movement are hotly debated and evidently the term FIRE was first coined in an old Motley Fool forum sometime in the early ’90s, the FIRE movement largely began in 1992 with the publication of one of my all-time favorite books, Your Money or Your Life by Joe Dominguez and Vicki Robin.

In the book, they outline a simple yet transcendent idea: whenever you’re working your actually trading your life energy for money. So whenever you buy something you should think about it in terms of the hours of your life since you can always go out and make more money, but you can never get back your time.

When I read Your Money or Your Life in August 2010 it completely changed my life. Over the past few years, I’ve had the opportunity to become close friends with the co-author Vicki Robin and she graciously wrote the foreword to my book.

I feel so grateful to be able to work closely with Vicki to help make financial independence available to everyone.

But back 8 years ago when I started my own financial independence and early retirement journey, there were very few people on the FIRE path. In fact, I only knew of a handful of what are now known as FIRE bloggers.

Today there are thousands of bloggers documenting their financial independence journey’s, an incredibly active financial independence subreddit, hundreds of podcasts, and even a documentary about the FIRE movement that I’m in called Playing with FIRE.

I’m so stoked about it. Check out a preview of the documentary below.

Also, any good movement needs a folk song and there wasn’t one about the FIRE movement so I wrote one. Here’s me playing my FIRE movement folk song.

How To FIRE: 9 Steps to Financial Independence Retire Early

For anyone interested in the FIRE Movement, here’s how it works.

It’s simple in theory (which is why I could sum it up in a 90-second song) but is a little more challenging in execution.

To make it as simple as possible, here are the 9 steps to reach FIRE (financial independence retire early).

Step 1. Think about what kind of life you want to live. What does a meaningful life look like to you?

The biggest problem with mainstream personal finance and money advice is it’s all about the money!

But what’s more important than money is life. You can always go out and make more money, but you can never get back your time. So before you even start thinking about the money, first think about what kind of life you want to live. Seriously, write it down.

What does the perfect day look like? Why is it perfect? What are the 10 things that make you happiest?

When I did this exercise I quickly realized that most of the things I enjoy most in life are actually pretty inexpensive or even free. It doesn’t cost any money to walk my dog in a park on a Saturday, play guitar with my friends, or board games with my wife.

Once I started thinking in terms of the life I wanted to live and what I enjoyed most, it became easier to prioritize where to spend my money and where to save.

At the end of the day money only matters if you live a life you love. I’ve always believed that money is not the goal, time is. But you need to think about what kind of life you want to live – what is important to you?

It’s always easier in life to chase that next thing – whether it’s the next job promotion, raise, or save 1 million dollars.

What’s harder to do is take the time to figure out what actually makes you happy and what kind of life you want to live. But once you look within instead of just outside, the easier it will be to plan for financial freedom.

Action Steps:

- Make a list of the 10 things that make you happiest in life.

- Write down what a perfect day looks like to you.

- Read one of my favorite books on life, The Art of Living by Thich Nhat Hanh

Step 2. Start by doing the simple math: How much do you really need?

The next step is to figure out how much money you need to live that life awesome life! I remember being in college and dreaming about driving a Maserati and living in a big lake house, but now when I see a Maserati driving down the road I don’t see $200,000, I see $1,200,000 in 30 years!

In 2010 when I started my financial independence journey, I didn’t set a goal for how long it would take. All I knew was that when I did the math I was never going to be able to retire if I was only able to save 5-10% of a $40,000 – $50,000 income.

The math I did was pretty simple. If I was able to save $5,000 per year maximum, even with an expected compounding rate of 6%, I would have about $433,000 in 30 years. While that might seem like a lot of money today, it’s not going to be that much in 30 years, because of two expected variables–taxes and inflation.

You will need to pay tax on that money when you take it out, assuming a 30% tax rate that cuts the after-tax value to $308,000, which when adjusted for 2% annual conservative inflation amount (it could be higher than this even!), then the future value of that money after taxes and inflation is approximately $170,000.

While $170,000 is still a lot of money, it’s not going to be in 30 years. It definitely won’t be enough to live on for 20+ years.

Typical wisdom is that you need 25x your annual expenses to retire early. When I did this calculation, I anticipated my annual expenses would be at least $50,000 in the future (who knows if I will actually be able to live off $50,000 in the future–I sure hope so!).

But it was the best starting point I had, so by simply multiplying 25x by $50,000, I determined that I would need to save $1,250,000. That’s a big number, but it was my target.

You can sit down with a piece of paper and see how much money you need to retire early by checking this calculator I built.

Assumptions

Step 3. Save more money by spending on what you value and not on what you don’t.

Savings Rate (the higher your savings rate the faster you can retire)

Saving is an opportunity to live a life you love. It’s not a sacrifice. As long as you view it as a sacrifice you’re always going be in a scarcity mindset.

The only way that you’ll be able to reach financial freedom and FIRE is by saving as much money as you can and investing it to grow.

Remember what I said about living differently? A 50% saving/investing rate is more common than you would think amongst the FIRE (financial independence early retirement) crowd. I know a lot of people that save this much each month because they get it.

Saving 50%+ of your income is definitely going against the status quo, but that’s how you fast-track wealth. If you want to go deeper, here are two posts on how much money you should be saving and my investing strategy.

The easiest way to monitor how much money you’re saving is by tracking what’s known as your savings rate. Your savings rate is simply the percentage of your income(s) that you are saving.

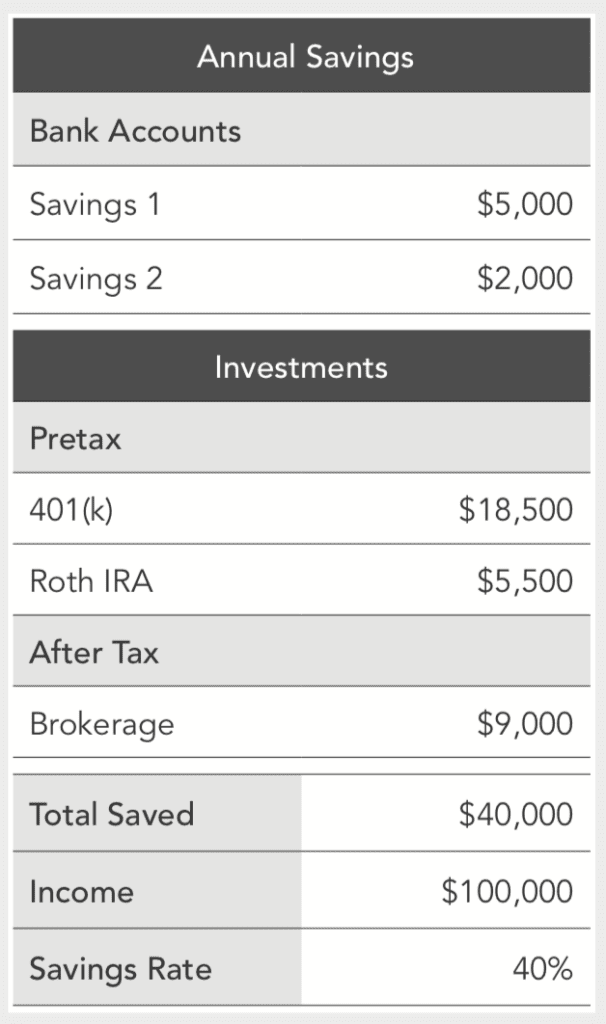

To calculate your savings rate, you want to add up all of the dollars that you save, both in pretax accounts (for example, 401(k)s and IRAs) and after-tax accounts (brokerage) and divide it by your income.

Here is an example of how it looks if you have a $100,000 income and are saving 40 percent.

It’s pretty simple. The more money you can save the faster, and bigger, it can grow. The average savings rate in the United States is currently around 3.2%, which based on simple math means that a majority of Americans will never be able to retire.

But if you can get that savings rate to 20%, 30%, or even 50% you’ll be able to cut years and even decades off of your retirement.

Action Steps:

- To help you easily calculate and monitor your savings rate I built a savings rate calculator.

Budgeting (aka the only budget you’ll ever need)

Keeping a budget is really hard and it’s what stops most people from really fast-tracking their financial independence.

I’m not going to tell you to create a budget or cut back on all of your expenses. What you need is to balance how much you spend. I’ve always viewed saving as an opportunity, not a sacrifice.

But you do need to find a way to reduce how much you are spending so you can increase how much you save.

The easiest way to do it is by cutting back on your housing, transportation, and food costs. The average American spends 70% of their money on housing, transportation, and food, so if you can spend less on them (say 25% or so, then you can bank the difference). If you move to a smaller apartment, walk to work, and cook at home, you could realistically increase your savings rate to 25%+ or even higher.

By reducing what I spent on my housing, transportation, and food costs, I increased my savings rate to 40% and sometimes as high as 80% while I was fast-tracking my financial independence. The only way I was able to fast track was by cutting way back on my living expenses and investing the difference.

Focus on where you spend the most money to save the most money. Cut back your housing expense as much as you can through a strategy known as house hacking where you rent or buy a 3 or 4 bedroom apartment or house and rent out the other room. You’re going to save a lot more money doing that than by cutting out things like your $5 latte.

I’m not here to tell you what to buy or not to buy, but it’s important to recognize that whenever you buy anything you’re actually trading your future freedom for it.

At the end of the day it comes down to a personal choice, but I was happy moving to a smaller apartment, moving closer to my office, and eating out less, to bank the difference. And I definitely was able to bank the difference–saving at least an additional $13,000 per year by cutting back.

While I don’t have the exact figures, I estimate that cutting back for 2 years, before buying my first home, I was able to save about $25,000 that I invested in 2011 and 2012, and that “cutting back” is now worth more than $100,000 in my investment accounts. I’m going to continue to let it grow and hopefully making that decision 2 years ago will compound in 20 years into a lot more money. It was totally worth cutting back on my three biggest expenses. Try it out.

When I was on my own financial independence journey I calculated that for every $100 I saved I was buying a week of freedom in the future.

Action Steps:

- If you want to calculate how much money you need to buy a week of freedom out my FIRE calculator.

Step 4. Pay down your bad debt, use your good debt

Not all debt is created equal. There is good debt vs bad debt. Some debt you lose money on and some debt you can make money with.

Good debt is debt like mortgage debt you use for investing in real estate or building a real estate empire or in some cases student loan debt if it helps you get a better job or make more money over your career.

Bad debt is credit card debt since the interest rate on it is probably over 20%. Pay down any credit card debt you have immediately since you are losing money with it.

While there are a bunch of different debt payoff strategies, the best strategy is simply to pay down your debt with the highest interest rate first, which in most cases is going to be credit card debt, then any personal loans, followed by student loans, and then mortgages.

The simple rationale is that compounding works both ways, meaning that just like your investments can grow and compound over time, so can your debt.

So whenever you’re paying off a debt you want to pay down your highest interest rate debt because it’s like getting that percentage return on your money.

If you pay off your 20% interest rate credit card it’s like you made 20% because your debt is no longer growing, as opposed to paying down your student loan balance with a 5% interest rate where you’d only be getting 5% on your money.

Action Steps:

- List your debts and order them from highest interest rate to lowest interest rate to understand where you are at realistically for where you need to begin.

Step 5. Hack your full-time job, get a raise, and build new skills

Since your full-time job is where you’re likely currently making the most money, it’s important to try and get paid as much as possible.

The simple fact is that most people deserve a raise, but they’re too afraid to ask for one. The impact of a single raise of a few thousands of dollars can actually add up to tons of additional money over time.

Just getting 1 percent bigger raises each year can make you literally hundreds of thousands of dollars richer over the next twenty to thirty years by investing and compounding that small raise difference.

A simple study that looked at an annual 3 percent versus a 4 percent raise each year showed that after thirty years the 4 percent raise was worth $578,549 more when that small 1 percent difference was invested in the stock market.

This is because your future earning potential is impacted by your base salary today. Most people are underpaid in their roles, but many don’t do anything about it.

Eighty-nine percent of Americans believe they deserve a raise, but only 54 percent plan to ask for one in the next year.

We typically spend more time planning for a vacation than working to improve and optimize our careers, which is a missed opportunity.

In reality, most of the jobs that will exist in 20 years haven’t even been created yet, so while traditional advice is that you should become an expert in one thing, it’s actually more valuable to have a broad range of complementary skill sets.

For example, if you know how to use Google Analytics, you should also learn about branding and how to start a blog.

Action Steps:

- Check out my post on how to get a raise.

- Check out the most valuable future skills

Step 6. Start a Side Hustle

A side hustle is anything you do to make money outside of your full-time job.

While you can make money doing literally anything, the best side hustles are the ones where you can make money doing something you actually enjoy and where you can control what you’re getting paid and when you work.

Far too many people drive for Lyft or Uber and are limited by the hours of a day they have to drive and what they get paid because the rates are set by the company, not the drivers.

While there is an infinite number of side hustles that you can launch, I like the side hustles that you can do online because they give you the ultimate flexibility to make money from anywhere in the world and on your own time.

Some of the best current side hustles are learning how to become a virtual assistant, start a blog using Bluehost (check out how to make money blogging), and running Facebook ads.

Action Steps:

- Check out my detailed step by step post on how to pick, launch, and grow a profitable side hustle

- Read Chapter 10 in my book Financial Freedom: A Proven Path to All The Money You Will Ever Need (Penguin Random House).

- Read 100 Side Hustles by Chris Guillebeau

Step 7. Invest as much as you can, as often as you can, in low-cost total stock market or S&P 500 index funds

It’s essential to switch from a saving to an investing mindset. It’s not possible to fast-track financial independence by keeping your money in a savings account–investing is an essential ingredient.

I have made more money through investing than anything else and most of it in my sleep! Just recently, I was looking at my investing returns over a 90-day period and realized that I had made over $15,000 in gains from one of my investments, which is more money than I made in 6 months working at my first job after college. If you really want to make money, then you need to be investing as much money as you can.

Investing your money is what really accelerates your ability to reach financial freedom faster because your money starts making money and then the growth accelerates.

While you can invest in literally anything, the most dependable investments are stocks, bonds, and real estate. You need a short-term investing strategy (money you’re going to need in the next 5 years) and long-term investing strategy (for the money you’re going to need in 10+ years).

Note: It’s always worth keeping at least 6 months of expenses saved in a high-interest online savings account for any unexpected emergencies in what’s known as an emergency fund.

Your short-term investments should be kept in a high-interest online savings account and your long-term investments for retirement should be largely kept in low cost highly diversified index funds like the Vanguard Total Stock Market Index Fund (VTSAX) or something similar that holds most of the stocks in the U.S. stock market.

You can invest in a total stock market or S&P 500 index fund in most employee retirement plans like a 401(k), 403(b), or 457(b), as well as individual retirement accounts like a Roth IRA, Traditional IRA, SEP IRA, and Solo 401(k). While I personally invest in a few individual stocks, I largely recommend that you avoid investing in individual stocks unless it’s with less than 10% of your total net worth.

While investing is simple and easy to learn, there are too many steps for this post, so to learn more check out the detailed video and links below.

Action Steps:

- Check out my post on How to Start Investing

- Check out my detailed Investing Strategy

- Check out my Early Retirement Strategy

- Read Boglehead’s Guide to Investing for an easy-to-follow investing book.

Step 8. Track your net worth and investment performance

The first step is calculating your net worth, which is simply your assets (anything of value that you have, investments, etc.) minus your liabilities (any debt that you have, like student loans, credit card debt, etc.).

A simple way to track your net worth is using this net-worth calculator I built and to track your net worth over time you should check out the free app I use to track my net worth called Personal Capital.

Action Steps:

- Sign up for Personal Capital and start tracking your net worth

- To learn more about the steps to FIRE check out the very detailed step-by-step blueprint in my book Financial Freedom: A Proven Path to All The Money You Will Ever Need (Penguin Random House).

Step 9. Then take it one day at a time, but build the best daily habits

Like many things in life, reaching financial independence is all about effort and execution. You need to be consistent. Consistency is more important than anything else–you can’t just follow these steps for a few months. If you want it, you’ll prioritize it. You can also start as slowly or quickly as you want.

At 24 years old, with no money, I had no idea how I was going to save my target $1,250,000. It’s been shown in a bunch of research studies that our brains can’t actually comprehend that much money–the numbers are too large and abstract to most people. It was daunting, to say the least. How was I going to make all that money?

This is why a lot of retirement calculators just aren’t that effective. They tell you that you’ll need $2,000,000 saved in 30 years, but don’t break down the steps to get you there.

Recent psychology research also highlights that our brains work best when we break down large goals into daily goals. I figured out that to reach $1,250,000 in 30 years (expecting a return of 6-7% per year) using my investing strategy, I would need to save $50 per day to retire in 30 years.

Every dollar I could save after $50, I would be fast-tracking my financial independence. It’s also worth noting that I didn’t start at $50 per day, I scaled up to it starting at $5 per day and then pushing it a few dollars more when I could.

In 2010 when I made the decision to chase financial independence, I jumped in 100%, but that’s just what I needed to do to get going. The key to building any sustainable results is to start at your own pace, start making more money where you can, and really push your investing percentage higher 1% at a time.

It really adds up and every $1 you are investing today will compound as long as you keep it invested. As I’ve mentioned before every $1 I invested in 2010 is worth almost $4 today.

Research also highlights that we should accomplish these daily goals through better habits. The key to building wealth is really in our daily habits. The better our money habits, the more money we will make, save invest, and grow. To go deeper, here are my best money habits.

It took almost all of my energy for five straight years to go from broke to financially independent. I also got lucky the stock market has grown so much over the past 7 years, but I was ready. Building wealth is about controlling as many of the variables as you can and then letting it grow.

Best FIRE Books

For a full list with reviews check out Best FIRE (Financial Independence Retire Early) books

Best FIRE Bloggers

There are now thousands of FIRE bloggers, but here are some of the originals and my favorites in no particular order:

- Mr. Money Mustache – Arguably the father of the FIRE movement, Pete Adeney (aka. Mr. Money Mustache) started blogging in 2011.

- Mad Fientist

- Root of Good – Justin McCurry retired at the age of 31 and knows more about tax optimization than anyone I know.

- Mr. 1500

- Go Curry Cracker

- Millennial Revolution

- JL Collins

- Get Rich Slowly

- Physician on FIRE

- Early Retirement Now

- Couple Money Podcast

FIRE Movement FAQs

Can people with kids pull off FIRE (financial independence retire early)?

Absolutely, I think you can definitely FIRE with kids. While expensive, there are certainly many ways to minimize the expenses of having kids or to make adjustments in other areas of your life that offset the cost of having kids.

For example, a vast majority of people spend 70%-80% of their money on housing, transportation, and food. That is where you are going to get the biggest savings.

You can save on all of these with kids – for example, moving to a different neighborhood, or a smaller house/apartment, moving to a different city, or finding other ways to get creative about your living situation can reduce your biggest expense (housing).

You can do that with kids. Same with having one car and cooking at home. Kids are just another variable that you can optimize around. FIRE is by no means easy, but you don’t have to go all-in – just making a few minor adjustments in your life can have a massive impact.

Is FIRE an elitist movement?

Like any movement, there are many different personalities. Some of whom are definitely hardcore.

FIRE, “retirement” can mean whatever you want. IMO there is no singular definition, nor should there be. There is no black and white and to seek one misses the point.

FIRE like any label, like any language, has limits. It’s a path you define for yourself. I think some people write it off as an elitist movement and dismiss it because they aren’t willing to make changes in their lives.

That’s okay. But the principles of FIRE are timeless and can literally transform your life if you are open to that type of change. A lot of people think you need a lot of money to FIRE, which isn’t true.

The simple idea of increasing your savings rate or cutting down on your biggest expenses so you can save more money isn’t revolutionary, they are practical and accessible to most.

What future do you think the FIRE movement has? Will it be a trend or will it transcend that?

This is a great question. I do think the FIRE movement has room to grow, but being able to label it also makes it easier for people to write off what are really good principles and a life-changing mindset.

I’m sure it will continue to grow, but it will hit a ceiling. The nice thing is that more people are waking up and starting to question the status quo of working 9 to 5 for 40 years and retiring at 65. Sure that’s one path, but it’s not the only path. There are many many paths to wealth and rich life.

There is an increasing number of people who are choosing not to follow traditional advice, which I think now because there are so many examples, will continue.

Thanks to the internet, there are more and more examples of people who are building extraordinary lives on their own terms. That’s freedom.

The nice thing is that it’s never been easier in history to make more money and live differently. The transformative power of these ideas is that they help you reclaim your time. It’s really not about money at the end of the day, it’s about putting money in its place and using it to live an awesome life.

While I don’t know if FIRE as an acronym will transcend, I do believe the principles will continue to spread, which is all we can hope for. In increasingly uncertain times, you can control money or let it control you.

But when you control it, it opens up the world and opportunities and a life you never thought you could live. That’s open to everyone.

Why is it easier to reach financial independence or retire early in the US?

Many reasons. Low-cost investing options, a lot of income opportunities (including lots of ways to side hustle), low-cost of living areas, and probably most impactful are the many ways to optimize and minimize your taxes.

Taxes are often higher outside of the U.S. and eat up a lot of savings potential, but in the U.S. there are many ways to minimize your taxes through efficient money management.

The dollar is also strong so you can go live outside the US to minimize the impact of inflation and make your money go further.

But don’t let this turn you off, it might be a little more challenging to do in Europe, but it’s definitely possible and worth the effort.

Read 4 comments or add your own

Read Comments